Question: please provide a a detailed solution QUESTION 2 (33 marks, 59 minutes) Marvel Transformers Ltd ('MT) is a listed company on the industrial goods and

please provide a a detailed solution

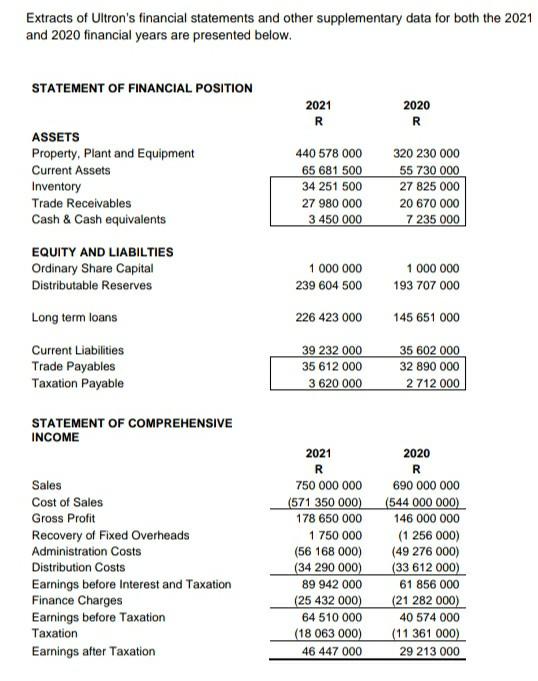

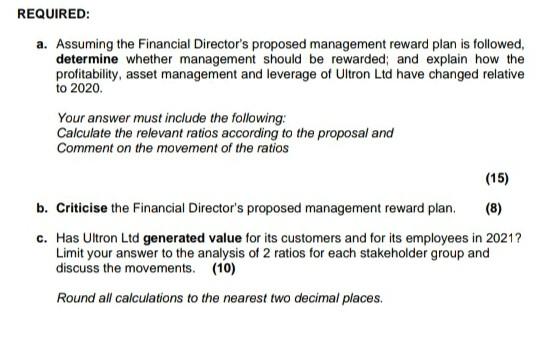

QUESTION 2 (33 marks, 59 minutes) Marvel Transformers Ltd ('MT") is a listed company on the industrial goods and services sector of the JSE. Established in 1937, MT is the only manufacturer of dry cell batteries and micro-wind turbines in South Africa. After decades of producing high-quality battery products, the company expanded its brand to include a range of benchmark-quality domestic lighting products in 2004. Today, MT proudly supplies a variety of energy- saving lighting to consumers across Africa. You are the group management accountant of the MT Group and are responsible for drafting financial reports and business proposals to the Board. MT's diverse product range has forced management to create subsidiary companies that focus on different items of equipment. The largest of these subsidiaries are Ultron Ltd and Megatron (Pty) Ltd. Ultron Ltd Ultron Ltd ('Ultron') manufactures various solar powered LED Lighting lamps. Ultron's solar lamps, available in Warm White or Cool Daylight, boast a high colour rendering index and a life span of 3 to 4 years. The demand for the LED Lamps has increased dramatically in 2020 and 2021 as a result of the continued load shedding energy outages. Eskom announced that capacity would remain "constrained" through August 2022. Due to the above you expect a high demand for solar lamps. In order to cope with this demand, Ultron had invested in a new plant towards the end of the 2021 financial year. The 2021 financial year of Ultron has ended recently and it is time to evaluate its performance. Each member of Ultron's management has a different opinion as to how Ultron's performance should be measured. The Investment Director believes that management should be rewarded if value was generated by MT in 2021. The Financial Director believes that management should be rewarded if the Du Pont measure has been improved upon relative to the prior year. The Production Director believes that he should be rewarded if Ultron's actual productivity has exceeded its budgeted productivity. The Risk Director believes that management should be rewarded if Ultron's business and financial risk has decreased relative to 2020 (defined using degree of leverage analysis). The Managing Director favours a more stakeholder orientated approach that considers the needs of Ultron's employees and its customers. She proposes that management be rewarded if Ultron can be shown to have added more value to its customers and employees in 2021 compared to 2020. Extracts of Ultron's financial statements and other supplementary data for both the 2021 and 2020 financial years are presented below. STATEMENT OF FINANCIAL POSITION 2021 R 2020 R 440 578 000 65 681 500 34 251 500 27 980 000 3 450 000 ASSETS Property, Plant and Equipment Current Assets Inventory Trade Receivables Cash & Cash equivalents EQUITY AND LIABILTIES Ordinary Share Capital Distributable Reserves Long term loans 320 230 000 55 730 000 27 825 000 20 670 000 7 235 000 1 000 000 239 604 500 1 000 000 193 707 000 226 423 000 145 651 000 Current Liabilities Trade Payables Taxation Payable 39 232 000 35 612 000 3 620 000 35 602 000 32 890 000 2 712 000 STATEMENT OF COMPREHENSIVE INCOME Sales Cost of Sales Gross Profit Recovery of Fixed Overheads Administration Costs Distribution Costs Earnings before Interest and Taxation Finance Charges Earnings before Taxation Taxation Earnings after Taxation 2021 R 750 000 000 (571 350 000) 178 650 000 1 750 000 (56 168 000) (34 290 000) 89 942 000 (25 432 000) 64 510 000 (18 063 000) 46 447 000 2020 R 690 000 000 (544 000 000 146 000 000 (1 256 000) (49 276 000) (33 612 000) 61 856 000 (21 282 000) 40 574 000 (11 361 000) 29 213 000 SUPPLEMENTARY DATA 2021 R 16.52% 11.34% 65% 2020 R 15.10% 12.50% 80% 550 Cost of Equity Weighted Average Cost of Capital % Cost of Sales that are Variable Costs % Administration Costs that are Variable Costs % Distribution Costs that are Variable Costs Number of Ordinary Shares Number of Shares held by Employees Number of Employees owning Ultron Shares Number of Employees Number of Resignations and Dismissals Training Costs (in Administration Costs) Salaries of Employees, excluding Directors Sick Leave Days taken in Total Number of New Customers Total Number of Customers Sales Transactions concluded Customer Complaints Industry Complaints as % of Transactions * Excluding Directors Total Number of Customers (2019) 20% 25% 40% 35% 1 000 000 1 000 000 120 000 100 000 240 200 600 15 23 R4 292 000 R3 457 000 R132 000 000 R110 000 000 8 300 8 250 90 55 1 700 1 689 85 679 79 216 478 389 1% 1% 1 800 REQUIRED: a. Assuming the Financial Director's proposed management reward plan is followed, determine whether management should be rewarded and explain how the profitability, asset management and leverage of Ultron Ltd have changed relative to 2020. Your answer must include the following: Calculate the relevant ratios according to the proposal and Comment on the movement of the ratios (15) b. Criticise the Financial Director's proposed management reward plan. (8) c. Has Ultron Ltd generated value for its customers and for its employees in 2021? Limit your answer to the analysis of 2 ratios for each stakeholder group and discuss the movements. (10) Round all calculations to the nearest two decimal places. QUESTION 2 (33 marks, 59 minutes) Marvel Transformers Ltd ('MT") is a listed company on the industrial goods and services sector of the JSE. Established in 1937, MT is the only manufacturer of dry cell batteries and micro-wind turbines in South Africa. After decades of producing high-quality battery products, the company expanded its brand to include a range of benchmark-quality domestic lighting products in 2004. Today, MT proudly supplies a variety of energy- saving lighting to consumers across Africa. You are the group management accountant of the MT Group and are responsible for drafting financial reports and business proposals to the Board. MT's diverse product range has forced management to create subsidiary companies that focus on different items of equipment. The largest of these subsidiaries are Ultron Ltd and Megatron (Pty) Ltd. Ultron Ltd Ultron Ltd ('Ultron') manufactures various solar powered LED Lighting lamps. Ultron's solar lamps, available in Warm White or Cool Daylight, boast a high colour rendering index and a life span of 3 to 4 years. The demand for the LED Lamps has increased dramatically in 2020 and 2021 as a result of the continued load shedding energy outages. Eskom announced that capacity would remain "constrained" through August 2022. Due to the above you expect a high demand for solar lamps. In order to cope with this demand, Ultron had invested in a new plant towards the end of the 2021 financial year. The 2021 financial year of Ultron has ended recently and it is time to evaluate its performance. Each member of Ultron's management has a different opinion as to how Ultron's performance should be measured. The Investment Director believes that management should be rewarded if value was generated by MT in 2021. The Financial Director believes that management should be rewarded if the Du Pont measure has been improved upon relative to the prior year. The Production Director believes that he should be rewarded if Ultron's actual productivity has exceeded its budgeted productivity. The Risk Director believes that management should be rewarded if Ultron's business and financial risk has decreased relative to 2020 (defined using degree of leverage analysis). The Managing Director favours a more stakeholder orientated approach that considers the needs of Ultron's employees and its customers. She proposes that management be rewarded if Ultron can be shown to have added more value to its customers and employees in 2021 compared to 2020. Extracts of Ultron's financial statements and other supplementary data for both the 2021 and 2020 financial years are presented below. STATEMENT OF FINANCIAL POSITION 2021 R 2020 R 440 578 000 65 681 500 34 251 500 27 980 000 3 450 000 ASSETS Property, Plant and Equipment Current Assets Inventory Trade Receivables Cash & Cash equivalents EQUITY AND LIABILTIES Ordinary Share Capital Distributable Reserves Long term loans 320 230 000 55 730 000 27 825 000 20 670 000 7 235 000 1 000 000 239 604 500 1 000 000 193 707 000 226 423 000 145 651 000 Current Liabilities Trade Payables Taxation Payable 39 232 000 35 612 000 3 620 000 35 602 000 32 890 000 2 712 000 STATEMENT OF COMPREHENSIVE INCOME Sales Cost of Sales Gross Profit Recovery of Fixed Overheads Administration Costs Distribution Costs Earnings before Interest and Taxation Finance Charges Earnings before Taxation Taxation Earnings after Taxation 2021 R 750 000 000 (571 350 000) 178 650 000 1 750 000 (56 168 000) (34 290 000) 89 942 000 (25 432 000) 64 510 000 (18 063 000) 46 447 000 2020 R 690 000 000 (544 000 000 146 000 000 (1 256 000) (49 276 000) (33 612 000) 61 856 000 (21 282 000) 40 574 000 (11 361 000) 29 213 000 SUPPLEMENTARY DATA 2021 R 16.52% 11.34% 65% 2020 R 15.10% 12.50% 80% 550 Cost of Equity Weighted Average Cost of Capital % Cost of Sales that are Variable Costs % Administration Costs that are Variable Costs % Distribution Costs that are Variable Costs Number of Ordinary Shares Number of Shares held by Employees Number of Employees owning Ultron Shares Number of Employees Number of Resignations and Dismissals Training Costs (in Administration Costs) Salaries of Employees, excluding Directors Sick Leave Days taken in Total Number of New Customers Total Number of Customers Sales Transactions concluded Customer Complaints Industry Complaints as % of Transactions * Excluding Directors Total Number of Customers (2019) 20% 25% 40% 35% 1 000 000 1 000 000 120 000 100 000 240 200 600 15 23 R4 292 000 R3 457 000 R132 000 000 R110 000 000 8 300 8 250 90 55 1 700 1 689 85 679 79 216 478 389 1% 1% 1 800 REQUIRED: a. Assuming the Financial Director's proposed management reward plan is followed, determine whether management should be rewarded and explain how the profitability, asset management and leverage of Ultron Ltd have changed relative to 2020. Your answer must include the following: Calculate the relevant ratios according to the proposal and Comment on the movement of the ratios (15) b. Criticise the Financial Director's proposed management reward plan. (8) c. Has Ultron Ltd generated value for its customers and for its employees in 2021? Limit your answer to the analysis of 2 ratios for each stakeholder group and discuss the movements. (10) Round all calculations to the nearest two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts