Question: please please please please open the comment box and please please answer the third row Brief Exercise 9.3 (Static) Straight-Line and Declining-Balance Depreciation (LO9-3) Messer

please please please please open the comment box and please please answer the third row

please please please please open the comment box and please please answer the third row

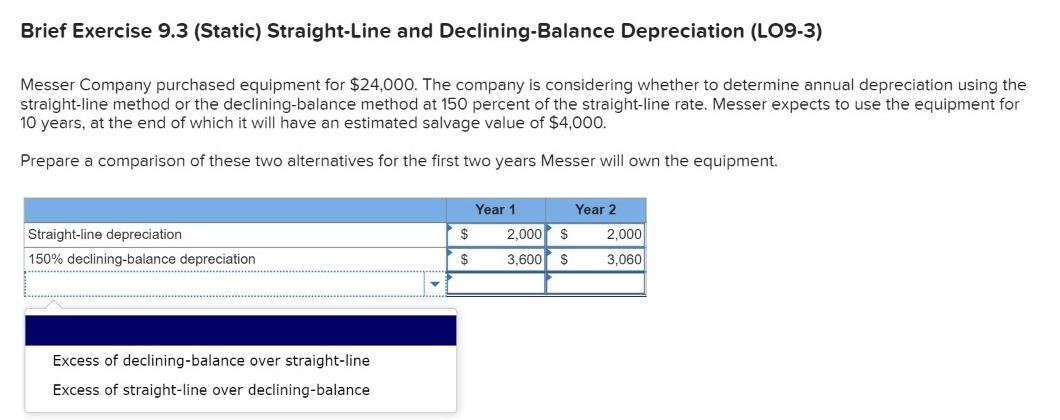

Brief Exercise 9.3 (Static) Straight-Line and Declining-Balance Depreciation (LO9-3) Messer Company purchased equipment for $24,000. The company is considering whether to determine annual depreciation using the straight-line method or the declining-balance method at 150 percent of the straight-line rate. Messer expects to use the equipment for 10 years, at the end of which it will have an estimated salvage value of $4,000. Prepare a comparison of these two alternatives for the first two years Messer will own the equipment. $ Straight-line depreciation 150% declining-balance depreciation Year 1 Year 2 2,000 $ 2.000 3,600 $ 3,060 $ Excess of declining-balance over straight-line Excess of straight-line over declining-balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts