Question: Please provide a solution with the explanation for the calculations. Thanks Net Present Value Eleanor Design 2020 Eleanor Designs is considering a new product line

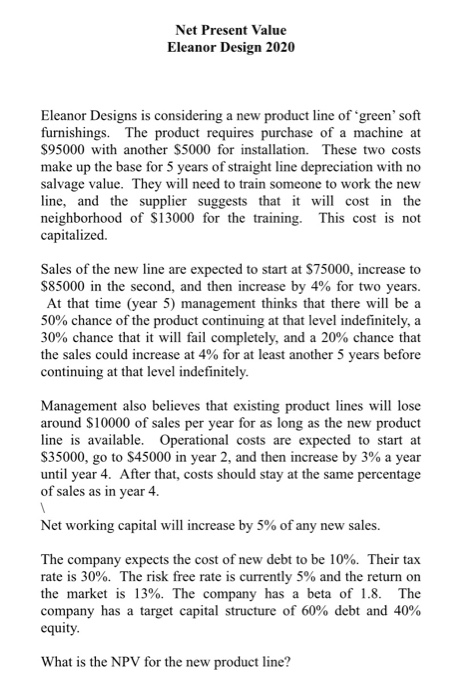

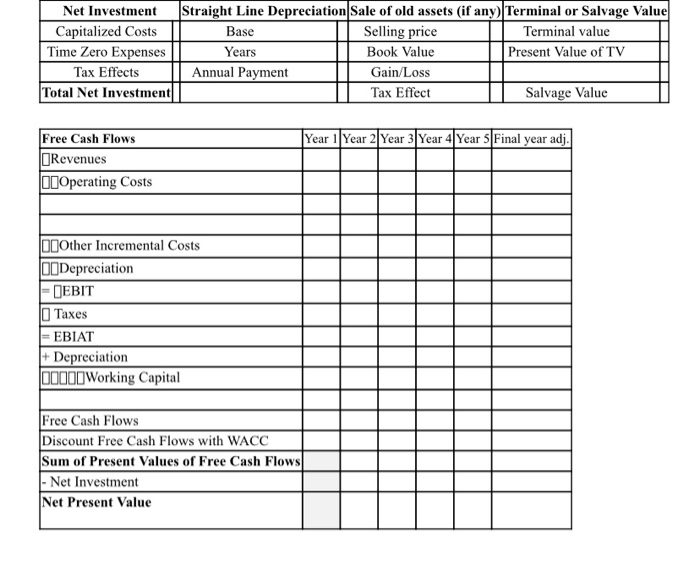

Net Present Value Eleanor Design 2020 Eleanor Designs is considering a new product line of 'green' soft furnishings. The product requires purchase of a machine at $95000 with another $5000 for installation. These two costs make up the base for 5 years of straight line depreciation with no salvage value. They will need to train someone to work the new line, and the supplier suggests that it will cost in the neighborhood of $13000 for the training. This cost is not capitalized. Sales of the new line are expected to start at $75000, increase to $85000 in the second, and then increase by 4% for two years. At that time (year 5) management thinks that there will be a 50% chance of the product continuing at that level indefinitely, a 30% chance that it will fail completely, and a 20% chance that the sales could increase at 4% for at least another 5 years before continuing at that level indefinitely. Management also believes that existing product lines will lose around $10000 of sales per year for as long as the new product line is available. Operational costs are expected to start at $35000, go to $45000 in year 2, and then increase by 3% a year until year 4. After that, costs should stay at the same percentage of sales as in year 4. Net working capital will increase by 5% of any new sales. The company expects the cost of new debt to be 10%. Their tax rate is 30%. The risk free rate is currently 5% and the return on the market is 13%. The company has a beta of 1.8. The company has a target capital structure of 60% debt and 40% equity. What is the NPV for the new product line? Net Investment Capitalized Costs Time Zero Expenses Tax Effects Total Net Investment Straight Line Depreciation Sale of old assets (if any) Terminal or Salvage Value Base Selling price Terminal value Years Book Value Present Value of TV Annual Payment Gain/Loss Tax Effect Salvage Value Year 1 Year 2 Year 3 Year 4 Year 5 Final year adj. Free Cash Flows Revenues 00 Operating Costs 00 Other Incremental Costs O Depreciation - DEBIT Taxes = EBIAT + Depreciation 00000 Working Capital Free Cash Flows Discount Free Cash Flows with WACC Sum of Present Values of Free Cash Flows |- Net Investment Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts