Question: please post a detailed explanation with the formula. Also please calculate on excel so I can follow along and learn. thank you. 1.) Two securities

please post a detailed explanation with the formula. Also please calculate on excel so I can follow along and learn. thank you.

please post a detailed explanation with the formula. Also please calculate on excel so I can follow along and learn. thank you.

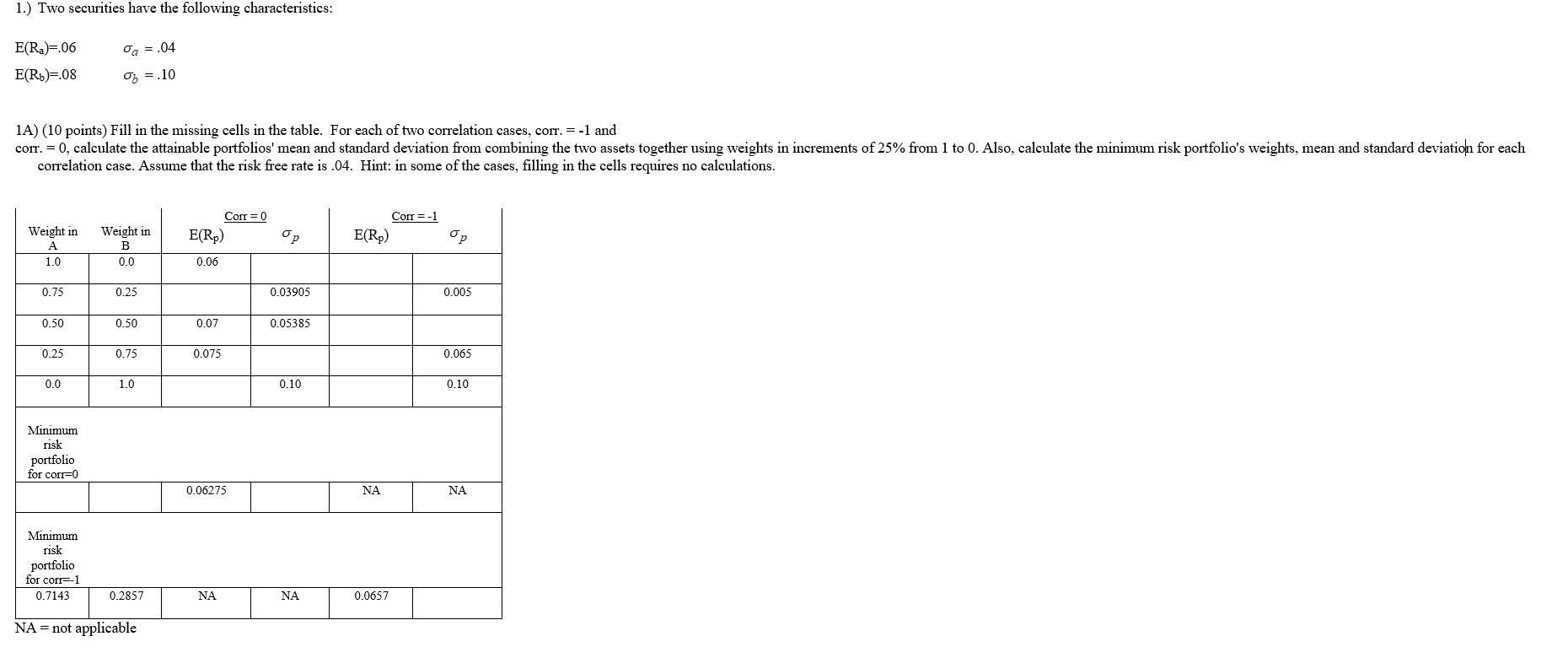

1.) Two securities have the following characteristics: Oa = .04 E(R)=.06 E(R)=.08 = = .10 1A) (10 points) Fill in the missing cells in the table. For each of two correlation cases, corr. = -1 and cort. = 0, calculate the attainable portfolios' mean and standard deviation from combining the two assets together using weights in increments of 25% from 1 to 0. Also, calculate the minimum risk portfolio's weights, mean and standard deviation for each correlation case. Assume that the risk free rate is .04. Hint: in some of the cases, filling in the cells requires no calculations. Corr = 0 E(Rp) Corr = -1 E(Rp) Weight in B 0.0 op Weight in A 1.0 op 0.06 0.75 0.25 0.03905 0.005 0.50 0.50 0.07 0.05385 0.25 0.75 0.075 0.065 0.0 1.0 0.10 0.10 Minimum risk portfolio for corr=0 0.06275 NA NA Minimum risk portfolio for corr-1 0.7143 0.2857 NA NA 0.0657 NA = not applicable 1.) Two securities have the following characteristics: Oa = .04 E(R)=.06 E(R)=.08 = = .10 1A) (10 points) Fill in the missing cells in the table. For each of two correlation cases, corr. = -1 and cort. = 0, calculate the attainable portfolios' mean and standard deviation from combining the two assets together using weights in increments of 25% from 1 to 0. Also, calculate the minimum risk portfolio's weights, mean and standard deviation for each correlation case. Assume that the risk free rate is .04. Hint: in some of the cases, filling in the cells requires no calculations. Corr = 0 E(Rp) Corr = -1 E(Rp) Weight in B 0.0 op Weight in A 1.0 op 0.06 0.75 0.25 0.03905 0.005 0.50 0.50 0.07 0.05385 0.25 0.75 0.075 0.065 0.0 1.0 0.10 0.10 Minimum risk portfolio for corr=0 0.06275 NA NA Minimum risk portfolio for corr-1 0.7143 0.2857 NA NA 0.0657 NA = not applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts