Question: please please solve this problem urgently and perfectly. mention each part answer as you give. I'll give positive rating if you solve perfectly and urgently

please please solve this problem urgently and perfectly. mention each part answer as you give. I'll give positive rating if you solve perfectly and urgently and solve all parts of this question urgently and perfectly and also mention each part answer

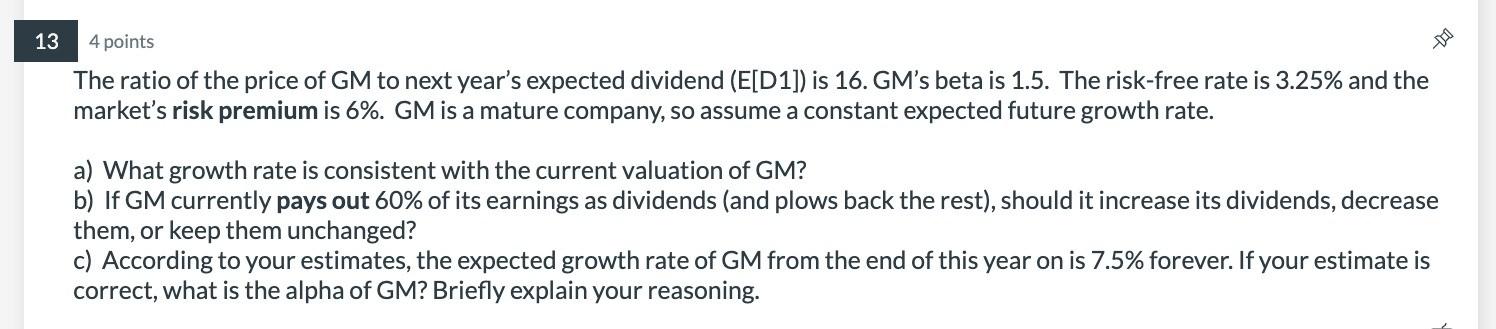

The ratio of the price of GM to next year's expected dividend (E[D1]) is 16. GM's beta is 1.5. The risk-free rate is 3.25% and the market's risk premium is 6%.GM is a mature company, so assume a constant expected future growth rate. a) What growth rate is consistent with the current valuation of GM? b) If GM currently pays out 60% of its earnings as dividends (and plows back the rest), should it increase its dividends, decrease them, or keep them unchanged? c) According to your estimates, the expected growth rate of GM from the end of this year on is 7.5% forever. If your estimate is correct, what is the alpha of GM? Briefly explain your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts