Question: Please provide a step by step solution for this problem. Thank you! The I Corporation has an obligation to pay $1 million in 10 years.

Please provide a step by step solution for this problem.

Thank you!

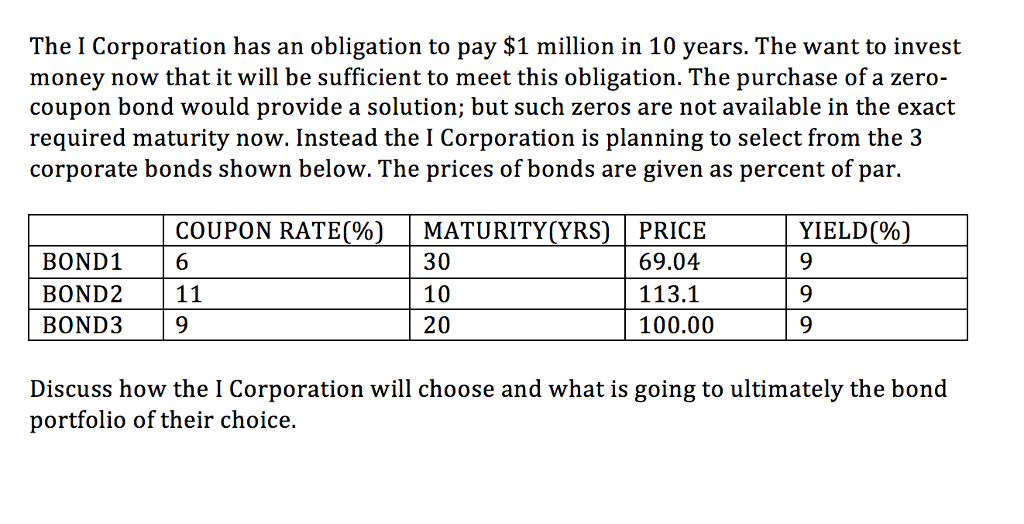

The I Corporation has an obligation to pay $1 million in 10 years. The want to invest money now that it will be sufficient to meet this obligation. The purchase of a zero- coupon bond would provide a solution; but such zeros are not available in the exact required maturity now. Instead the I Corporation is planning to select from the 3 corporate bonds shown below. The prices of bonds are given as percent of par. COUPON RATE(%)MATURITY(YRS)PRICE 30 10 20 YIELD(%) BOND1 6 BOND211 BOND39 69.04 113.1 100.00 Discuss how the I Corporation will choose and what is going to ultimately the bond portfolio of their choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts