Question: please provide a detailed solution QUESTION 3 (35 marks, 63 minutes) For Young and Old (Pty) Ltd ('For Young and Old') is a family owned

please provide a detailed solution

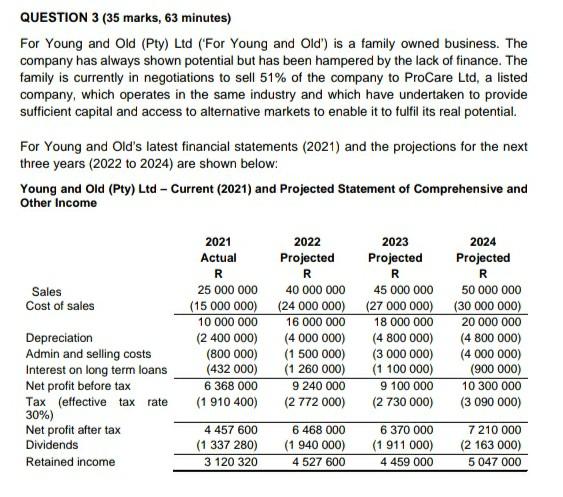

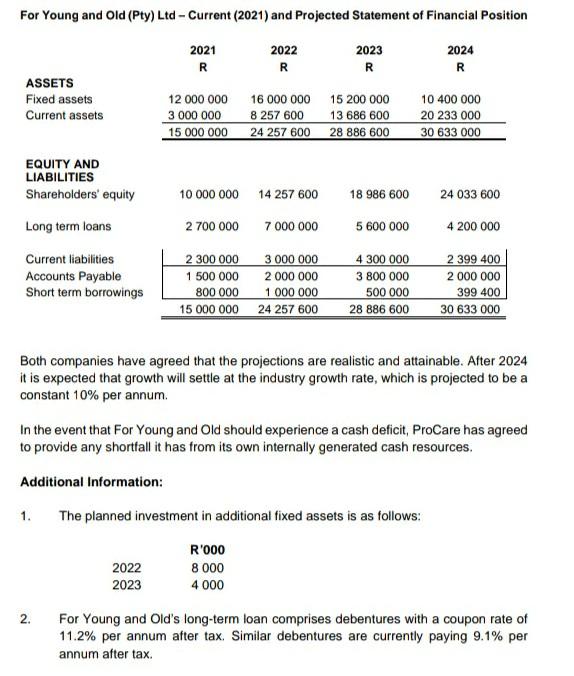

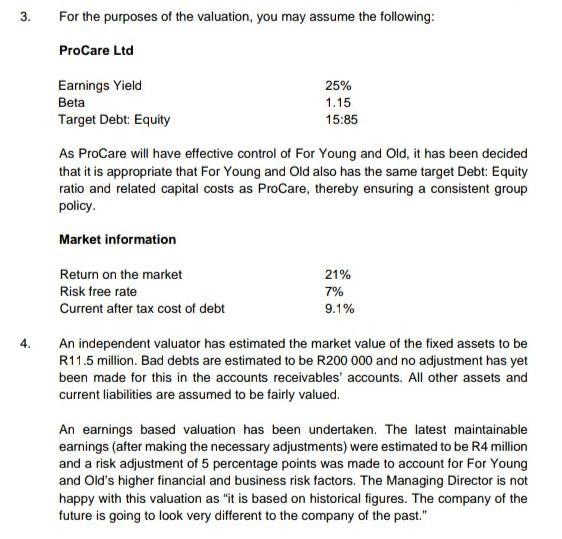

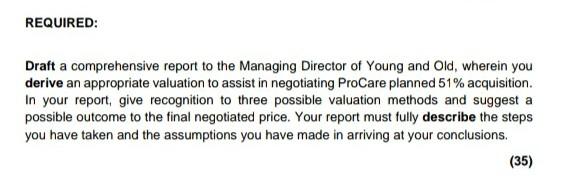

QUESTION 3 (35 marks, 63 minutes) For Young and Old (Pty) Ltd ('For Young and Old') is a family owned business. The company has always shown potential but has been hampered by the lack of finance. The family is currently in negotiations to sell 51% of the company to ProCare Ltd, a listed company, which operates in the same industry and which have undertaken to provide sufficient capital and access to alternative markets to enable it to fulfil its real potential. For Young and Old's latest financial statements (2021) and the projections for the next three years (2022 to 2024) are shown below: Young and Old (Pty) Ltd - Current (2021) and Projected Statement of Comprehensive and Other Income Sales Cost of sales Depreciation Admin and selling costs Interest on long term loans Net profit before tax Tax (effective tax rate 30%) Net profit after tax Dividends Retained income 2021 2022 2023 2024 Actual Projected Projected Projected R R R R 25 000 000 40 000 000 45 000 000 50 000 000 (15 000 000) (24 000 000) (27 000 000) (30 000 000) 10 000 000 16 000 000 18 000 000 20 000 000 (2 400 000) (4 000 000) (4 800 000) (4 800 000) (800 000) (1 500 000) (3 000 000) (4 000 000) (432 000) (1 260 000) (1 100 000) (900 000) 6 368 000 9 240 000 9 100 000 10 300 000 (1 910 400) (2 772 000) (2 730 000) (3 090 000) 4 457 600 6 468 000 6 370 000 7210 000 (1 337 280) (1 940 000) (1 911 000) (2 163 000) 3 120 320 4 527 600 4 459 000 5 047 000 For Young and Old (Pty) Ltd - Current (2021) and Projected Statement of Financial Position 2021 R 2022 R 2023 R 2024 R ASSETS Fixed assets Current assets 12 000 000 16 000 000 15 200 000 3 000 000 8 257 600 13 686 600 15 000 000 24 257 600 28 886 600 10 400 000 20 233 000 30 633 000 EQUITY AND LIABILITIES Shareholders' equity 10 000 000 14 257 600 18 986 600 24 033 600 Long term loans 2 700 000 7 000 000 5 600 000 4 200 000 Current liabilities Accounts Payable Short term borrowings 2 300 000 3 000 000 1 500 000 2 000 000 800 000 1 000 000 15 000 000 24 257 600 4 300 000 3 800 000 500 000 28 886 600 2 399 400 2 000 000 399 400 30 633 000 Both companies have agreed that the projections are realistic and attainable. After 2024 it is expected that growth will settle at the industry growth rate, which is projected to be a constant 10% per annum. In the event that For Young and Old should experience a cash deficit, ProCare has agreed to provide any shortfall it has from its own internally generated cash resources. Additional Information: 1. The planned investment in additional fixed assets is as follows: 2022 2023 R'000 8 000 4 000 2. For Young and Old's long-term loan comprises debentures with a coupon rate of 11.2% per annum after tax. Similar debentures are currently paying 9.1% per annum after tax. 3. For the purposes of the valuation, you may assume the following: ProCare Ltd Earnings Yield 25% Beta 1.15 Target Debt: Equity 15:85 As ProCare will have effective control of For Young and Old, it has been decided that it is appropriate that For Young and Old also has the same target Debt: Equity ratio and related capital costs as ProCare, thereby ensuring a consistent group policy. Market information Return on the market Risk free rate Current after tax cost of debt 21% 7% 9.1% An independent valuator has estimated the market value of the fixed assets to be R11.5 million. Bad debts are estimated to be R200 000 and no adjustment has yet been made for this in the accounts receivables' accounts. All other assets and current liabilities are assumed to be fairly valued. An earnings based valuation has been undertaken. The latest maintainable earnings (after making the necessary adjustments) were estimated to be R4 million and a risk adjustment of 5 percentage points was made to account for For Young and Old's higher financial and business risk factors. The Managing Director is not happy with this valuation as it is based on historical figures. The company of the future is going to look very different to the company of the past." REQUIRED: Draft a comprehensive report to the Managing Director of Young and Old, wherein you derive an appropriate valuation to assist in negotiating ProCare planned 51% acquisition. In your report, give recognition to three possible valuation methods and suggest a possible outcome to the final negotiated price. Your report must fully describe the steps you have taken and the assumptions you have made in arriving at your conclusions. (35) QUESTION 3 (35 marks, 63 minutes) For Young and Old (Pty) Ltd ('For Young and Old') is a family owned business. The company has always shown potential but has been hampered by the lack of finance. The family is currently in negotiations to sell 51% of the company to ProCare Ltd, a listed company, which operates in the same industry and which have undertaken to provide sufficient capital and access to alternative markets to enable it to fulfil its real potential. For Young and Old's latest financial statements (2021) and the projections for the next three years (2022 to 2024) are shown below: Young and Old (Pty) Ltd - Current (2021) and Projected Statement of Comprehensive and Other Income Sales Cost of sales Depreciation Admin and selling costs Interest on long term loans Net profit before tax Tax (effective tax rate 30%) Net profit after tax Dividends Retained income 2021 2022 2023 2024 Actual Projected Projected Projected R R R R 25 000 000 40 000 000 45 000 000 50 000 000 (15 000 000) (24 000 000) (27 000 000) (30 000 000) 10 000 000 16 000 000 18 000 000 20 000 000 (2 400 000) (4 000 000) (4 800 000) (4 800 000) (800 000) (1 500 000) (3 000 000) (4 000 000) (432 000) (1 260 000) (1 100 000) (900 000) 6 368 000 9 240 000 9 100 000 10 300 000 (1 910 400) (2 772 000) (2 730 000) (3 090 000) 4 457 600 6 468 000 6 370 000 7210 000 (1 337 280) (1 940 000) (1 911 000) (2 163 000) 3 120 320 4 527 600 4 459 000 5 047 000 For Young and Old (Pty) Ltd - Current (2021) and Projected Statement of Financial Position 2021 R 2022 R 2023 R 2024 R ASSETS Fixed assets Current assets 12 000 000 16 000 000 15 200 000 3 000 000 8 257 600 13 686 600 15 000 000 24 257 600 28 886 600 10 400 000 20 233 000 30 633 000 EQUITY AND LIABILITIES Shareholders' equity 10 000 000 14 257 600 18 986 600 24 033 600 Long term loans 2 700 000 7 000 000 5 600 000 4 200 000 Current liabilities Accounts Payable Short term borrowings 2 300 000 3 000 000 1 500 000 2 000 000 800 000 1 000 000 15 000 000 24 257 600 4 300 000 3 800 000 500 000 28 886 600 2 399 400 2 000 000 399 400 30 633 000 Both companies have agreed that the projections are realistic and attainable. After 2024 it is expected that growth will settle at the industry growth rate, which is projected to be a constant 10% per annum. In the event that For Young and Old should experience a cash deficit, ProCare has agreed to provide any shortfall it has from its own internally generated cash resources. Additional Information: 1. The planned investment in additional fixed assets is as follows: 2022 2023 R'000 8 000 4 000 2. For Young and Old's long-term loan comprises debentures with a coupon rate of 11.2% per annum after tax. Similar debentures are currently paying 9.1% per annum after tax. 3. For the purposes of the valuation, you may assume the following: ProCare Ltd Earnings Yield 25% Beta 1.15 Target Debt: Equity 15:85 As ProCare will have effective control of For Young and Old, it has been decided that it is appropriate that For Young and Old also has the same target Debt: Equity ratio and related capital costs as ProCare, thereby ensuring a consistent group policy. Market information Return on the market Risk free rate Current after tax cost of debt 21% 7% 9.1% An independent valuator has estimated the market value of the fixed assets to be R11.5 million. Bad debts are estimated to be R200 000 and no adjustment has yet been made for this in the accounts receivables' accounts. All other assets and current liabilities are assumed to be fairly valued. An earnings based valuation has been undertaken. The latest maintainable earnings (after making the necessary adjustments) were estimated to be R4 million and a risk adjustment of 5 percentage points was made to account for For Young and Old's higher financial and business risk factors. The Managing Director is not happy with this valuation as it is based on historical figures. The company of the future is going to look very different to the company of the past." REQUIRED: Draft a comprehensive report to the Managing Director of Young and Old, wherein you derive an appropriate valuation to assist in negotiating ProCare planned 51% acquisition. In your report, give recognition to three possible valuation methods and suggest a possible outcome to the final negotiated price. Your report must fully describe the steps you have taken and the assumptions you have made in arriving at your conclusions. (35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts