Question: please post answer clearly. the table needs to be complete. B. Consider the following capital restructure plan: use $209 million of cash from its balance

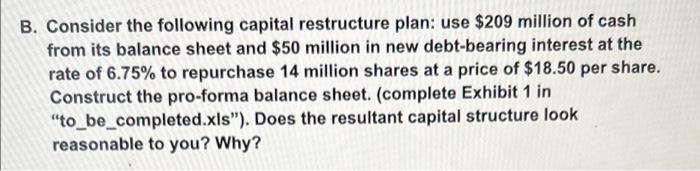

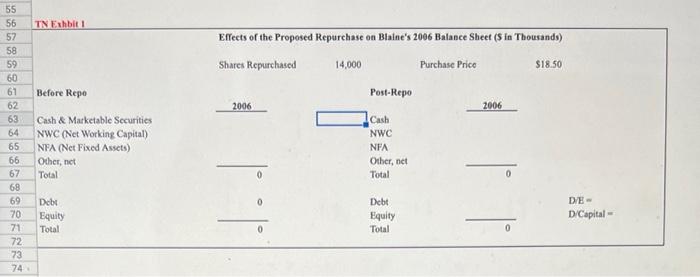

B. Consider the following capital restructure plan: use $209 million of cash from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to repurchase 14 million shares at a price of $18.50 per share. Construct the pro-forma balance sheet. (complete Exhibit 1 in "to_be_completed.xls"). Does the resultant capital structure look reasonable to you? Why? TN Exhbit 1 Effects of the Proposed Repurchase on Blaine's 2006 Balance Sheet (s in Thousands) Shares Repurchased 14,000 Purchase Price $18.50 Before Repo Post-Repo 2006 2006 &B M899 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 Cash & Marketable Securities NWC (Net Working Capital) NFA (Net Fixed Assets) Other, not Total (Cash NWC NFA Othernet Total 0 0 0 Debt Equity Total Debt Equity Total DYE- D/Capital 0 0 B. Consider the following capital restructure plan: use $209 million of cash from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to repurchase 14 million shares at a price of $18.50 per share. Construct the pro-forma balance sheet. (complete Exhibit 1 in "to_be_completed.xls"). Does the resultant capital structure look reasonable to you? Why? TN Exhbit 1 Effects of the Proposed Repurchase on Blaine's 2006 Balance Sheet (s in Thousands) Shares Repurchased 14,000 Purchase Price $18.50 Before Repo Post-Repo 2006 2006 &B M899 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 Cash & Marketable Securities NWC (Net Working Capital) NFA (Net Fixed Assets) Other, not Total (Cash NWC NFA Othernet Total 0 0 0 Debt Equity Total Debt Equity Total DYE- D/Capital 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts