Question: Please provide a step-by-step explanation and calculation! thank you so much! 25. On April 8, 2008, Sunset Corp. acquired equipment at a cost of $240,000.

Please provide a step-by-step explanation and calculation! thank you so much!

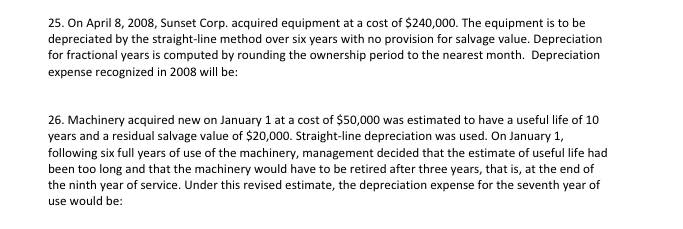

25. On April 8, 2008, Sunset Corp. acquired equipment at a cost of $240,000. The equipment is to be depreciated by the straight-line method over six years with no provision for salvage value. Depreciation for fractional years is computed by rounding the ownership period to the nearest month. Depreciation expense recognized in 2008 will be: 26. Machinery acquired new on January 1 at a cost of $50,000 was estimated to have a useful life of 10 years and a residual salvage value of $20,000. Straight-line depreciation was used. On January 1 following six full years of use of the machinery, management decided that the estimate of useful life had been too long and that the machinery would have to be retired after three years, that is, at the end of the ninth year of service. Under this revised estimate, the depreciation expense for the seventh year of use would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts