Question: Please prepare a 1-page write-up where you evaluate the analyst report of MAVI. Your evaluation should include the following: 1) The analyst forecasts/assumptions of model

Please prepare a 1-page write-up where you evaluate the analyst report of MAVI.

Please prepare a 1-page write-up where you evaluate the analyst report of MAVI.

Your evaluation should include the following:

1) The analyst forecasts/assumptions of model inputs

2) Decision on why you would followot follow the analyst recommendation

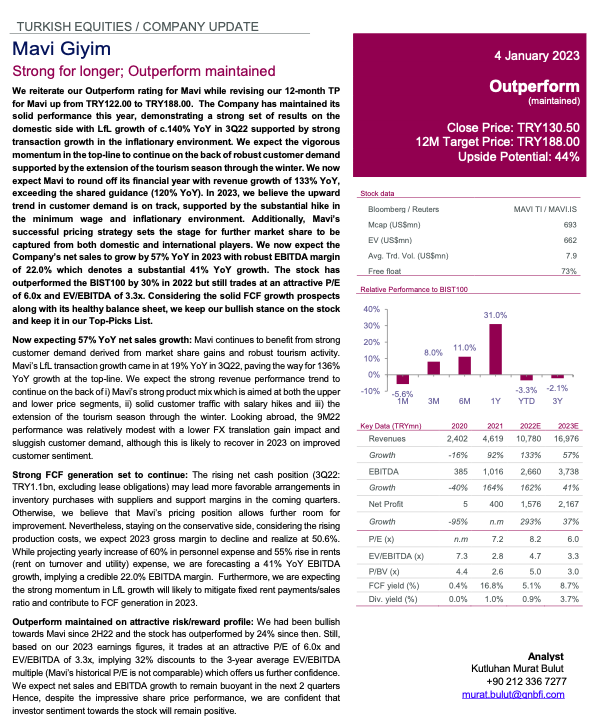

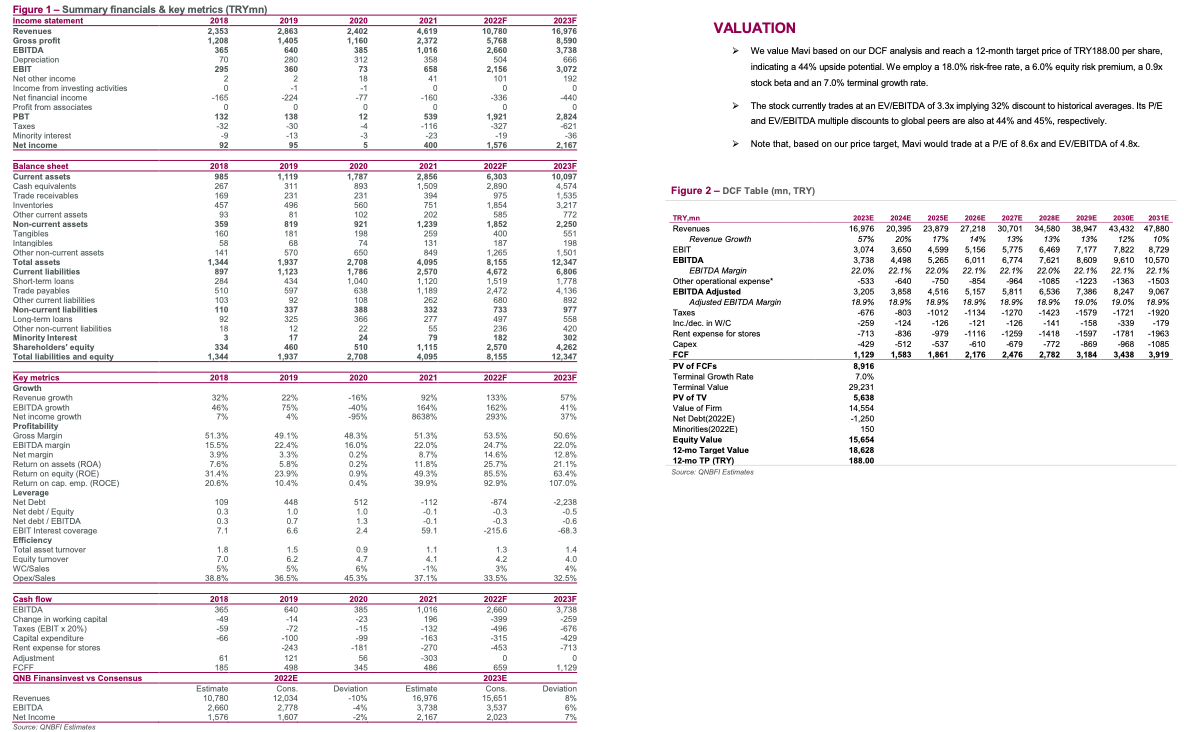

Mavi Giyim 4 January 202 Strong for longer; Outperform maintained We reiterate our Outperform rating for Mavi while revising our 12-month TP for Mavi up from TRY122.00 to TRY188.00. The Company has maintained its solid performance this year, demonstrating a strong set of results on the domestic side with LfL growth of c.140\% YoY in 3Q22 supported by strong transaction growth in the inflationary environment. We expect the vigorous 12M Target Price: TRY 188.0 momentum in the top-line to continue on the back of robust customer demand Upside Potential: 44 supported by the extension of the tourism season through the winter. We now expect Mavi to round off its financial year with revenue growth of 133% YoY, exceeding the shared guidance (120\% YoY). In 2023, we believe the upward trend in customer demand is on track, supported by the substantial hike in the minimum wage and inflationary environment. Additionally, Mavi's successful pricing strategy sets the stage for further market share to be captured from both domestic and international players. We now expect the Company's net sales to grow by 57% YoY in 2023 with robust EBITDA margin of 22.0% which denotes a substantial 41% YoY growth. The stock has outperformed the BIST100 by 30% in 2022 but still trades at an attractive P/E of 6.0x and EV/EBITDA of 3.3x. Considering the solid FCF growth prospects along with its healthy balance sheet, we keep our bullish stance on the stock and keep it in our Top-Picks List. Now expecting 57% YoY net sales growth: Mavi continues to benefit from strong customer demand derived from market share gains and robust tourism activity. Mavi's LfL transaction growth came in at 19% YoY in 3022 , paving the way for 136% YoY growth at the top-line. We expect the strong revenue performance trend to continue on the back ofi) Mavis strong product mix which is aimed at both the upper and lower price segments, i.) solid customer traffic with salary hikes and ii) the extension of the tourism season through the winter. Looking abroad, the 9M22 performance was relatively modest with a lower FX translation gain impact and sluggish customer demand, although this is likely to recover in 2023 on improved customer sentiment. Strong FCF generation set to continue: The rising net cash position (3Q22: TRY1.1bn, excluding lease obligations) may lead more favorable arrangements in inventory purchases with suppliers and support margins in the coming quarters. Otherwise, we believe that Mavi's pricing position allows further room for improvement. Nevertheless, staying on the conservative side, considering the rising production costs, we expect 2023 gross margin to decline and realize at 50.6%. While projecting yearly increase of 60% in personnel expense and 55% rise in rents (rent on turnover and utility) expense, we are forecasting a 41% YoY EBITDA growth, implying a credible 22.0% EBITDA margin. Furthermore, we are expecting the strong momentum in LfL growth will likely to mitigate fixed rent payments/sales ratio and contribute to FCF generation in 2023. Outperform maintained on attractive riskireward profile: We had been bullish towards Mavi since 2H22 and the stock has outperformed by 24% since then. Still, based on our 2023 earnings figures, it trades at an attractive P/E of 6.0x and EVIEBITDA of 3.3x, implying 32\% discounts to the 3-year average EV/EBITDA multiple (Mavi's historical P/E is not comparable) which offers us further confidence. We expect net sales and EBITDA growth to remain buoyant in the next 2 quarters Hence, despite the impressive share price performance, we are confident that investor sentiment towards the stock will remain positive. VALUATION We value Mavi based on our DCF analysis and reach a 12-month target price of TRY188.00 per share, indicating a 44% upside potential. We employ a 18.0% risk-free rate, a 6.0% equity risk premium, a 0.9x stock beta and an 7.0% terminal growth rate. The stock currently trades at an EVIEBITDA of 3.3x implying 32% discount to historical averages. Its P/E and EV/EBITDA multiple discounts to global peers are also at 44% and 45%, respectively. Note that, based on our price target, Mavi would trade at a P/E of 8.6x and EV/EBITDA of 4.8Bx. Figure 2 - DCF Table (mn, TRY) Mavi Giyim 4 January 202 Strong for longer; Outperform maintained We reiterate our Outperform rating for Mavi while revising our 12-month TP for Mavi up from TRY122.00 to TRY188.00. The Company has maintained its solid performance this year, demonstrating a strong set of results on the domestic side with LfL growth of c.140\% YoY in 3Q22 supported by strong transaction growth in the inflationary environment. We expect the vigorous 12M Target Price: TRY 188.0 momentum in the top-line to continue on the back of robust customer demand Upside Potential: 44 supported by the extension of the tourism season through the winter. We now expect Mavi to round off its financial year with revenue growth of 133% YoY, exceeding the shared guidance (120\% YoY). In 2023, we believe the upward trend in customer demand is on track, supported by the substantial hike in the minimum wage and inflationary environment. Additionally, Mavi's successful pricing strategy sets the stage for further market share to be captured from both domestic and international players. We now expect the Company's net sales to grow by 57% YoY in 2023 with robust EBITDA margin of 22.0% which denotes a substantial 41% YoY growth. The stock has outperformed the BIST100 by 30% in 2022 but still trades at an attractive P/E of 6.0x and EV/EBITDA of 3.3x. Considering the solid FCF growth prospects along with its healthy balance sheet, we keep our bullish stance on the stock and keep it in our Top-Picks List. Now expecting 57% YoY net sales growth: Mavi continues to benefit from strong customer demand derived from market share gains and robust tourism activity. Mavi's LfL transaction growth came in at 19% YoY in 3022 , paving the way for 136% YoY growth at the top-line. We expect the strong revenue performance trend to continue on the back ofi) Mavis strong product mix which is aimed at both the upper and lower price segments, i.) solid customer traffic with salary hikes and ii) the extension of the tourism season through the winter. Looking abroad, the 9M22 performance was relatively modest with a lower FX translation gain impact and sluggish customer demand, although this is likely to recover in 2023 on improved customer sentiment. Strong FCF generation set to continue: The rising net cash position (3Q22: TRY1.1bn, excluding lease obligations) may lead more favorable arrangements in inventory purchases with suppliers and support margins in the coming quarters. Otherwise, we believe that Mavi's pricing position allows further room for improvement. Nevertheless, staying on the conservative side, considering the rising production costs, we expect 2023 gross margin to decline and realize at 50.6%. While projecting yearly increase of 60% in personnel expense and 55% rise in rents (rent on turnover and utility) expense, we are forecasting a 41% YoY EBITDA growth, implying a credible 22.0% EBITDA margin. Furthermore, we are expecting the strong momentum in LfL growth will likely to mitigate fixed rent payments/sales ratio and contribute to FCF generation in 2023. Outperform maintained on attractive riskireward profile: We had been bullish towards Mavi since 2H22 and the stock has outperformed by 24% since then. Still, based on our 2023 earnings figures, it trades at an attractive P/E of 6.0x and EVIEBITDA of 3.3x, implying 32\% discounts to the 3-year average EV/EBITDA multiple (Mavi's historical P/E is not comparable) which offers us further confidence. We expect net sales and EBITDA growth to remain buoyant in the next 2 quarters Hence, despite the impressive share price performance, we are confident that investor sentiment towards the stock will remain positive. VALUATION We value Mavi based on our DCF analysis and reach a 12-month target price of TRY188.00 per share, indicating a 44% upside potential. We employ a 18.0% risk-free rate, a 6.0% equity risk premium, a 0.9x stock beta and an 7.0% terminal growth rate. The stock currently trades at an EVIEBITDA of 3.3x implying 32% discount to historical averages. Its P/E and EV/EBITDA multiple discounts to global peers are also at 44% and 45%, respectively. Note that, based on our price target, Mavi would trade at a P/E of 8.6x and EV/EBITDA of 4.8Bx. Figure 2 - DCF Table (mn, TRY)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts