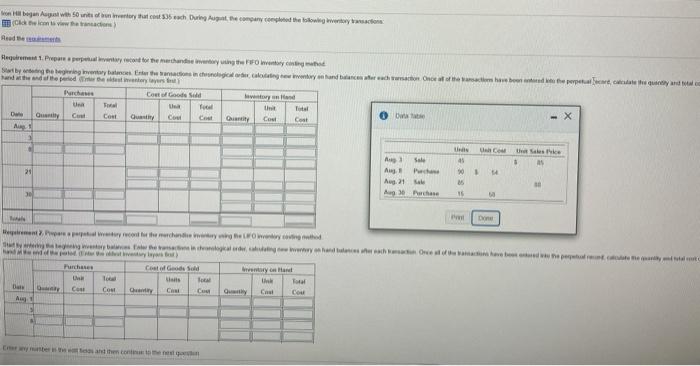

Question: PLEASE PREPARE FIFO, LIFO AND WEIGHTED AVERAGE METHODS using information provided. Will give thumbs up for complete work (no explanation needed) thank you in advance

clearer picture given

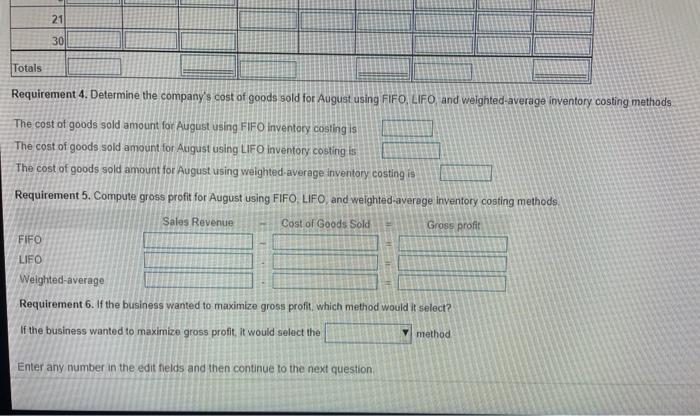

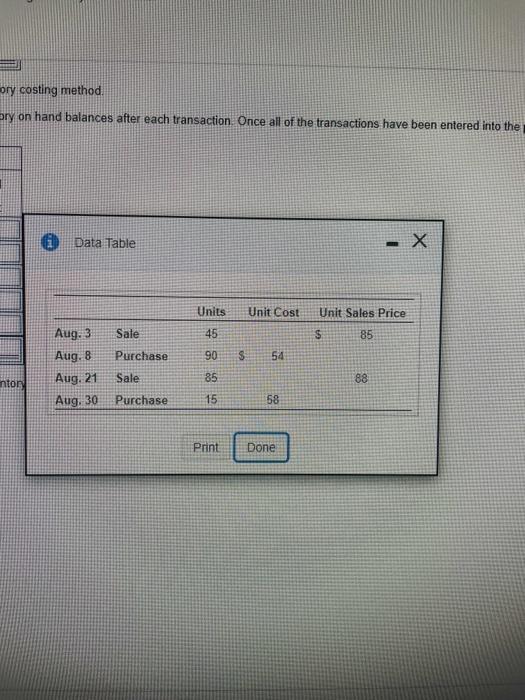

clearer picture givenobogan pa niso rych During the company of the blowing yo miten to win Hem 1. Prepared for the chandisewing the content Staby begin to Enter the actions in the recording to try and chaton or other be the perpetuate the yard and the end of the World Con Good Lavatory and focal Tel De Cost Cou Quy Cost Cost La cu Sales 21 A Sale A Pech Aug. 21 Auchan 45 90 05 16 30 D mentre per conto the change wwwwwwwwwwwwanden ene peut style Purchase Code Sud Une ats Total D By Co Cou Chat C C Cou A 21 301 Totals Requirement 4. Determine the company's cost of goods sold for August using FIFO, LIFO and weighted average inventory costing methods The cost of goods sold amount for August using FIFO inventory costing is The cost of goods sold amount for August using LIFO inventory costing is The cost of goods sold amount for August using weighted average inventory costing is Requirement 5. Compute gross profit for August using FIFO LIFO and weighted average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit FIFO LIFO Weighted average Requirement 6. If the business wanted to maximize gross profit, which method would it select? If the business wanted to maximize gross profit, it would select the method Enter any number in the edit fields and then continue to the next question ory costing method Ery on hand balances after each transaction Once all of the transactions have been entered into the Data Table - X Units Unit Cost Unit Sales Price Sale 45 $ 85 Purchase 90 S 54 Aug. 3 Aug. 8 Aug. 21 Aug, 30 Sale 85 ntor 88 Purchase 15 58 Print Done obogan pa niso rych During the company of the blowing yo miten to win Hem 1. Prepared for the chandisewing the content Staby begin to Enter the actions in the recording to try and chaton or other be the perpetuate the yard and the end of the World Con Good Lavatory and focal Tel De Cost Cou Quy Cost Cost La cu Sales 21 A Sale A Pech Aug. 21 Auchan 45 90 05 16 30 D mentre per conto the change wwwwwwwwwwwwanden ene peut style Purchase Code Sud Une ats Total D By Co Cou Chat C C Cou A 21 301 Totals Requirement 4. Determine the company's cost of goods sold for August using FIFO, LIFO and weighted average inventory costing methods The cost of goods sold amount for August using FIFO inventory costing is The cost of goods sold amount for August using LIFO inventory costing is The cost of goods sold amount for August using weighted average inventory costing is Requirement 5. Compute gross profit for August using FIFO LIFO and weighted average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit FIFO LIFO Weighted average Requirement 6. If the business wanted to maximize gross profit, which method would it select? If the business wanted to maximize gross profit, it would select the method Enter any number in the edit fields and then continue to the next question ory costing method Ery on hand balances after each transaction Once all of the transactions have been entered into the Data Table - X Units Unit Cost Unit Sales Price Sale 45 $ 85 Purchase 90 S 54 Aug. 3 Aug. 8 Aug. 21 Aug, 30 Sale 85 ntor 88 Purchase 15 58 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts