Question: PLEASE POST EXCEL FORMULAS PLEASE POST EXCEL FORMULAS H Question 2 4 As an analyst for Old Money bank you are responsible for making recommendations

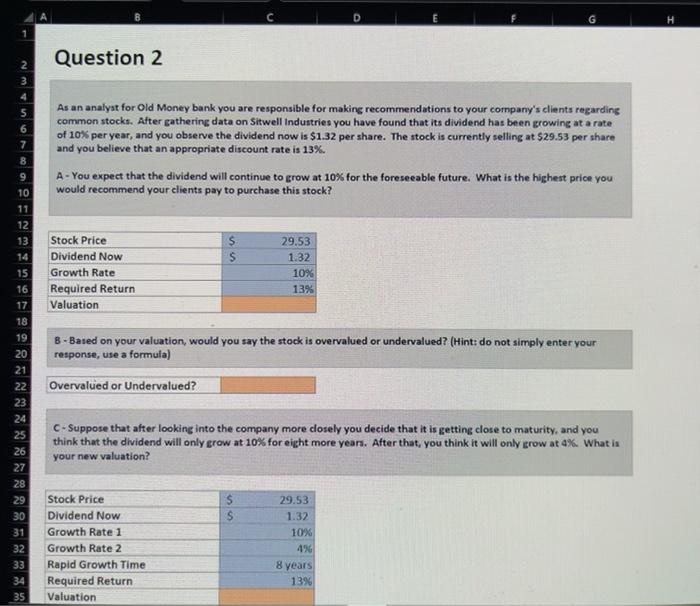

H Question 2 4 As an analyst for Old Money bank you are responsible for making recommendations to your company's clients regarding common stocks. After gathering data on Sitwell Industries you have found that its dividend has been growing at a rate of 10% per year, and you observe the dividend now is $1.32 per share. The stock is currently selling at $29.53 per share and you believe that an appropriate discount rate is 13%. A-You expect that the dividend will continue to grow at 10% for the foreseeable future. What is the highest price you would recommend your clients pay to purchase this stock? $ S Stock Price Dividend Now Growth Rate Required Return Valuation 29.53 1.32 10% 13% B-Based on your valuation, would you say the stock is overvalued or undervalued? (Hint: do not simply enter your response, use a formula) 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Overvalued or Undervalued? C-Suppose that after looking into the company more closely you decide that it is getting close to maturity, and you think that the dividend will only grow at 10% for eight more years. After that you think it will only grow at 4%. What is your new valuation? S 29.53 1.32 10% Stock Price Dividend Now Growth Rate 1 Growth Rate 2 Rapid Growth Time Required Return Valuation 8 years 1396

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts