Question: Please Pleaseanswer it I will due it as soon as possible Thanks a lot Please Background Information: Rosie owns and operates Sunshine Berries, which sells

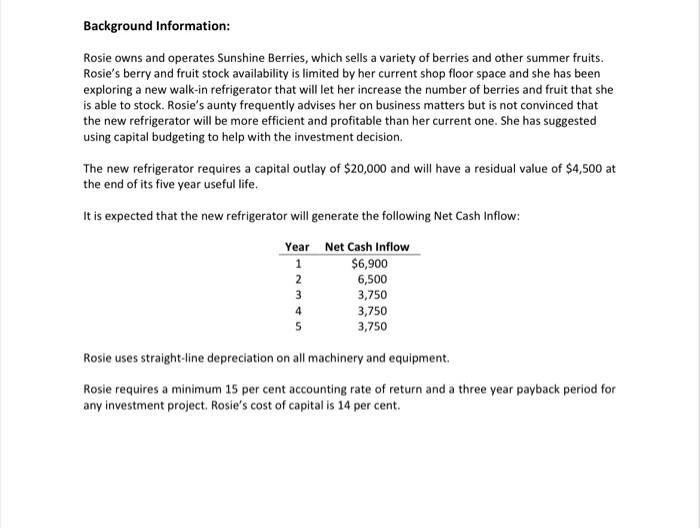

Background Information: Rosie owns and operates Sunshine Berries, which sells a variety of berries and other summer fruits. Rosie's berry and fruit stock availability is limited by her current shop floor space and she has been exploring a new walk-in refrigerator that will let her increase the number of berries and fruit that she is able to stock. Rosie's aunty frequently advises her on business matters but is not convinced that the new refrigerator will be more efficient and profitable than her current one. She has suggested using capital budgeting to help with the investment decision The new refrigerator requires a capital outlay of $20,000 and will have a residual value of $4,500 at the end of its five year useful life. It is expected that the new refrigerator will generate the following Net Cash Inflow: Year Net Cash Inflow 1 $6,900 2 6,500 3 3,750 3,750 5 3,750 Rosie uses straight-line depreciation on all machinery and equipment Rosie requires a minimum 15 per cent accounting rate of return and a three year payback period for any investment project. Rosie's cost of capital is 14 per cent. 4 2. Draw the cash flow time line for the investment in the proposed new refrigerator and indicate the cash flow patterns represented on the cash flow time line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts