Question: please PowerPoint need 10 slides information Please create a PowerPoint presentation that represents all main points from the attached IBCF Qualification Specification. You may use

please PowerPoint need 10 slides information Please create a PowerPoint presentation that represents all main points from the attached IBCF Qualification Specification. You may use graphics or any other tools to highlight the essence and requirements of the qualification. As Advanced PowerPoint is a key element for this role, management is looking for dynamic ways to represent information. The presentation should not be over 10 slides.

this is full informatiom

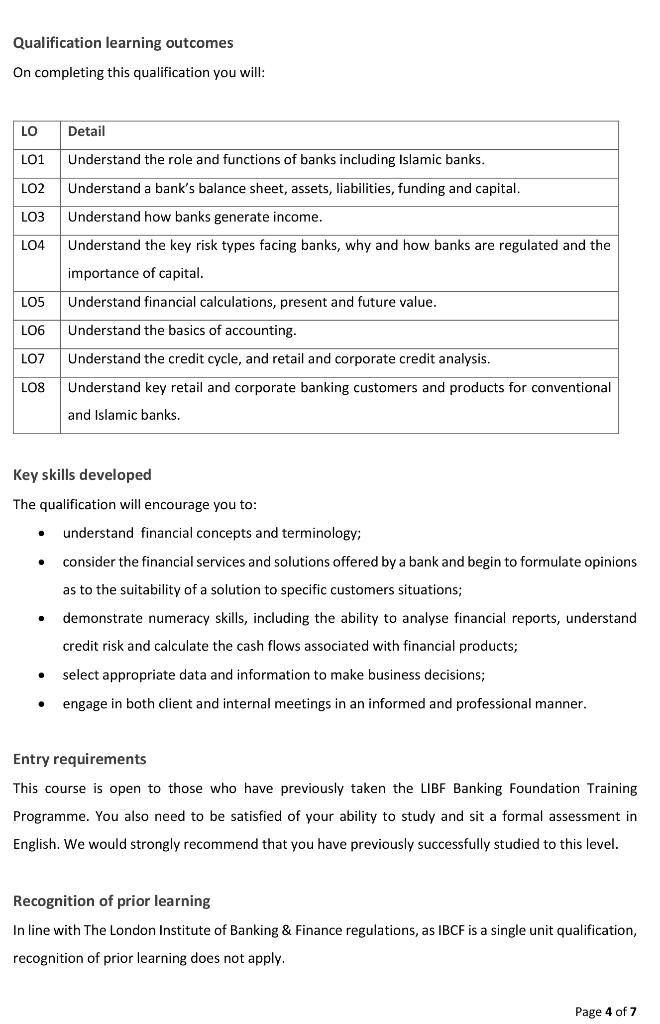

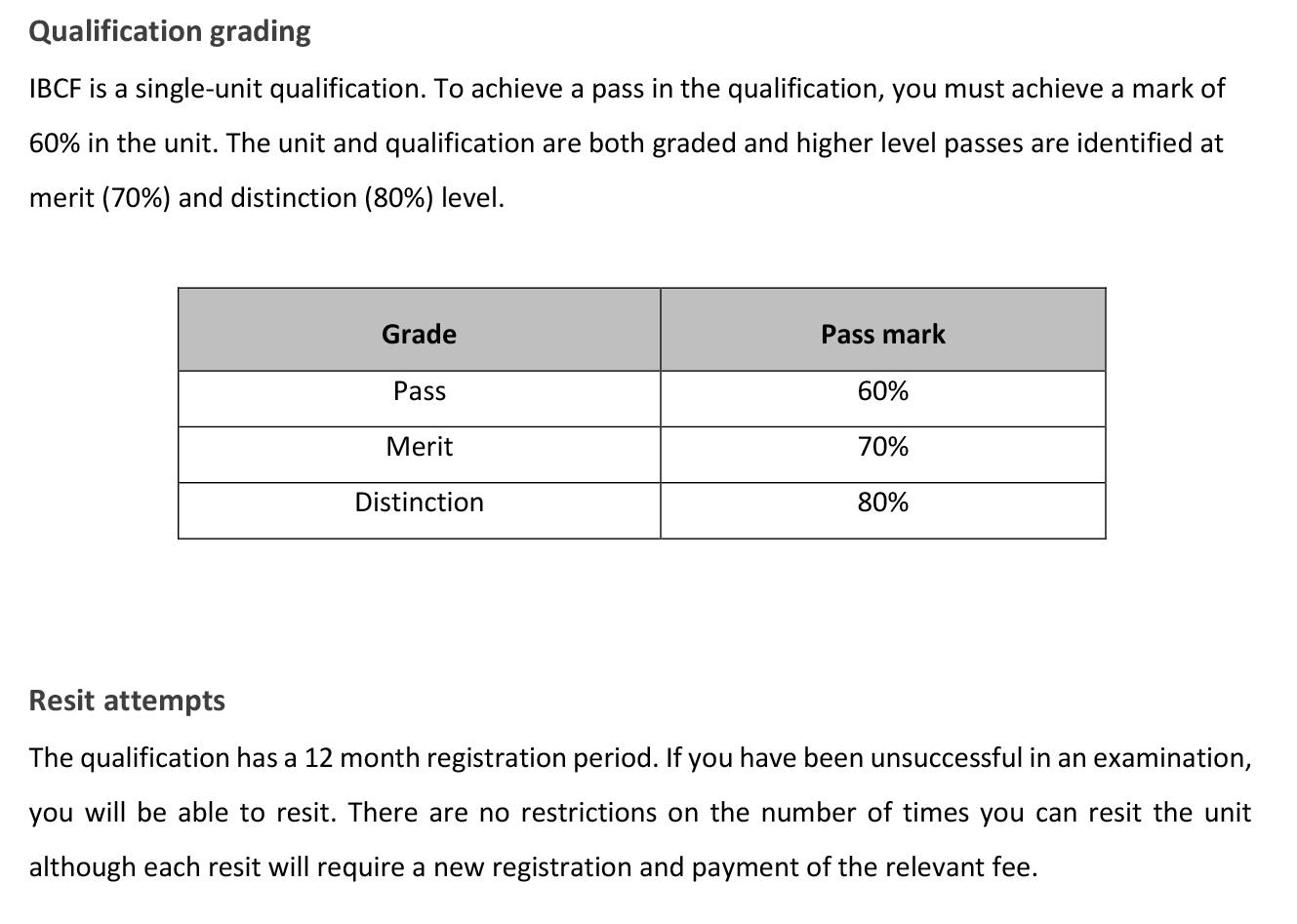

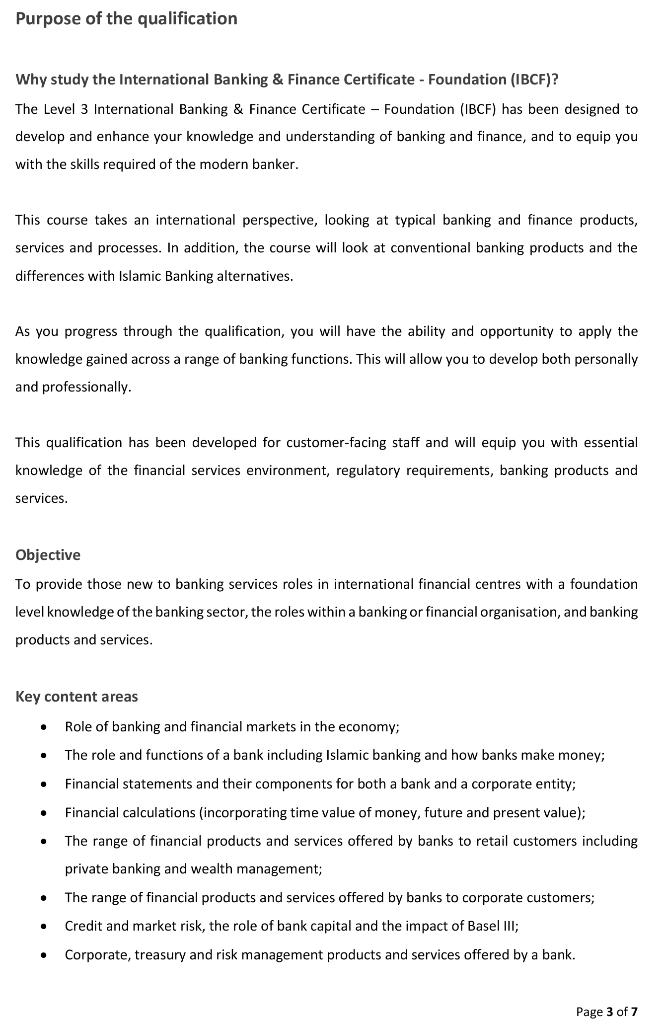

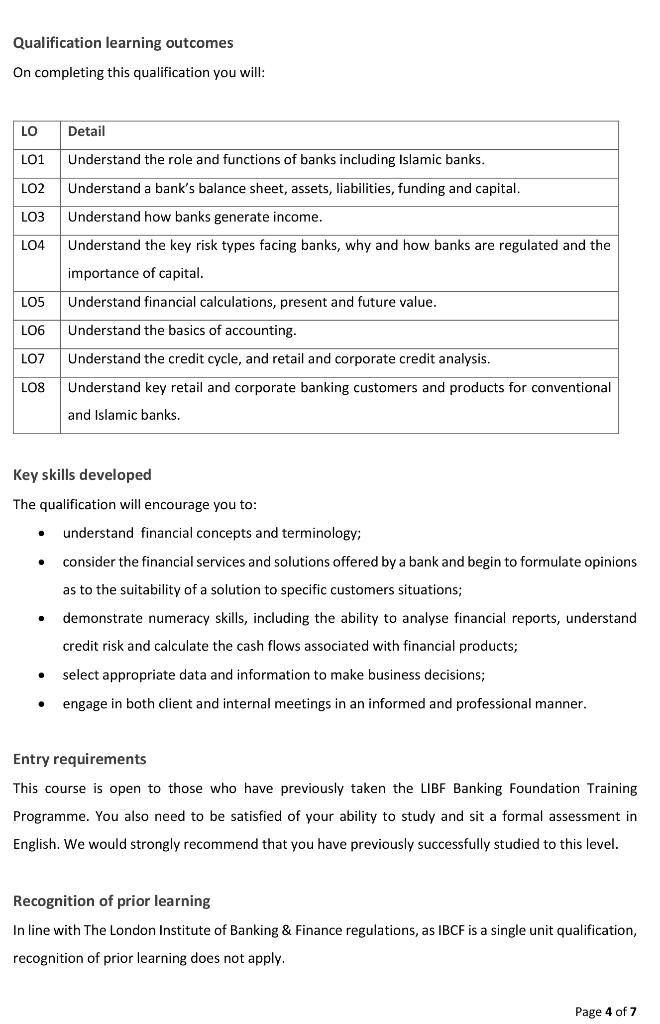

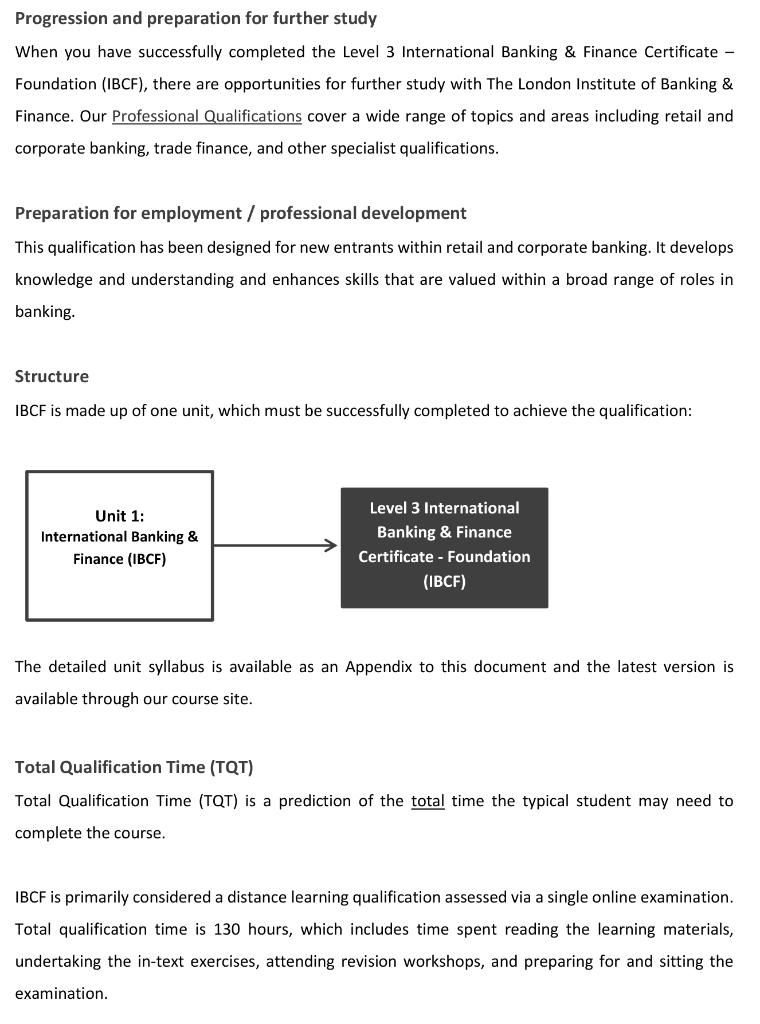

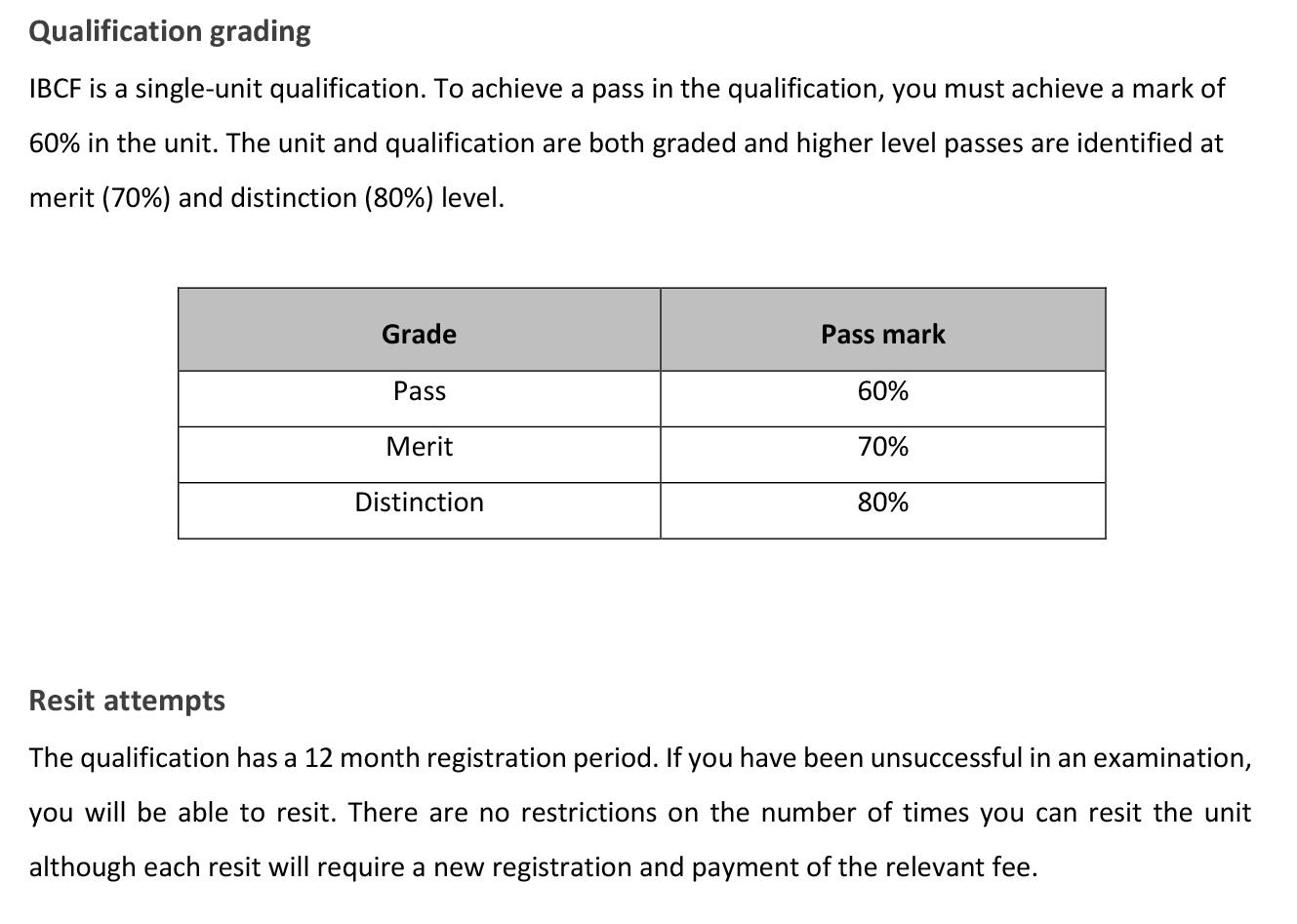

The London Institute of Banking & Finance Level 3 International Banking & Finance Certificate - Foundation Purpose of the qualification Why study the International Banking & Finance Certificate - Foundation (IBCF)? The Level 3 International Banking & Finance Certificate - Foundation (IBCF) has been designed to develop and enhance your knowledge and understanding of banking and finance, and to equip you with the skills required of the modern banker. This course takes an international perspective, looking at typical banking and finance products, services and processes. In addition, the course will look at conventional banking products and the differences with Islamic Banking alternatives. As you progress through the qualification, you will have the ability and opportunity to apply the knowledge gained across a range of banking functions. This will allow you to develop both personally and professionally. This qualification has been developed for customer-facing staff and will equip you with essential knowledge of the financial services environment, regulatory requirements, banking products and services. Objective To provide those new to banking services roles in international financial centres with a foundation level knowledge of the banking sector, the roles within a banking or financial organisation, and banking products and services. Key content areas . . . Role of banking and financial markets in the economy The role and functions of a bank including Islamic banking and how banks make money; Financial statements and their components for both a bank and a corporate entity; Financial calculations (incorporating time value of money, future and present value); The range of financial products and services offered by banks to retail customers including private banking and wealth management; The range of financial products and services offered by banks to corporate customers; Credit and market risk, the role of bank capital and the impact of Basel III; Corporate, treasury and risk management products and services offered by a bank. . . . Page 3 of 7 Qualification learning outcomes On completing this qualification you will: LO Detail LO1 Understand the role and functions of banks including Islamic banks. LO2 LO3 LO4 Understand a bank's balance sheet, assets, liabilities, funding and capital. Understand how banks generate income. Understand the key risk types facing banks, why and how banks are regulated and the importance of capital. Understand financial calculations, present and future value. LO5 LO6 Understand the basics of accounting. LOZ LOS Understand the credit cycle, and retail and corporate credit analysis. Understand key retail and corporate banking customers and products for conventional and Islamic banks. . Key skills developed The qualification will encourage you to: understand financial concepts and terminology; consider the financial services and solutions offered by a bank and begin to formulate opinions as to the suitability of a solution to specific customers situations; demonstrate numeracy skills, including the ability to analyse financial reports, understand credit risk and calculate the cash flows associated with financial products; select appropriate data and information to make business decisions; engage in both client and internal meetings in an informed and professional manner. . . Entry requirements This course is open to those who have previously taken the LIBF Banking Foundation Training Programme. You also need to be satisfied of your ability to study and sit a formal assessment in English. We would strongly recommend that you have previously successfully studied to this level. Recognition of prior learning In line with The London Institute of Banking & Finance regulations, as IBCF is a single unit qualification, recognition of prior learning does not apply. Page 4 of 7 Progression and preparation for further study When you have successfully completed the Level 3 International Banking & Finance Certificate - Foundation (IBCF), there are opportunities for further study with The London Institute of Banking & Finance. Our Professional Qualifications cover a wide range of topics and areas including retail and corporate banking, trade finance, and other specialist qualifications. Preparation for employment / professional development This qualification has been designed for new entrants within retail and corporate banking. It develops knowledge and understanding and enhances skills that are valued within a broad range of roles in banking. Structure IBCF is made up of one unit, which must be successfully completed to achieve the qualification: Unit 1: International Banking & Finance (IBCF) Level 3 International Banking & Finance Certificate - Foundation (IBCF) The detailed unit syllabus is available as an Appendix to this document and the latest version is available through our course site. Total Qualification Time (TQT) Total Qualification Time (TQT) is a prediction of the total time the typical student may need to complete the course. IBCF is primarily considered a distance learning qualification assessed via a single online examination. Total qualification time is 130 hours, which includes time spent reading the learning materials, undertaking the in-text exercises, attending revision workshops, and preparing for and sitting the examination. Learning resources Study for the IBCF qualification is undertaken part-time on a distance-learning basis, supported by comprehensive learning materials. . Students are provided with the following learning resources: online study materials including a series of workbooks with embedded exercises; online access to additional resources through MyLIBF- www.myLIBF.ac.uk; access to KnowledgeBank (virtual library) through MyLIBF; . study skills resources, unit syllabus; specimen examination paper; and . student handbook. Preparing for the assessment To prepare for each assessment, you should make use of all learning resources as described in the section above. Learning resources will be available to you in the online course site. It is also recommended that you attend the revision workshops organised by the LIBF MENA Office. The examination is sat electronically. Your examination will be booked for you by the LIBF MENA Office and you will be advised of your examination date, time and location. Assessment The unit is assessed through a three hour mandatory multiple-choice examination. A total of 80 marks are available comprising 50 marks in part 1 and 30 marks in part 2. The unit pass mark is 60%, and you must achieve the minimum pass mark for the unit. The structure of the assessment ensures that all aspects of the course content are subject to external examination. . Part 1: an electronic assessment with 50 multiple choice questions. This component is worth 50 marks. . Part 2: An electronic assessment with six mini cases studies, each with five linked multiple choice questions. This component is worth 30 marks. Feedback for MCQ assessments is provided in your analysis sheets (available on www.mylibf.ac.uk) for the qualification. Qualification grading IBCF is a single-unit qualification. To achieve a pass in the qualification, you must achieve a mark of 60% in the unit. The unit and qualification are both graded and higher level passes are identified at merit (70%) and distinction (80%) level. Grade Pass mark Pass 60% Merit 70% Distinction 80% Resit attempts The qualification has a 12 month registration period. If you have been unsuccessful in an examination, you will be able to resit. There are no restrictions on the number of times you can resit the unit although each resit will require a new registration and payment of the relevant fee