Question: Please post how you got the answer as well In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broad-based fund

Please post how you got the answer as well

Please post how you got the answer as well

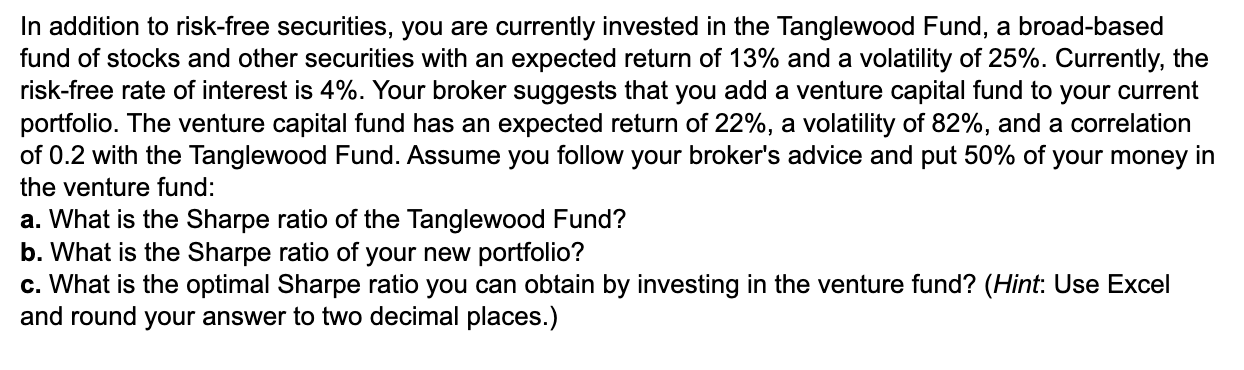

In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broad-based fund of stocks and other securities with an expected return of 13% and a volatility of 25%. Currently, the risk-free rate of interest is 4%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of 22%, a volatility of 82%, and a correlation of 0.2 with the Tanglewood Fund. Assume you follow your broker's advice and put 50% of your money in the venture fund: a. What is the Sharpe ratio of the Tanglewood Fund? b. What is the Sharpe ratio of your new portfolio? c. What is the optimal Sharpe ratio you can obtain by investing in the venture fund? (Hint: Use Excel and round your answer to two decimal places.) In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broad-based fund of stocks and other securities with an expected return of 13% and a volatility of 25%. Currently, the risk-free rate of interest is 4%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of 22%, a volatility of 82%, and a correlation of 0.2 with the Tanglewood Fund. Assume you follow your broker's advice and put 50% of your money in the venture fund: a. What is the Sharpe ratio of the Tanglewood Fund? b. What is the Sharpe ratio of your new portfolio? c. What is the optimal Sharpe ratio you can obtain by investing in the venture fund? (Hint: Use Excel and round your answer to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts