Question: Please present all final answers to two decimals for number (e.g. 1.23) and two decimals for percent (e.g. 1.23%). FULL working must be presented (with

Please present all final answers to two decimals for number (e.g. 1.23) and two decimals for percent (e.g. 1.23%).

FULL working must be presented (with formulas, working stages, and results with units).

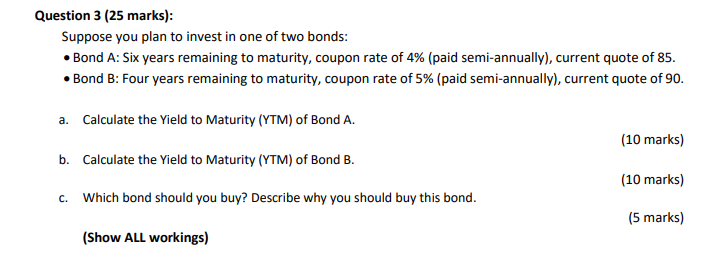

Question 3 (25 marks): Suppose you plan to invest in one of two bonds: Bond A: Six years remaining to maturity, coupon rate of 4% (paid semi-annually), current quote of 85. Bond B: Four years remaining to maturity, coupon rate of 5% (paid semi-annually), current quote of 90. a. Calculate the Yield to Maturity (YTM) of Bond A. (10 marks) b. Calculate the Yield to Maturity (YTM) of Bond B. (10 marks) C. Which bond should you buy? Describe why you should buy this bond. (5 marks) (Show ALL workings)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts