Question: please provide a clear answer Suppose Cardinal Company has a defined benefit pension plan. Here is information on this year's pension. Interest cost $10,000, service

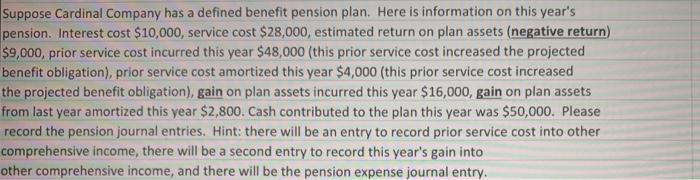

Suppose Cardinal Company has a defined benefit pension plan. Here is information on this year's pension. Interest cost $10,000, service cost $28,000, estimated return on plan assets (negative return) $9,000, prior service cost incurred this year $48,000 (this prior service cost increased the projected benefit obligation), prior service cost amortized this year $4,000 (this prior service cost increased the projected benefit obligation), gain on plan assets incurred this year $16,000, gain on plan assets from last year amortized this year $2,800. Cash contributed to the plan this year was $50,000. Please record the pension journal entries. Hint: there will be an entry to record prior service cost into other comprehensive income, there will be a second entry to record this year's gain into other comprehensive income, and there will be the pension expense journal entry. Suppose Cardinal Company has a defined benefit pension plan. Here is information on this year's pension. Interest cost $10,000, service cost $28,000, estimated return on plan assets (negative return) $9,000, prior service cost incurred this year $48,000 (this prior service cost increased the projected benefit obligation), prior service cost amortized this year $4,000 (this prior service cost increased the projected benefit obligation), gain on plan assets incurred this year $16,000, gain on plan assets from last year amortized this year $2,800. Cash contributed to the plan this year was $50,000. Please record the pension journal entries. Hint: there will be an entry to record prior service cost into other comprehensive income, there will be a second entry to record this year's gain into other comprehensive income, and there will be the pension expense journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts