Question: Please prepare amortization schedule (effective interest method) anf all journal entries. Label the journal entries specifically for Jack and Luna O DO D I JUN

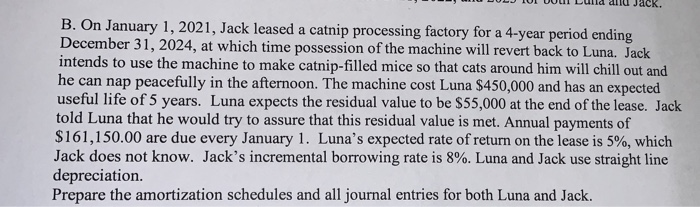

"O DO D I JUN B. On January 1, 2021, Jack leased a catnip processing factory for a 4-year period ending December 31, 2024, at which time possession of the machine will revert back to Luna. Jack intends to use the machine to make catnip-filled mice so that cats around him will chill out and he can nap peacefully in the afternoon. The machine cost Luna $450,000 and has an expected useful life of 5 years. Luna expects the residual value to be $55,000 at the end of the lease. Jack told Luna that he would try to assure that this residual value is met. Annual payments of $161,150.00 are due every January 1. Luna's expected rate of return on the lease is 5%, which Jack does not know. Jack's incremental borrowing rate is 8%. Luna and Jack use straight line depreciation. Prepare the amortization schedules and all journal entries for both Luna and Jack

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts