Question: please post the answer and formula Question 4 0 / 20 pts A close-end fund has $86M in assets, $1.2M in debt, and 98.7M shares

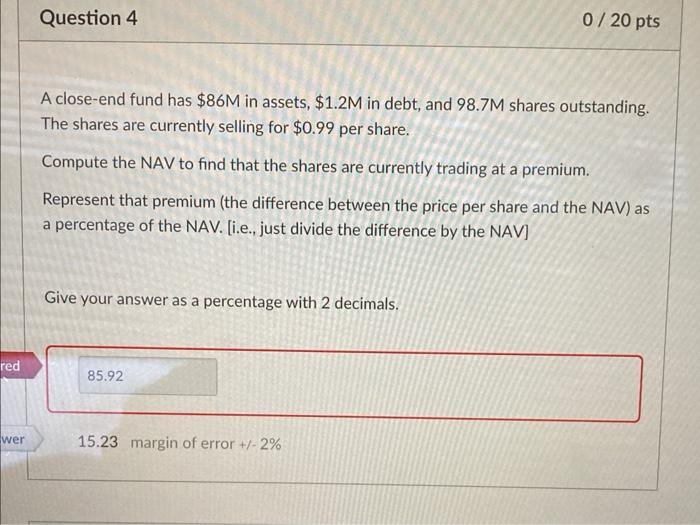

Question 4 0 / 20 pts A close-end fund has $86M in assets, $1.2M in debt, and 98.7M shares outstanding. The shares are currently selling for $0.99 per share. Compute the NAV to find that the shares are currently trading at a premium. Represent that premium (the difference between the price per share and the NAV) as a percentage of the NAV. [i.e., just divide the difference by the NAV] Give your answer as a percentage with 2 decimals. red 85.92 wer 15.23 margin of error +/- 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts