Question: Please provide a clear explanation and calculations without using excel. ASAP. Thank you! As a CFO, you are considering whether to acquire a small private

Please provide a clear explanation and calculations without using excel. ASAP. Thank you!

Please provide a clear explanation and calculations without using excel. ASAP. Thank you!

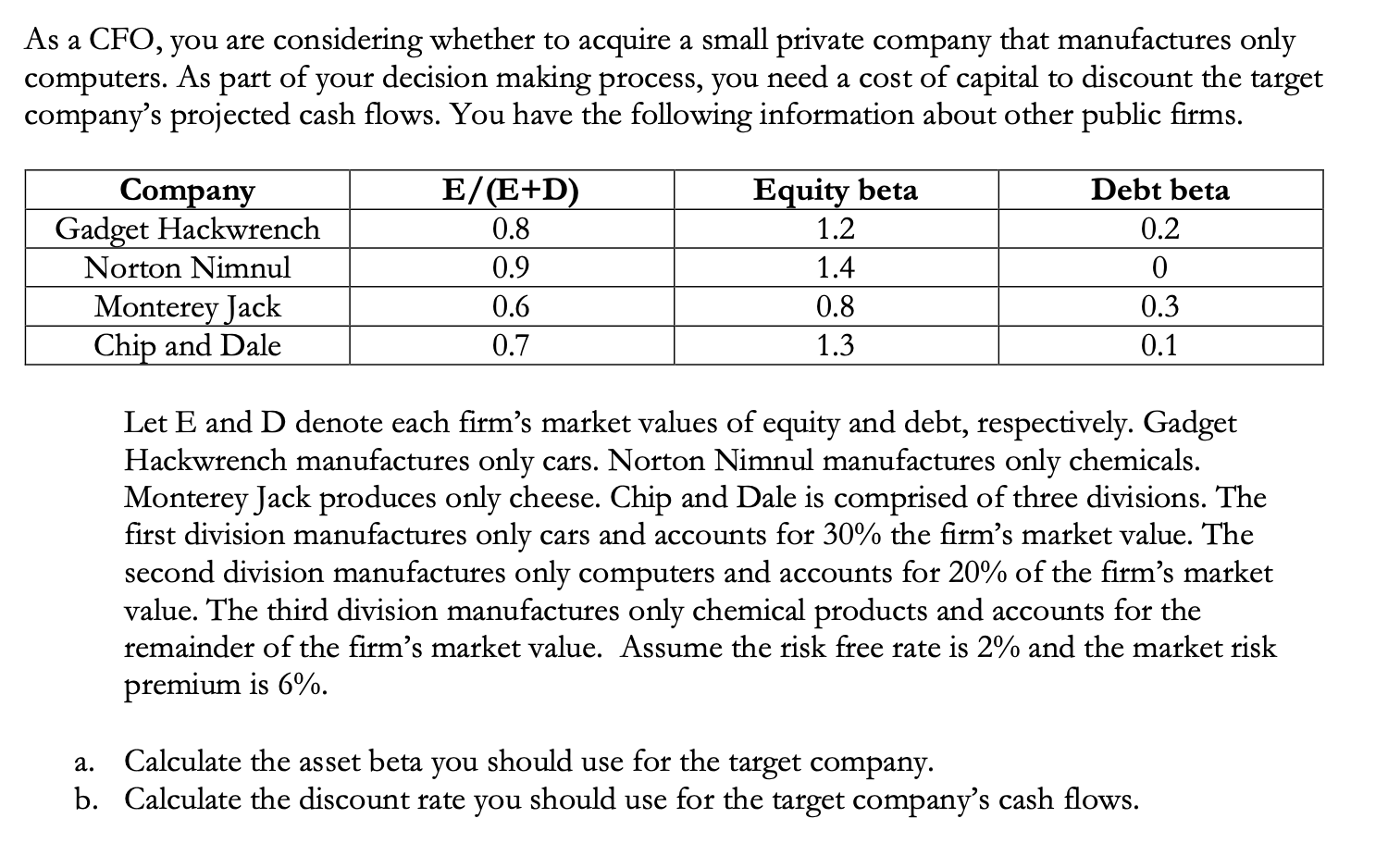

As a CFO, you are considering whether to acquire a small private company that manufactures only computers. As part of your decision making process, you need a cost of capital to discount the target company's projected cash flows. You have the following information about other public firms. Company Gadget Hackwrench Norton Nimnul Monterey Jack Chip and Dale E/(E+D) 0.8 0.9 0.6 0.7 Equity beta 1.2 1.4 0.8 1.3 Debt beta 0.2 0 0.3 0.1 Let E and D denote each firm's market values of equity and debt, respectively. Gadget Hackwrench manufactures only cars. Norton Nimnul manufactures only chemicals. Monterey Jack produces only cheese. Chip and Dale is comprised of three divisions. The first division manufactures only cars and accounts for 30% the firm's market value. The second division manufactures only computers and accounts for 20% of the firm's market value. The third division manufactures only chemical products and accounts for the remainder of the firm's market value. Assume the risk free rate is 2% and the market risk premium is 6%. a. Calculate the asset beta you should use for the target company. b. Calculate the discount rate you should use for the target company's cash flows. As a CFO, you are considering whether to acquire a small private company that manufactures only computers. As part of your decision making process, you need a cost of capital to discount the target company's projected cash flows. You have the following information about other public firms. Company Gadget Hackwrench Norton Nimnul Monterey Jack Chip and Dale E/(E+D) 0.8 0.9 0.6 0.7 Equity beta 1.2 1.4 0.8 1.3 Debt beta 0.2 0 0.3 0.1 Let E and D denote each firm's market values of equity and debt, respectively. Gadget Hackwrench manufactures only cars. Norton Nimnul manufactures only chemicals. Monterey Jack produces only cheese. Chip and Dale is comprised of three divisions. The first division manufactures only cars and accounts for 30% the firm's market value. The second division manufactures only computers and accounts for 20% of the firm's market value. The third division manufactures only chemical products and accounts for the remainder of the firm's market value. Assume the risk free rate is 2% and the market risk premium is 6%. a. Calculate the asset beta you should use for the target company. b. Calculate the discount rate you should use for the target company's cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts