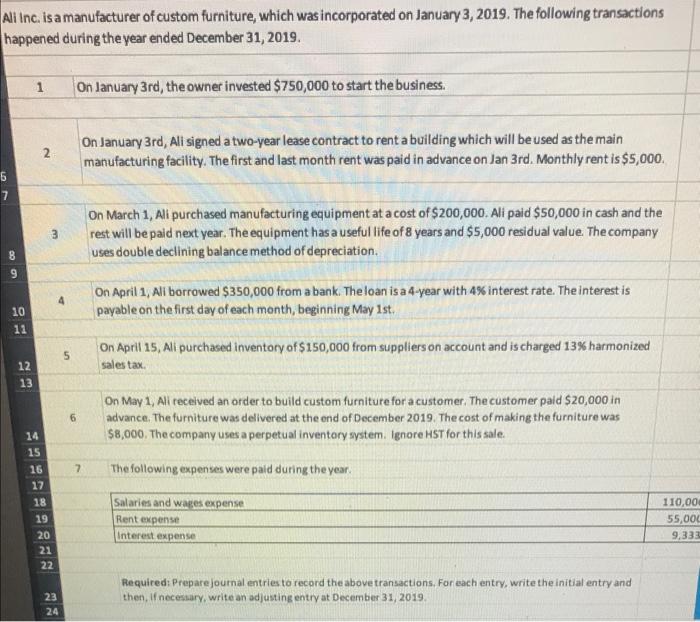

Question: Please Prepare a Journal Entry. Please read what the question is asking. thanks All Inc. is a manufacturer of custom furniture, which was incorporated on

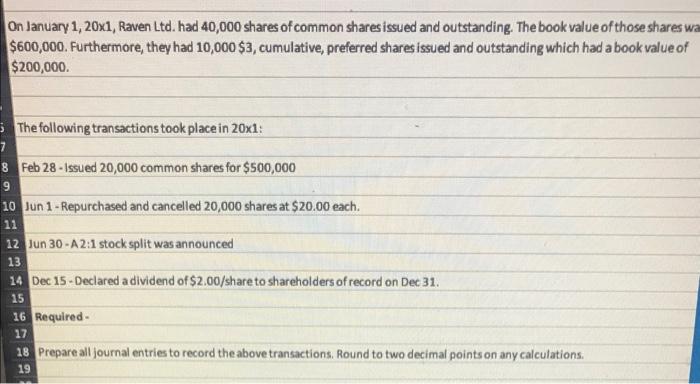

All Inc. is a manufacturer of custom furniture, which was incorporated on January 3, 2019. The following transactions happened during the year ended December 31, 2019. 1 On January 3rd, the owner invested $750,000 to start the business. 2 On January 3rd, Ali signed a two-year lease contract to rent a building which will be used as the main manufacturing facility. The first and last month rent was paid in advance on Jan 3rd. Monthly rent is$5,000 5 7 On March 1, All purchased manufacturing equipment at a cost of $200,000. Ali paid $50,000 in cash and the rest will be paid next year. The equipment has a useful life of 8 years and $5,000 residual value. The company uses double declining balance method of depreciation. 8 9 4 On April 1, All borrowed $350,000 from a bank. The loan is a 4-year with 4% interest rate. The interest is payable on the first day of each month, beginning May 1st. 10 11 5 On April 15, Ali purchased inventory of $150,000 from suppliers on account and is charged 13% harmonized sales tax. 12 13 6 On May 1, All received an order to build custom furniture for a customer. The customer paid $20,000 in advance. The furniture was delivered at the end of December 2019. The cost of making the furniture was $8,000. The company uses a perpetual inventory system. Ignore HST for this sale. 14 15 2 The following expenses were paid during the year. 16 17 18 19 20 21 22 Salaries and wages expense Rent expense Interest expense 110,000 55,000 9.333 Required: Prepare journal entries to record the above transactions. For each entry, write the initial entry and then, if necessary, write an adjusting entry at December 31, 2019 23 24 On January 1, 20x1, Raven Ltd. had 40,000 shares of common shares issued and outstanding. The book value of those shares wa $600,000. Furthermore, they had 10,000 $3, cumulative, preferred shares issued and outstanding which had a book value of $200,000 The following transactions took place in 20x1: 7 8 Feb 28 - Issued 20,000 common shares for $500,000 9 10 Jun 1 - Repurchased and cancelled 20,000 shares at $20.00 each. 11 12 Jun 30-A2:1 stock split was announced 13 14 Dec 15 - Declared a dividend of $2.00/share to shareholders of record on Dec 31. 15 16 Required 17 18 Prepare all journal entries to record the above transactions. Round to two decimal points on any calculations. 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts