Question: please post full image, sometimes it only shows half the answer. thank you Required information [The following information applies to the questions displayed below.) The

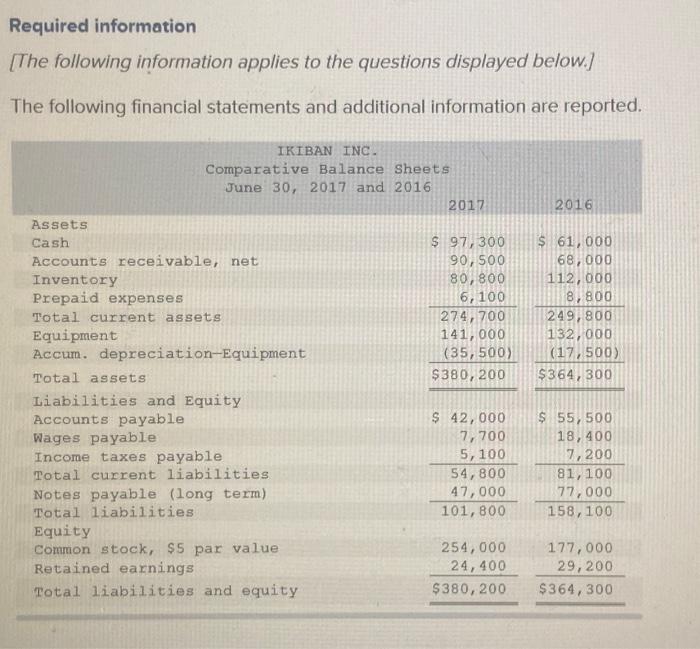

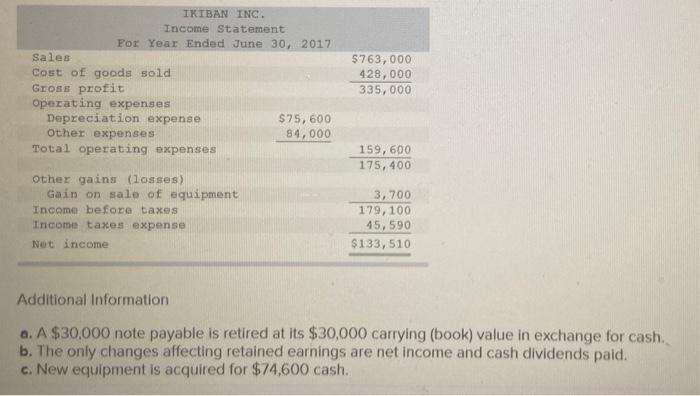

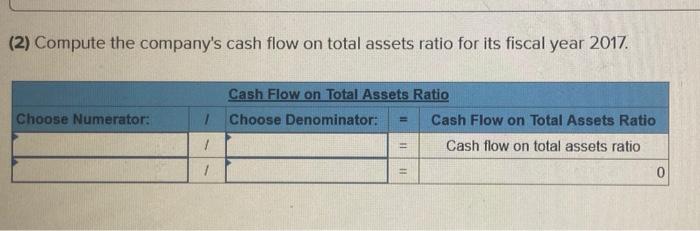

Required information [The following information applies to the questions displayed below.) The following financial statements and additional information are reported. 2016 IKIBAN INC. Comparative Balance Sheets June 30, 2017 and 2016 2017 Assets Cash $ 97,300 Accounts receivable, net 90,500 Inventory 80,800 Prepaid expenses 6,100 Total current assets 274, 700 Equipment 141,000 Accum. depreciation-Equipment (35,500) Total assets $380, 200 Liabilities and Equity Accounts payable $ 42,000 Wages payable 7,700 Income taxes payable 5,100 Total current liabilities 54,800 Notes payable (long term) 47,000 Total liabilities 101,800 Equity Common stock, $5 par value 254,000 Retained earnings 24,400 Total liabilities and equity $380, 200 $ 61,000 68,000 112,000 8,800 249,800 132,000 (17,500) $364, 300 $ 55,500 18,400 7,200 81, 100 77,000 158, 100 177,000 29, 200 $364, 300 IKIBAN INC. Income Statement For Year Ended June 30, 2017 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $75,600 Other expenses 84,000 Total operating expenses $763,000 428,000 335,000 159, 600 175, 400 other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 3, 700 179, 100 45,590 $133, 510 Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $74,600 cash. (2) Compute the company's cash flow on total assets ratio for its fiscal year 2017. Choose Numerator: / Cash Flow on Total Assets Ratio Choose Denominator: Cash Flow on Total Assets Ratio Cash flow on total assets ratio 0 1 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts