Question: Please provide a spreadsheet with the solver answer. Want to learn how to use it. Thank you very much and appreciate your help 1. (Cash

Please provide a spreadsheet with the solver answer. Want to learn how to use it. Thank you very much and appreciate your help

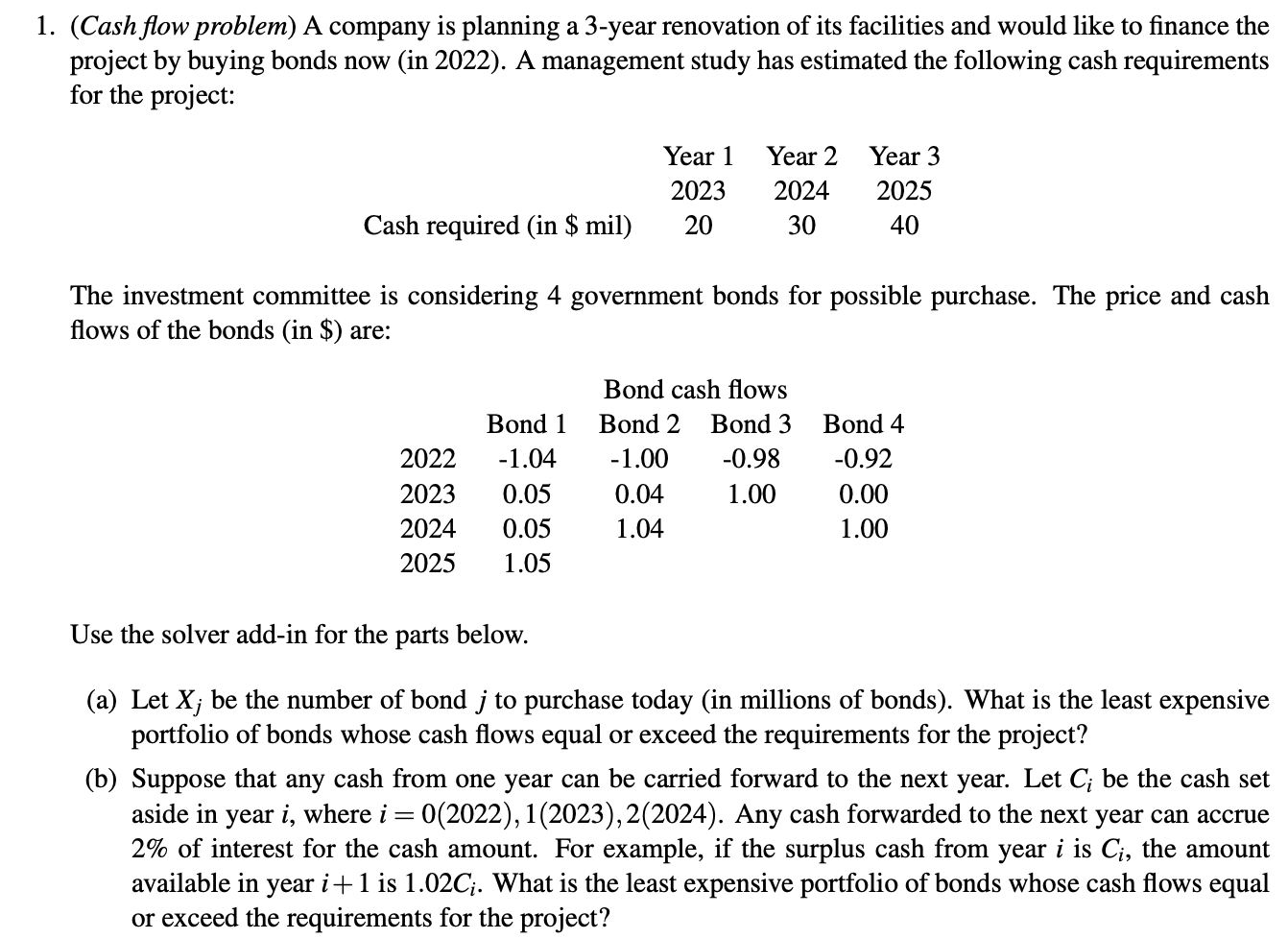

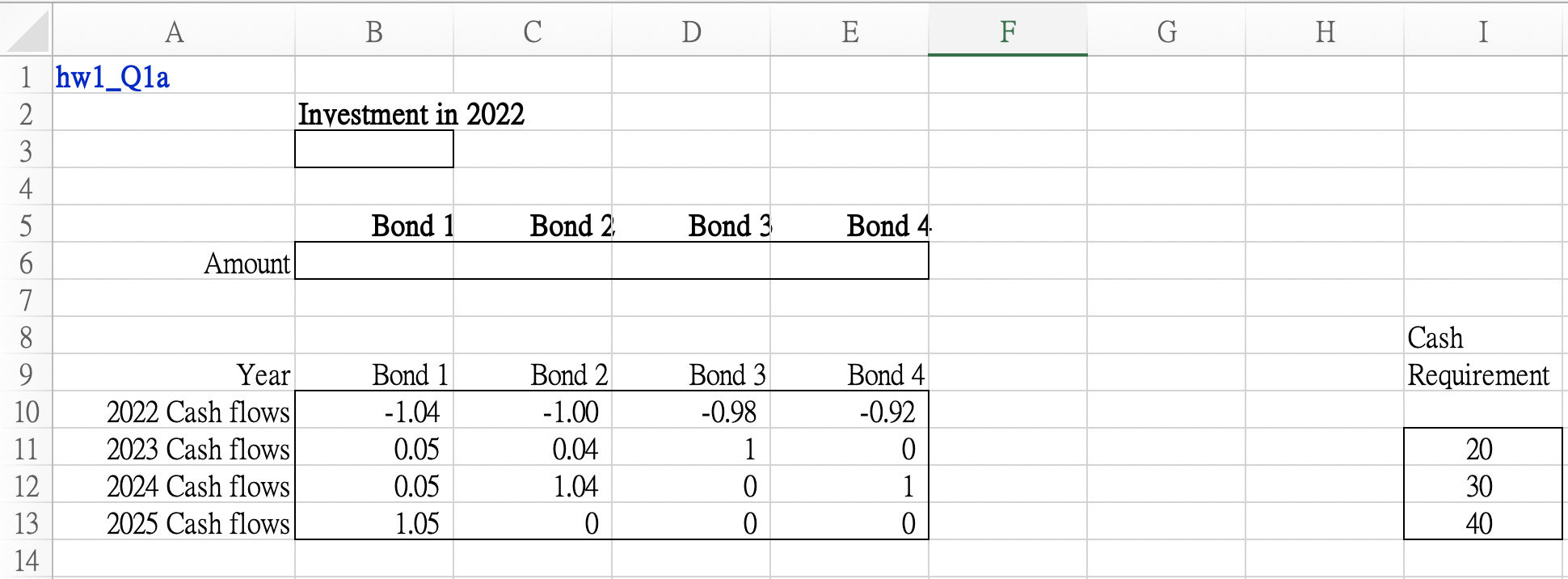

1. (Cash flow problem) A company is planning a 3-year renovation of its facilities and would like to finance the project by buying bonds now (in 2022). A management study has estimated the following cash requirements for the project: Year 1 2023 20 Year 2 2024 30 Year 3 2025 40 Cash required (in $ mil) The investment committee is considering 4 government bonds for possible purchase. The price and cash flows of the bonds (in $) are: 2022 2023 2024 2025 Bond 1 -1.04 0.05 0.05 1.05 Bond cash flows Bond 2 Bond 3 -1.00 -0.98 0.04 1.00 1.04 Bond 4 -0.92 0.00 1.00 Use the solver add-in for the parts below. (a) Let X; be the number of bond j to purchase today (in millions of bonds). What is the least expensive portfolio of bonds whose cash flows equal or exceed the requirements for the project? (b) Suppose that any cash from one year can be carried forward to the next year. Let C; be the cash set aside in year i, where i = 0(2022), 1(2023), 2(2024). Any cash forwarded to the next year can accrue 2% of interest for the cash amount. For example, if the surplus cash from year i is Ci, the amount available in year i +1 is 1.02C;. What is the least expensive portfolio of bonds whose cash flows equal or exceed the requirements for the project? D E F H I Q Bond 3 Bond 4 A B 1 hw1_Q1a 2 Investment in 2022 3 4 5 Bond 1 Bond 2 6 Amount 7 8 Year Bond 1 Bond 2 10 2022 Cash flows -1.04 -1.00 11 2023 Cash flows 0.05 0.04 12 2024 Cash flows 0.05 1.04 13 2025 Cash flows 1.05 0 14 Cash Requirement Bond 3 -0.98 1 0 0 Bond 4 -0.92 0 1 0 20 30 40Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts