Question: Please post the answer zoomed out so I can see the full answer. Hopefully that makes sense, thank you! Problem 15-1A (Algo) Recording and adjusting

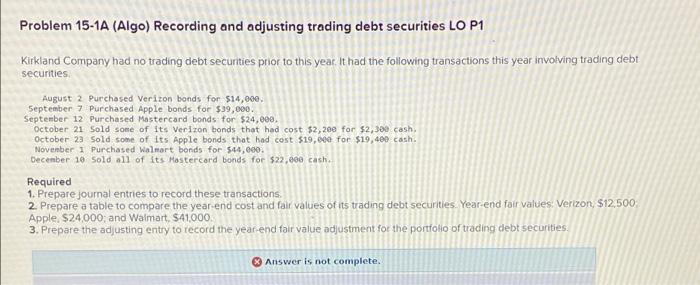

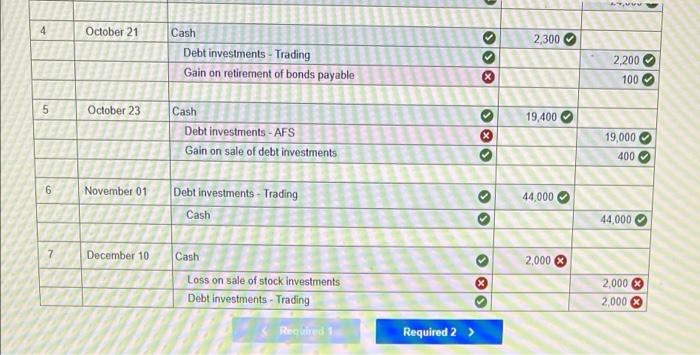

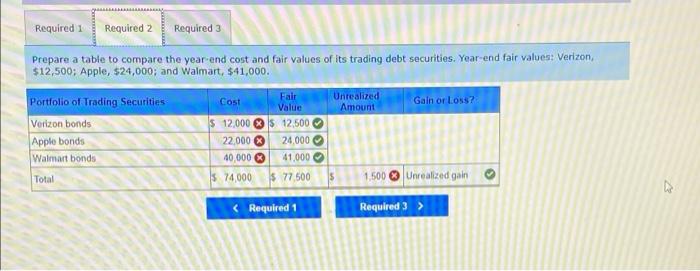

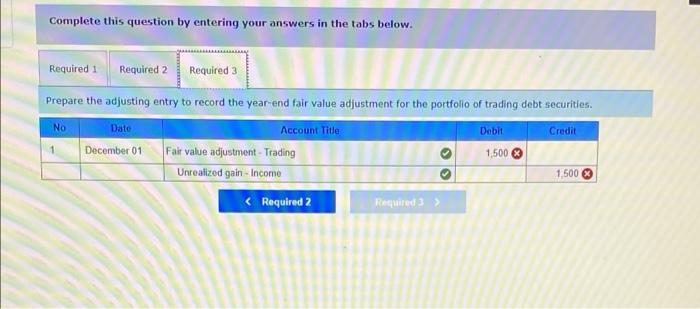

Problem 15-1A (Algo) Recording and adjusting trading debt securities LO P1 Kirkland Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt securities August 2 Purchased Verizon bonds for $14,000 September 7 Purchased Apple bonds for $39,000. September 12 Purchased Mastercard bonds for $24,000, October 21 sold some of its Verizon bonds that had cost $2,200 for $2,300 cash October 2a Sold some of its Apple bonds that had cost $19,000 for $19,400 cash. November I Purchased Walmart bonds for 544,000. December 10 sold all of its Mastercard bonds for $22.800 cash. Required 1. Prepare journal entries to record these transactions. 2. Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values. Verizon, $12,500 Apple $24000; and Walmart $41000 3. Prepare the adjusting entry to record the year end fair value adjustment for the portfolio of trading debt securities. Answer is not complete. No Date Debit Credit 1 August 02 General Journal Debt investments - Trading Cash 14,000 SIS 14,000 2 September 07 X Debt investments - AFS 39,000 Cash 39,000 September 12 Debt investments - HTM 24,000 Cash 24,000 4 October 21 2,300 Cash Debt investments - Trading Gain on retirement of bonds payable * O 2,200 100 5 October 23 19,400 Cash Debt investments - AFS Gain on sale of debt investments 19.000 400 00 4 October 21 2,300 Cash Debt investments - Trading Gain on retirement of bonds payable >>> 2,200 100 5 October 23 > 19,400 > Cash Debt investments - AFS Gain on sale of debt investments 19,000 400 6 November 01 Debt investments - Trading > 44,000 Cash 44,000 7 December 10 Cash 2,000 Loss on sale of stock investments Debt investments - Trading > Xls 2,000 $ 2,000 XX Requited Required 2 > Required 1 Required 2 Required 3 Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values: Verizon $12,500; Apple, $24,000; and Walmart, $41,000. Portfolio of Trading Securities Falt Unrealized Cost Gain or loss? Value Amount Verizon bonds $ 12,000 $ 12,500 Apple bonds 22.000 24,000 40,000 41.000 $ 74,000 $77.500 1,500 Unrealized gain Walmart bonds O > Total 5 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the adjusting entry to record the year end fair value adjustment for the portfolio of trading debt securities. No Date Account Title Debit Credit December 01 Fair value adjustment - Trading 1,500 Unrealizod gain -Income 1,500 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts