Question: Please post step by step with no excel. answer has to be one of those answers. thanks 0. Question SOA FM 1990N 15: Bart buys

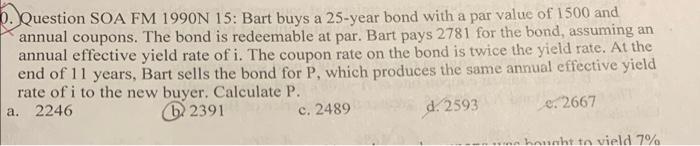

0. Question SOA FM 1990N 15: Bart buys a 25-year bond with a par value of 1500 and annual coupons. The bond is redeemable at par. Bart pays 2781 for the bond, assuming an annual effective yield rate of i. The coupon rate on the bond is twice the yield rate. At the end of 11 years, Bart sells the bond for P, which produces the same annual effective yield rate of i to the new buyer. Calculate P. a. 2246 b) 2391 c. 2489 d. 2593 e. 2667 hount to vield 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts