Question: Please present the formula in excel step-by-step. Example 4.22 Delayed Annuities Suppose Danielle Caravello will receive the following annuity payments. What is the value of

Please present the formula in excel step-by-step.

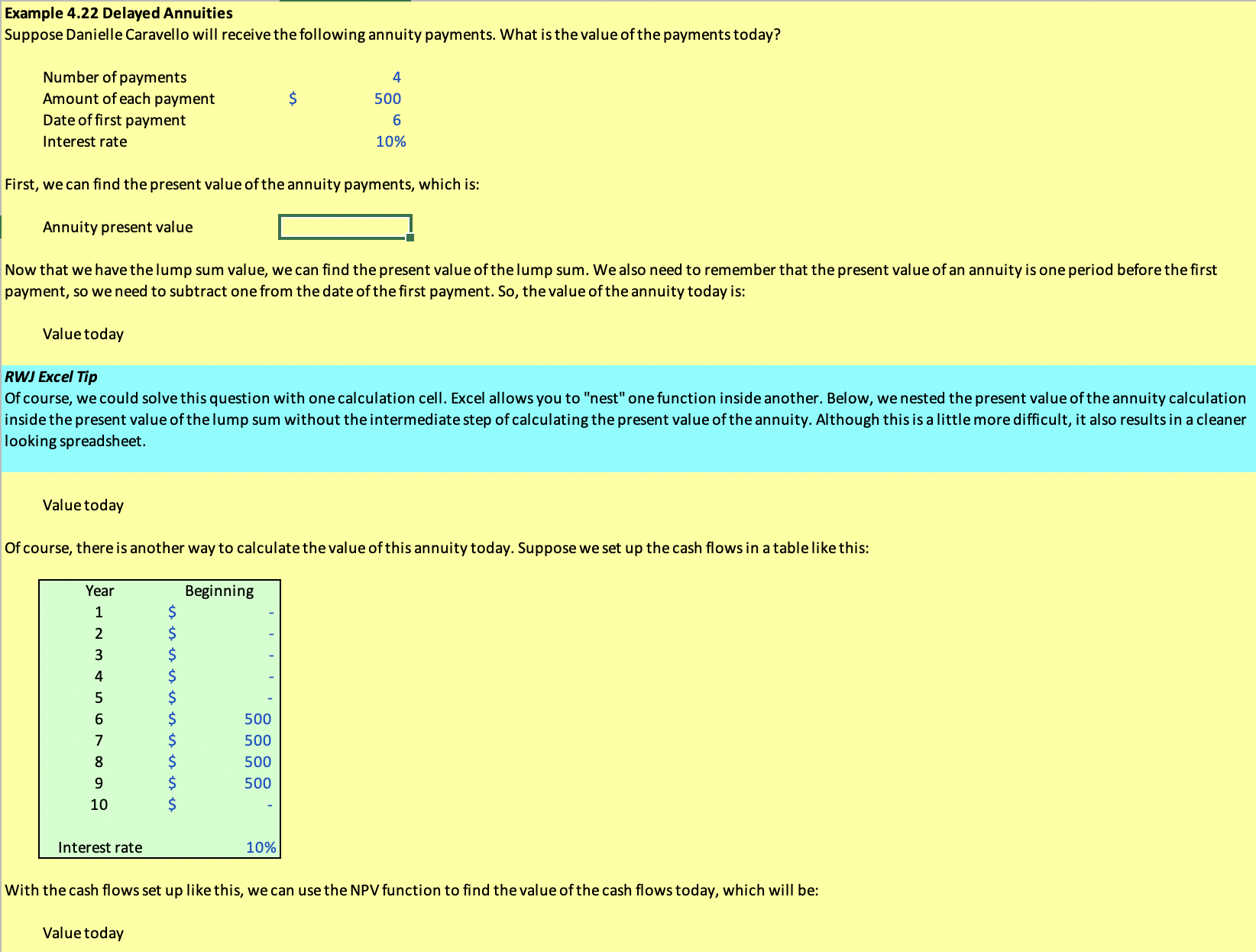

Example 4.22 Delayed Annuities Suppose Danielle Caravello will receive the following annuity payments. What is the value of the payments today? First, we can find the present value of the annuity payments, which is: Annuity present value Now that we have the lump sum value, we can find the present value of the lump sum. We also need to remember that the present value of an annuity is one period before the first payment, so we need to subtract one from the date of the first payment. So, the value of the annuity today is: Value today RWJ Excel Tip Of course, we could solve this question with one calculation cell. Excel allows you to "nest" one function inside another. Below, we nested the present value of the annuity calculation inside the present value of the lump sum without the intermediate step of calculating the present value of the annuity. Although this is a little more difficult, it also results in a cleaner looking spreadsheet. Value today Of course, there is another way to calculate the value of this annuity today. Suppose we set up the cash flows in a table like this: With the cash flows set up like this, we can use the NPV function to find the value of the cash flows today, which will be: Value today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts