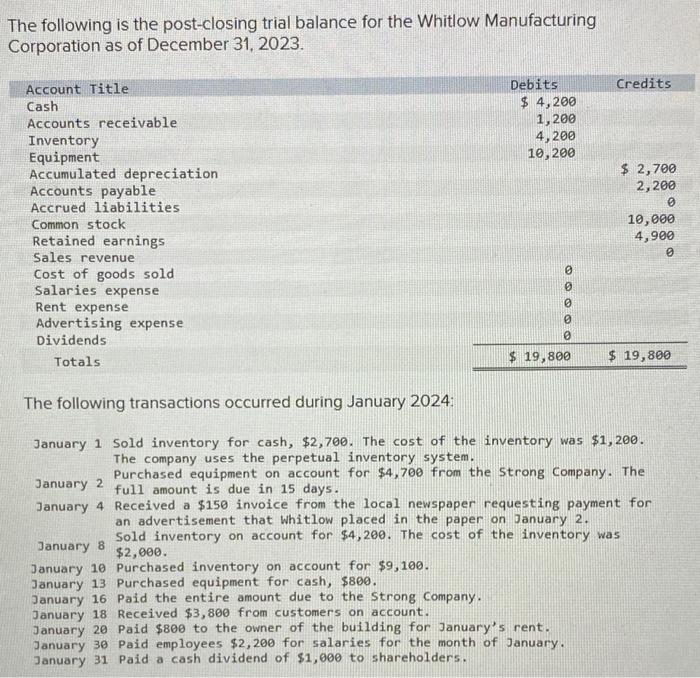

Question: please post separate entries for separate dates thank you! The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31,2023.

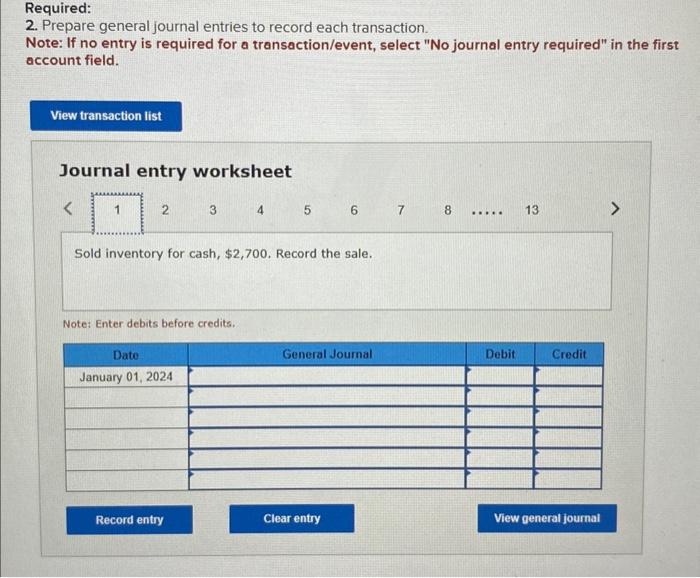

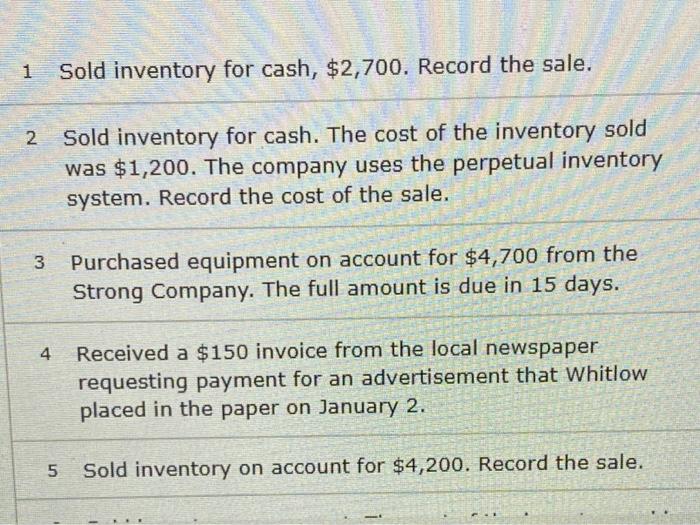

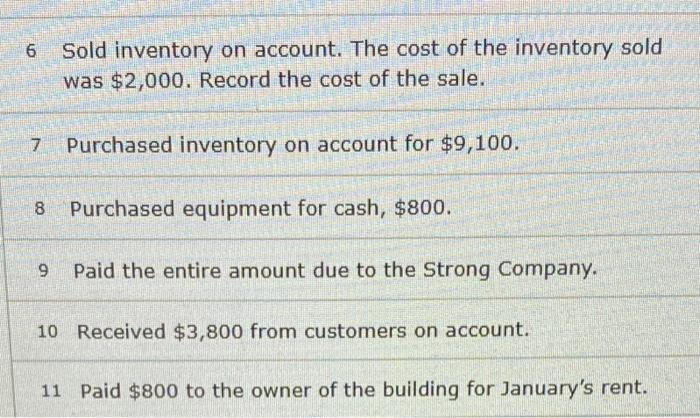

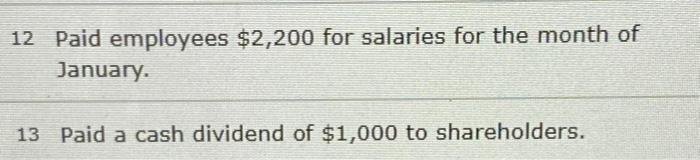

The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31,2023. The following transactions occurred during January 2024: January 1 Sold inventory for cash, $2,700. The cost of the inventory was $1,200. The company uses the perpetual inventory system. Purchased equipment on account for $4,700 from the Strong Company. The January 2 full amount is due in 15 days. January 4 Received a $150 invoice from the local newspaper requesting payment for an advertisement that Whitlow placed in the paper on January 2. January 8 Sold inventory on account for $4,200. The cost of the inventory was January 10 Purchased January 13 Purchased inventory on account for $9,100. January 13 Purchased equipment for cash, $800. January 16 paid the entire amount due to the strong Company. January 18 Received $3,800 from customers on account. January 20 Paid $800 to the owner of the building for January's rent. January 30 Paid employees $2,200 for salaries for the month of January. January 31 Paid a cash dividend of $1,00 to shareholders. 2. Prepare general journal entries to record each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Sold inventory for cash, $2,700. Record the sale. Note: Enter debits before credits. 1 Sold inventory for cash, $2,700. Record the sale. 2 Sold inventory for cash. The cost of the inventory sold was $1,200. The company uses the perpetual inventory system. Record the cost of the sale. 3 Purchased equipment on account for $4,700 from the Strong Company. The full amount is due in 15 days. 4 Received a $150 invoice from the local newspaper requesting payment for an advertisement that Whitlow placed in the paper on January 2 . 5 Sold inventory on account for $4,200. Record the sale. 6 Sold inventory on account. The cost of the inventory sold was $2,000. Record the cost of the sale. 7 Purchased inventory on account for $9,100. 8 Purchased equipment for cash, $800. 9 Paid the entire amount due to the Strong Company. 10 Received $3,800 from customers on account. 11 Paid $800 to the owner of the building for January's rent. 12 Paid employees $2,200 for salaries for the month of January. 13 Paid a cash dividend of $1,000 to shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts