Question: Please post the results with a explanation C10-1 Calculating Interest and Depreciation Expenses and Effects on Loan Covenant Ratios (Chapters 9 and 10) [LO 9-3,

![[LO 9-3, LO 9-7, LO 10-2, LO 10-5] Zoom Car Corporation (ZCC)](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66d9868ec45cb_79066d9868e5e65e.jpg)

Please post the results with a explanation

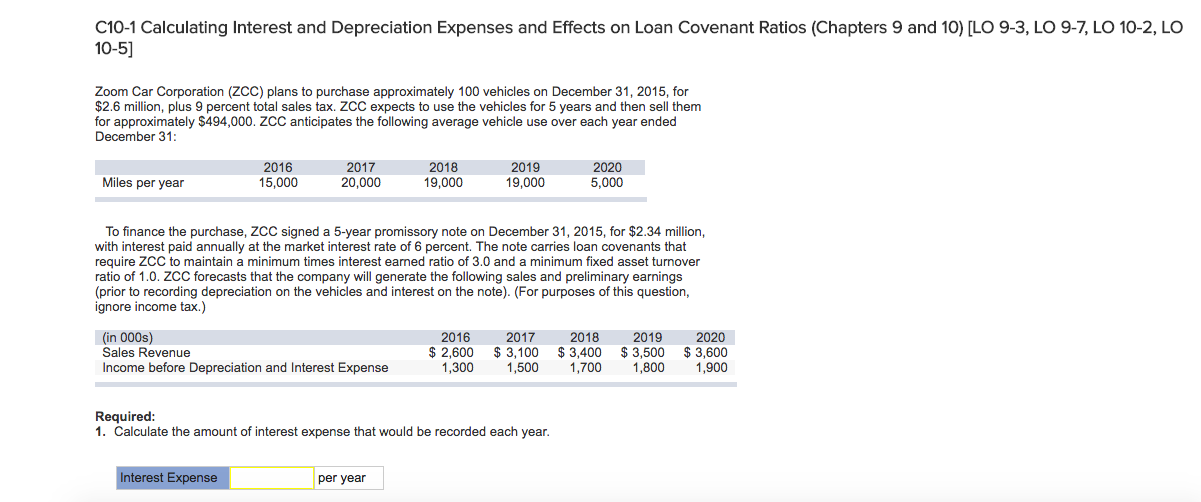

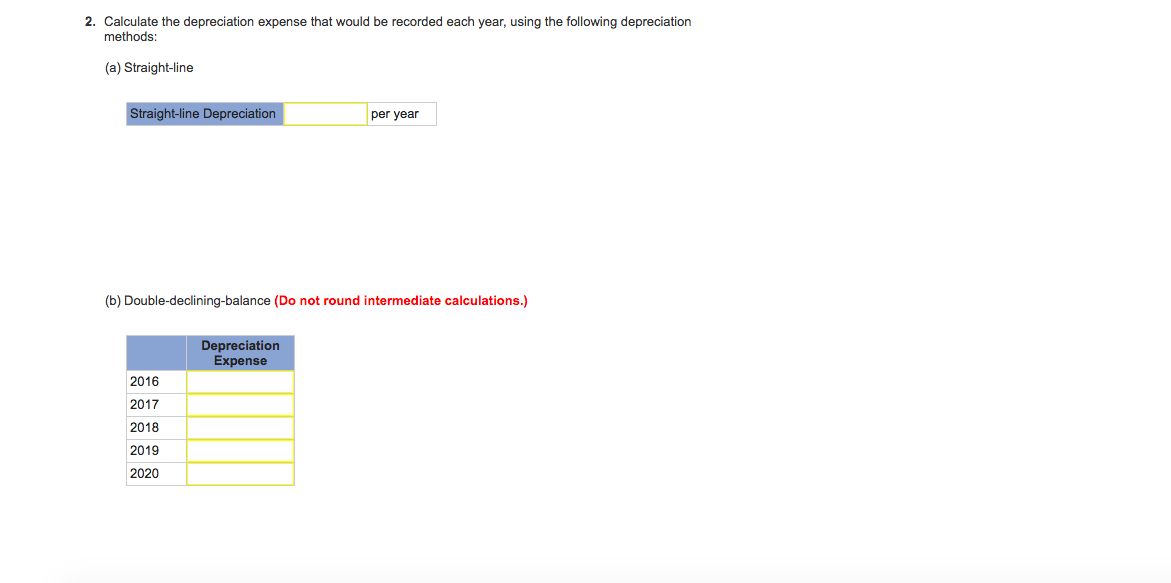

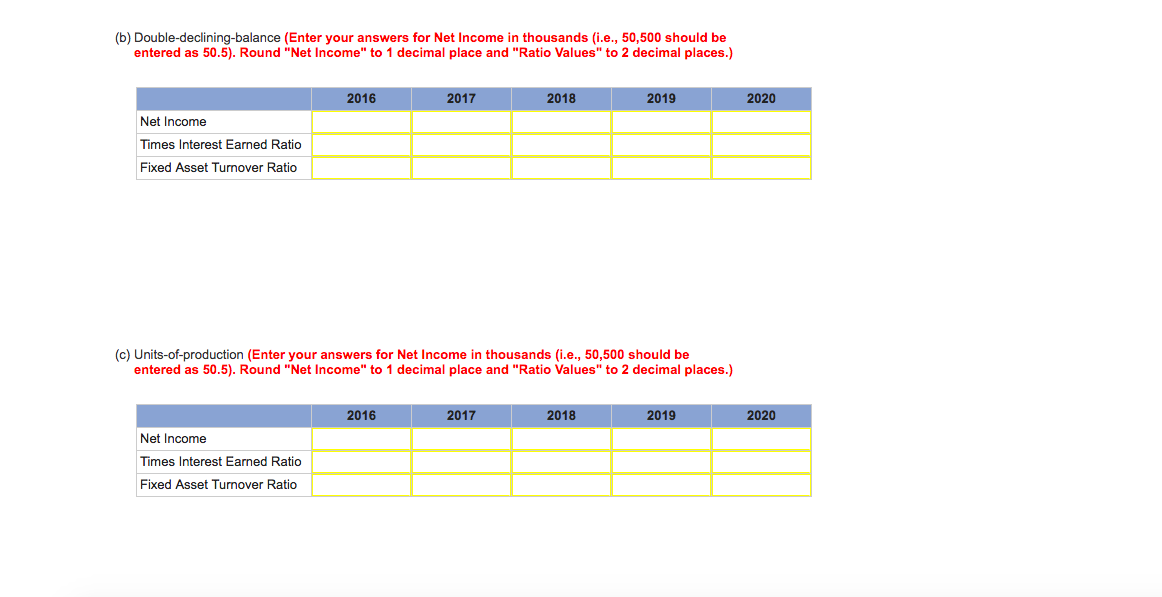

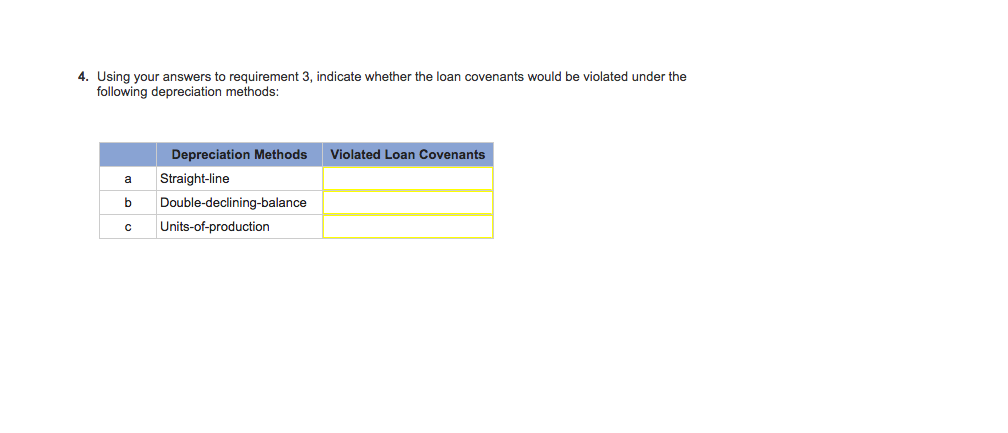

C10-1 Calculating Interest and Depreciation Expenses and Effects on Loan Covenant Ratios (Chapters 9 and 10) [LO 9-3, LO 9-7, LO 10-2, LO 10-5] Zoom Car Corporation (ZCC) plans to purchase approximately 100 vehicles on December 31, 2015, for $2.6 million, plus 9 percent total sales tax. ZCC expects to use the vehicles for 5 years and then sell them for approximately $494,000. ZCC anticipates the following average vehicle use over each year ended December 31 2016 15,000 2017 20,000 2018 19,000 2019 19,000 2020 5,000 Miles per year To finance the purchase, ZCC signed a 5-year promissory note on December 31, 2015, for $2.34 million, with interest paid annually at the market interest rate of 6 percent. The note carries loan covenants that require ZCC to maintain a minimum times interest earned ratio of 3.0 and a minimum fixed asset turnover ratio of 1.0. ZCC forecasts that the company will generate the following sales and preliminary earning:s (prior to recording depreciation on the vehicles and interest on the note). (For purposes of this question, ignore income tax.) (in 000s) Sales Revenue Income before Depreciation and Interest Expense 2020 $2,600 3,100 $ 3,400 $ 3,500 $ 3,600 1,300 500 1,700 ,800 ,900 2016 2017 2018 2019 Required 1. Calculate the amount of interest expense that would be recorded each year Interest Expense per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts