Question: please post answer step by step Problem 10-10 (calculator version) Ron Rhodes calls his broker to inquire about purchasing a bond of Golden Years Recreation

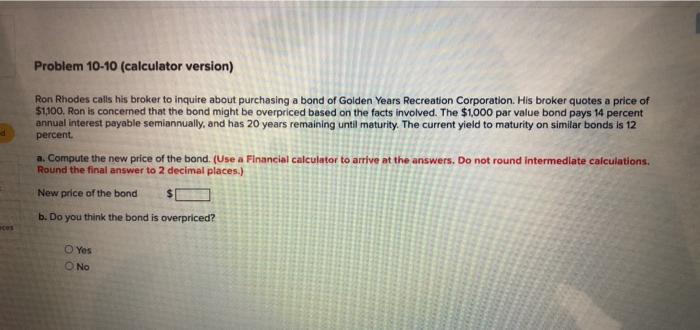

Problem 10-10 (calculator version) Ron Rhodes calls his broker to inquire about purchasing a bond of Golden Years Recreation Corporation. His broker quotes a price of $1,100. Ron is concerned that the bond might be overpriced based on the facts involved. The $1000 par value bond pays 14 percent annual interest payable semiannually, and has 20 years remaining until maturity. The current yield to maturity on similar bonds is 12 percent a. Compute the new price of the band. (Use a Financial calculator to arrive at the answers. Do not round intermediate calculations. Round the final answer to 2 decimal places.) New price of the bond b. Do you think the bond is overpriced? aces Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts