Question: Please provide a written step-by-step solution to the problem. Do not use any software in answering the problem so that I could understand how it

Please provide a written step-by-step solution to the problem. Do not use any software in answering the problem so that I could understand how it is solved. Thank you

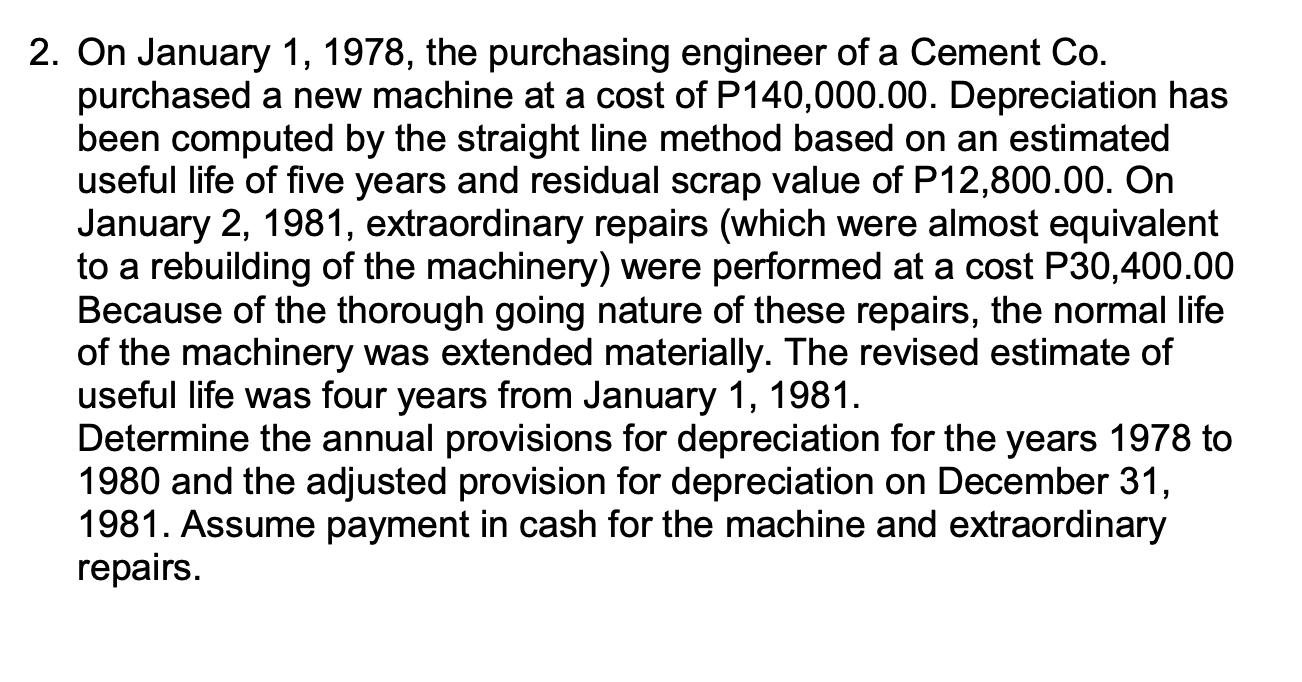

2. On January 1, 1978, the purchasing engineer of a Cement Co. purchased a new machine at a cost of P140,000.00. Depreciation has been computed by the straight line method based on an estimated useful life of five years and residual scrap value of P12,800.00. On January 2, 1981, extraordinary repairs (which were almost equivalent to a rebuilding of the machinery) were performed at a cost P30,400.00 Because of the thorough going nature of these repairs, the normal life of the machinery was extended materially. The revised estimate of useful life was four years from January 1, 1981. Determine the annual provisions for depreciation for the years 1978 to 1980 and the adjusted provision for depreciation on December 31, 1981. Assume payment in cash for the machine and extraordinary repairs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts