Question: please post the correct answer. A wholesale business with a December 31 year-end purchased new equipment on November 25, 2019, for $43,300. Before 2019, the

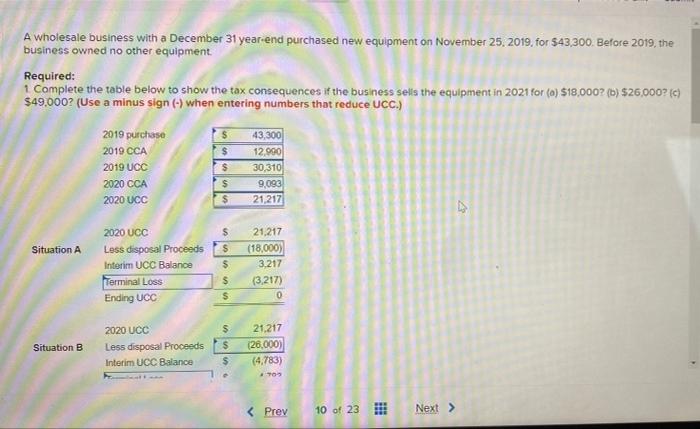

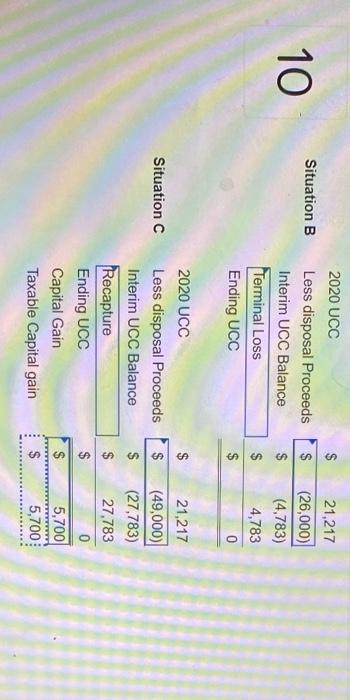

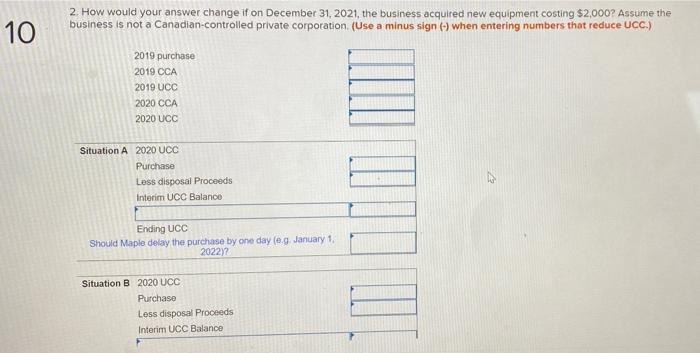

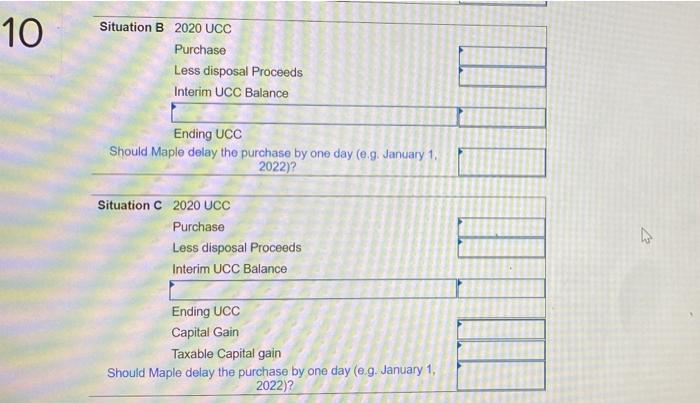

A wholesale business with a December 31 year-end purchased new equipment on November 25, 2019, for $43,300. Before 2019, the business owned no other equipment Required: 1 Complete the table below to show the tax consequences if the business sells the equipment in 2021 for (a) $18,000? (b) $26.000? (0) $49,000? (Use a minus sign (-) when entering numbers that reduce UCC.) 2019 purchase 2019 CCA 2019 UCC 2020 CCA 2020 UCC $ $ $ $ $ 43,300 12.990 30,310 9,093 21,217 Situation A 2020 UCC Less disposal Proceeds Interim UCC Balance Terminal Loss Ending UCC $ $ $ 21.217 (18,000) 3.217 (3.217) 0 $ $ Situation B 2020 UCC Less disposal Proceeds Intetim UCC Balance $ $ $ 21.217 (26.000) (4,783) . Situation B $ $ 10 2020 UCC Less disposal Proceeds Interim UCC Balance Terminal Loss Ending UCC $ $ $ 21,217 (26,000) (4,783) 4,783 0 $ Situation C $ $ 2020 UCC Less disposal Proceeds Interim UCC Balance Recapture Ending UCC Capital Gain Taxable Capital gain 21,217 (49,000) (27,783) 27,783 0 $ $ $ 5,700 5,700 : $ 10 2. How would your answer change if on December 31, 2021, the business acquired new equipment costing $2,000? Assume the business is not a Canadian-controlled private corporation (Use a minus sign (-) when entering numbers that reduce UCC.) 2019 purchase 2019 CCA 2019 UCC 2020 CCA 2020 UCC Situation A 2020 UCC Purchase Lass disposal Proceeds Interim UCC Balance Ending UCC Should Maple delay the purchase by one day (9. January 1, 20227? Situation B 2020 UCC Purchase Less disposal Proceeds Interim UCC Balance 10 Situation B 2020 UCC Purchase Less disposal Proceeds Interim UCC Balance 7 Ending UCC Should Maple delay the purchase by one day (e.g. January 1, 2022)? Situation C2020 UCC Purchase Less disposal Proceeds Interim UCC Balance Ending UCC Capital Gain Taxable Capital gain Should Maple delay the purchase by one day (0.9. January 1, 2022)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts