Question: please provide accurate solution as soon as possible. Add 2900 in place of REGISTRATION Subject is financial management Yam-Hash Corporation currently uses a water purification

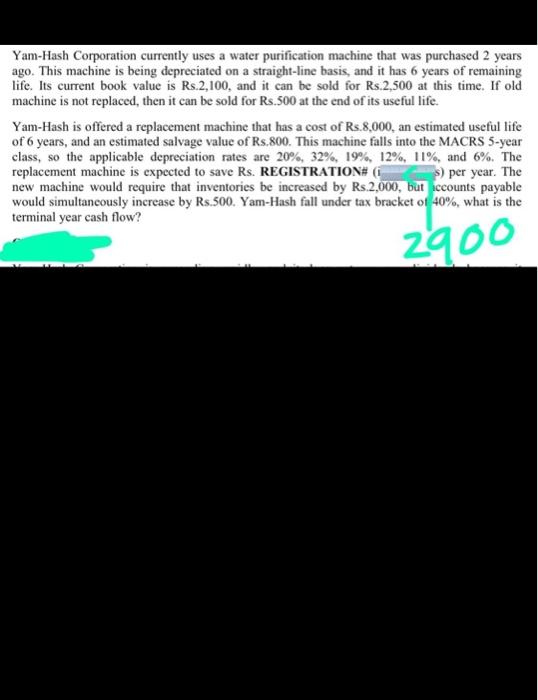

Yam-Hash Corporation currently uses a water purification machine that was purchased 2 years ago. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current book value is Rs.2,100, and it can be sold for Rs.2,500 at this time. If old machine is not replaced, then it can be sold for Rs.500 at the end of its useful life. Yam-Hash is offered a replacement machine that has a cost of Rs.8,000, an estimated useful life of 6 years, and an estimated salvage value of Rs.800. This machine falls into the MACRS 5-year class, so the applicable depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. The replacement machine is expected to save Rs. REGISTRATION# 1 s) per year. The new machine would require that inventories be increased by Rs.2.000, but accounts payable would simultaneously increase by Rs.500. Yam-Hash fall under tax bracket of 40%, what is the terminal year cash flow? 2900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts