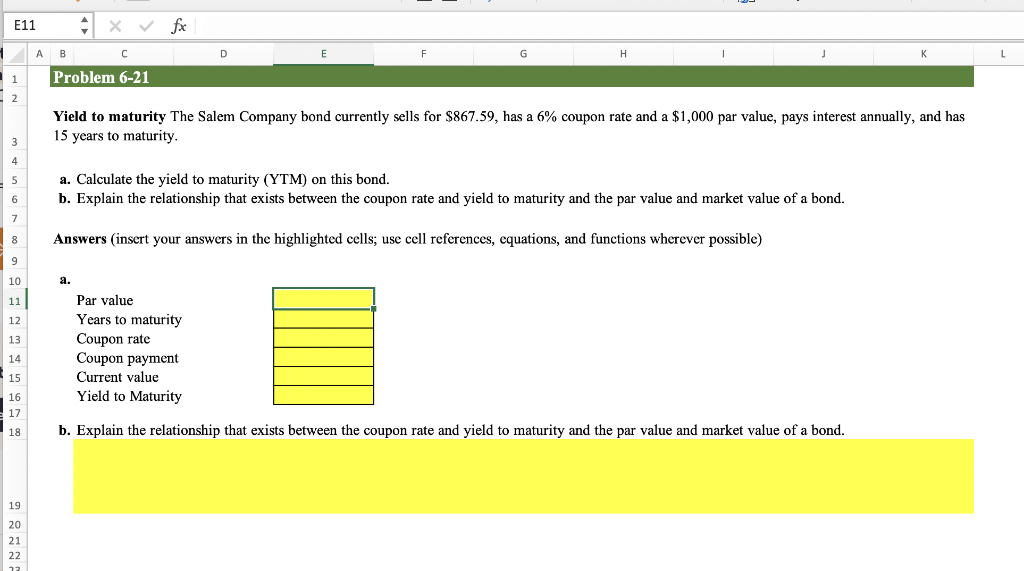

Question: **PLEASE POST THE EQUATIONS I NEED TO TYPE INTO EXCEL AS WELL. THE FIRST YELLOW BOX IS E11. THANK YOU Yield to maturity The Salem

**PLEASE POST THE EQUATIONS I NEED TO TYPE INTO EXCEL AS WELL. THE FIRST YELLOW BOX IS E11. THANK YOU

Yield to maturity The Salem Company bond currently sells for $867.59, has a 6% coupon rate and a $1,000 par value, pays interest annually, and has 15 years to maturity. a. Calculate the yield to maturity (YTM) on this bond. b. Explain the relationship that exists between the coupon rate and yield to maturity and the par value and market value of a bond. Answers (insert your answers in the highlighted cells; use cell references, equations, and functions wherever possible) b. Explain the relationship that exists between the coupon rate and yield to maturity and the par value and market value of a bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts