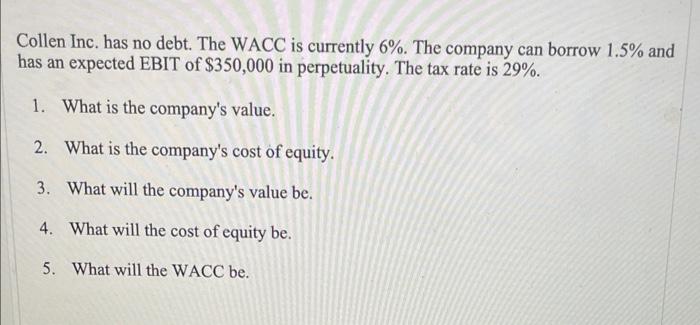

Question: please post formulas used, thanks Collen Inc. has no debt. The WACC is currently 6%. The company can borrow 1.5% and has an expected EBIT

please post formulas used, thanks

Collen Inc. has no debt. The WACC is currently 6%. The company can borrow 1.5% and has an expected EBIT of $350,000 in perpetuality. The tax rate is 29%. 1. What is the company's value. 2. What is the company's cost of equity. 3. What will the company's value be. 4. What will the cost of equity be. 5. What will the WACC be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock