Question: please post the 3 answers individually Problem 1: On January 1, 2018, Itchy Company purchased a tractor-trailer rig for $176,000 The vehicle is expected to

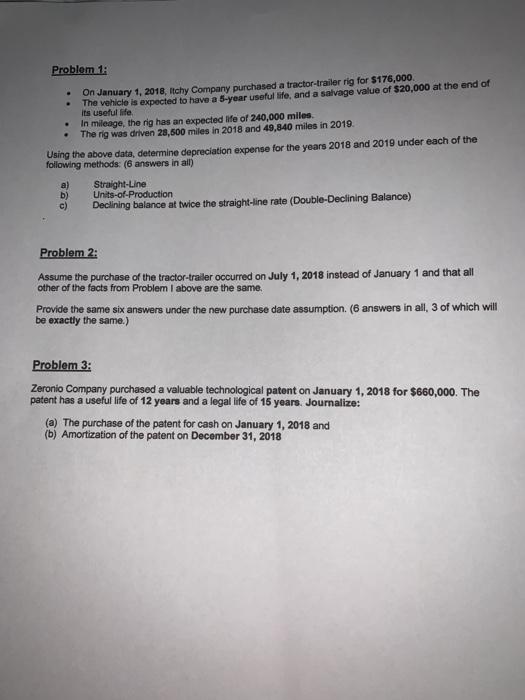

Problem 1: On January 1, 2018, Itchy Company purchased a tractor-trailer rig for $176,000 The vehicle is expected to have a 5-year useful life, and a salvage value of $20,000 at the end of its useful life In mileage, the rig has an expected life of 240,000 miles The rig was driven 28,500 miles in 2018 and 49,840 miles in 2019. Using the above data, determine depreciation expense for the years 2018 and 2019 under each of the following methods: (6 answers in all) Straight-Line b) Units-of-Production c) Declining balance at twice the straight-line rate (Double-Declining Balance) Problem 2: Assume the purchase of the tractor-trailer occurred on July 1, 2018 instead of January 1 and that all other of the facts from Problem I above are the same. Provide the same six answers under the new purchase date assumption. (6 answers in all, 3 of which will be exactly the same.) Problem 3: Zeronic Company purchased a valuable technological patent on January 1, 2018 for $660,000. The patent has a useful life of 12 years and a legal life of 16 years. Journalize: (a) The purchase of the patent for cash on January 1, 2018 and (b) Amortization of the patent on December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts