Question: Please provide a step by step solution with the general equations and the numbers plugged into the equations. No excel please!! Tucker Enterprise Inc. is

Please provide a step by step solution with the general equations and the numbers plugged into the equations. No excel please!!

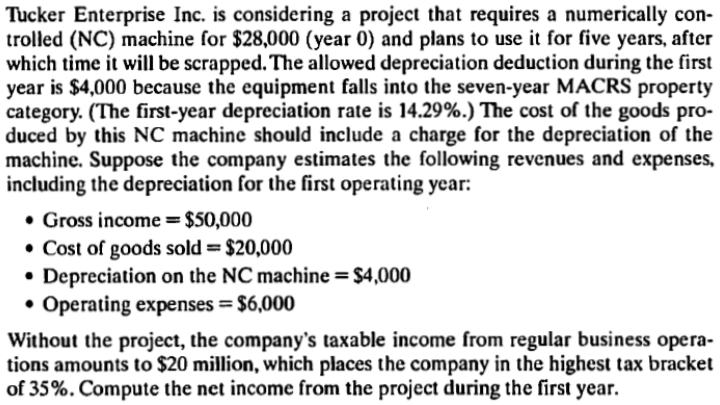

Tucker Enterprise Inc. is considering a project that requires a numerically con- trolled (NC) machine for $28,000 (year 0) and plans to use it for five years, after which time it will be scrapped. The allowed depreciation deduction during the first year is $4,000 because the equipment falls into the seven-year MACRS property category. (The first-year depreciation rate is 14.29%.) The cost of the goods pro- duced by this NC machine should include a charge for the depreciation of the machine. Suppose the company estimates the following revenues and expenses, including the depreciation for the first operating year: Gross income $50,000 Cost of goods sold$20,000 Depreciation on the NC machine $4,000 Operating expenses $6,000 Without the project, the company's taxable income from regular business opera- tions amounts to $20 million, which places the company in the highest tax bracket of 35%. Compute the net income from the project during the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts