Question: please prepare a graph as well Question 02: (05 Marks) Teri Hall has recently opened Sheer Elegance, Inc., a store specializing in fashionable stockings. Ms.

please prepare a graph as well

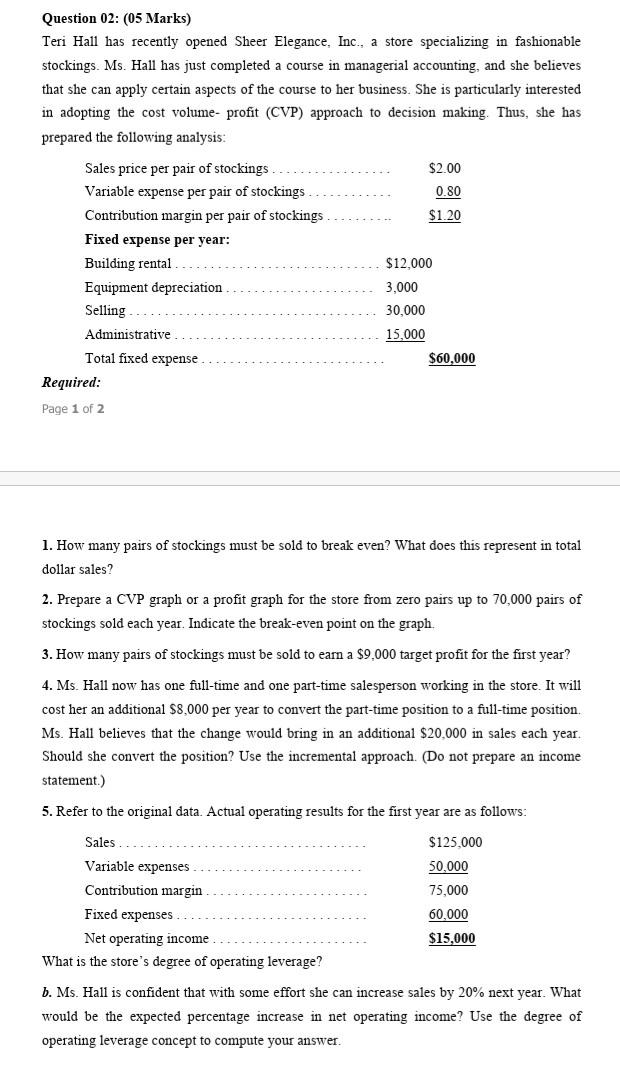

Question 02: (05 Marks) Teri Hall has recently opened Sheer Elegance, Inc., a store specializing in fashionable stockings. Ms. Hall has just completed a course in managerial accounting, and she believes that she can apply certain aspects of the course to her business. She is particularly interested in adopting the cost volume-profit (CVP) approach to decision making. Thus, she has prepared the following analysis Sales price per pair of stockings $2.00 Variable expense per pair of stockings 0.80 Contribution margin per pair of stockings $1.20 Fixed expense per year: Building rental $12.000 Equipment depreciation 3.000 Selling .... 30.000 Administrative 15,000 Total fixed expense $60.000 Required: Page 1 of 2 1. How many pairs of stockings must be sold to break even? What does this represent in total dollar sales? 2. Prepare a CVP graph or a profit graph for the store from zero pairs up to 70,000 pairs of stockings sold each year. Indicate the break-even point on the graph. 3. How many pairs of stockings must be sold to earn a $9.000 target profit for the first year? 4. Ms. Hall now has one full-time and one part-time salesperson working in the store. It will cost her an additional $8,000 per year to convert the part-time position to a full-time position. Ms. Hall believes that the change would bring in an additional $20,000 in sales each year. Should she convert the position? Use the incremental approach. (Do not prepare an income statement.) 5. Refer to the original data. Actual operating results for the first year are as follows: Sales $125.000 50.000 75,000 Variable expenses Contribution margin Fixed expenses Net operating income What is the store's degree of operating leverage? 60,000 $15,000 b. Ms. Hall is confident that with some effort she can increase sales by 20% next year. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts