Question: Please prepare Tax Return Form 1041 for this question that you previously answered In the current year, the Mixon Family Trust had the following income

Please prepare Tax Return Form 1041 for this question that you previously answered

In the current year, the Mixon Family Trust had the following income and expense items:

Rental income 104,000, dividends from equity stocks 15,890, tax exempt interest income 23,400, long term capital gains from stocks 43,100 rental operating expenses 33,443 and trustee fees 12,000. Under the trust agreement - all capital gains and 50% of trustee fees are allocated to the principal account. The trustee has to maintain reserve for depreciation equal to tax depreciation deduction for current year of $9,650. The trustee must distribute 20,000 of trust income annually to Janey Mixon and has the discretion to distribute additional amounts of income or corpus to Janey, Jonathan, or Mark Mixon. During the year, the trustee distributed 30,000 to each of the three named beneficiaries.

1. Calculate the following amounts for the current year:

a) trust accounting income b) distributable net income - DNI

Please note - capital gains info is in the text of inquiry - thanks.

View comments (1)

Expert Answer

-

Chinna answered this

Chinna answered this Was this answer helpful?

1

0

291 answers

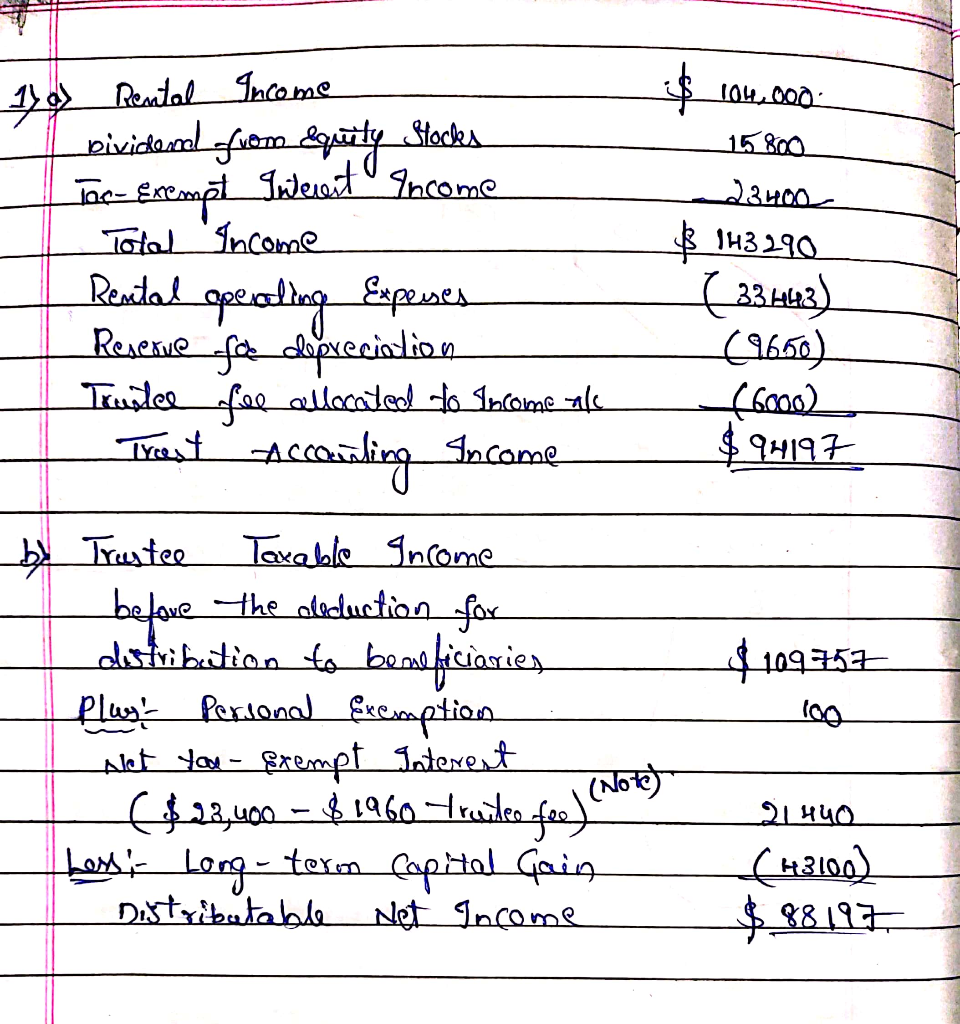

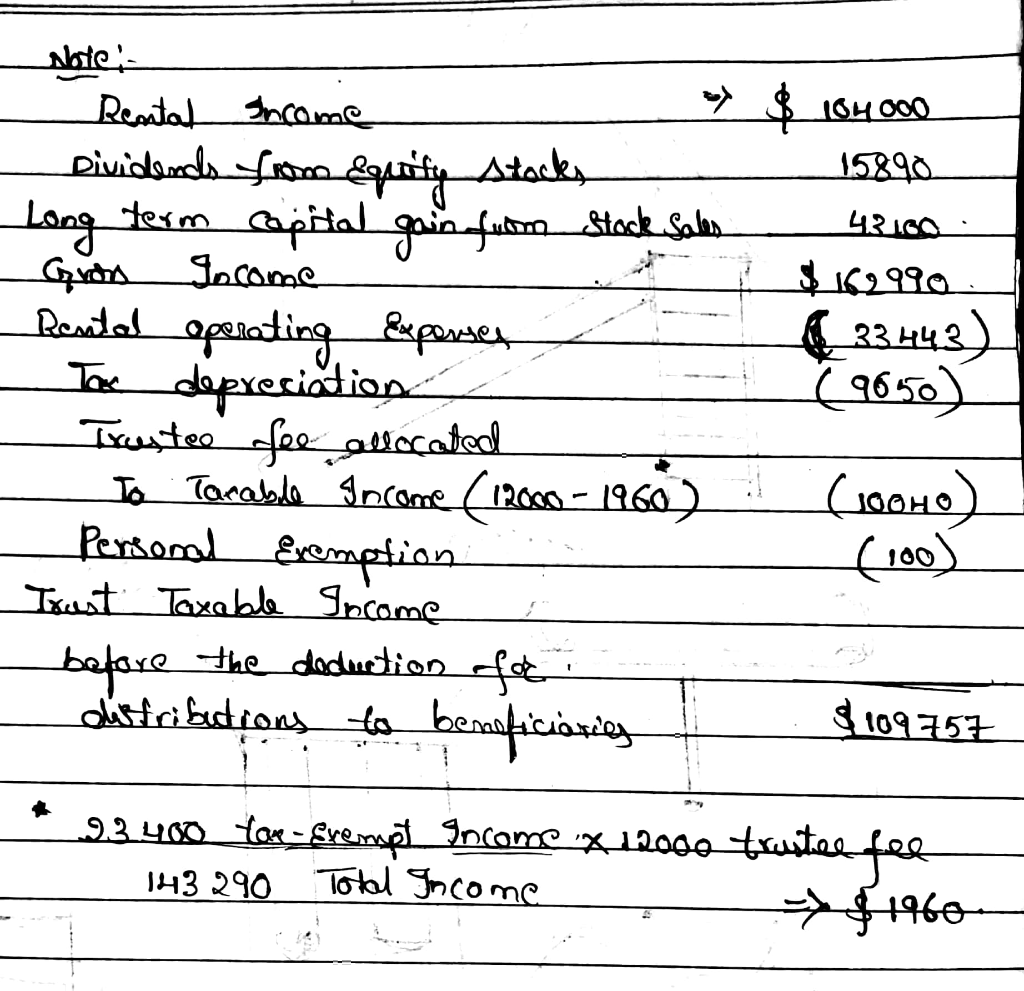

170) Rental Income bividend from equity Stocks Tac-Exempt Iwesent Income Toled 'Income Rental operating Expenses Reserve for depreciation Trustee fee allocated to Socome al Trest Accounting Income $ 104.000 15800 23400 $ 143290 ( 33.6423) (9650) 66000) $ 94197 U 1 $109757 100 - by Trustee Taxable income before the oleduction for distribution to beneficiaries play's Perlend fxemption Alet you - Exempt Interest $22,400 $1960 Frandse fee). Less Long-teron capital Gain Distributable Net Income 21 440 (443100) $88197 abte Rental Income Day $ 104000 - Dividends from Equify stocks _15890 Long term capital gains futon Stock Sales 4 2100 Greta Locome Rental To operating Expenses (_33443) - Taxe depresition lisci Trees tee see allocated To Tarabide Income (12000 - 1960) i (loomo Personal Exemption (100) Trust Taxable Income before the deduction of e- distributions to beneficiaries : 5109757 ...23400_face-Exempt Income x 12000 Frete fier - 143290 Total Income $1960 170) Rental Income bividend from equity Stocks Tac-Exempt Iwesent Income Toled 'Income Rental operating Expenses Reserve for depreciation Trustee fee allocated to Socome al Trest Accounting Income $ 104.000 15800 23400 $ 143290 ( 33.6423) (9650) 66000) $ 94197 U 1 $109757 100 - by Trustee Taxable income before the oleduction for distribution to beneficiaries play's Perlend fxemption Alet you - Exempt Interest $22,400 $1960 Frandse fee). Less Long-teron capital Gain Distributable Net Income 21 440 (443100) $88197 abte Rental Income Day $ 104000 - Dividends from Equify stocks _15890 Long term capital gains futon Stock Sales 4 2100 Greta Locome Rental To operating Expenses (_33443) - Taxe depresition lisci Trees tee see allocated To Tarabide Income (12000 - 1960) i (loomo Personal Exemption (100) Trust Taxable Income before the deduction of e- distributions to beneficiaries : 5109757 ...23400_face-Exempt Income x 12000 Frete fier - 143290 Total Income $1960

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts