Question: Please provide all correct answer choices from all multiple choice questions! Thank you in advance!!! The Boxwood Company sells blankets for $35 each. The following

Please provide all correct answer choices from all multiple choice questions! Thank you in advance!!!

Please provide all correct answer choices from all multiple choice questions! Thank you in advance!!!

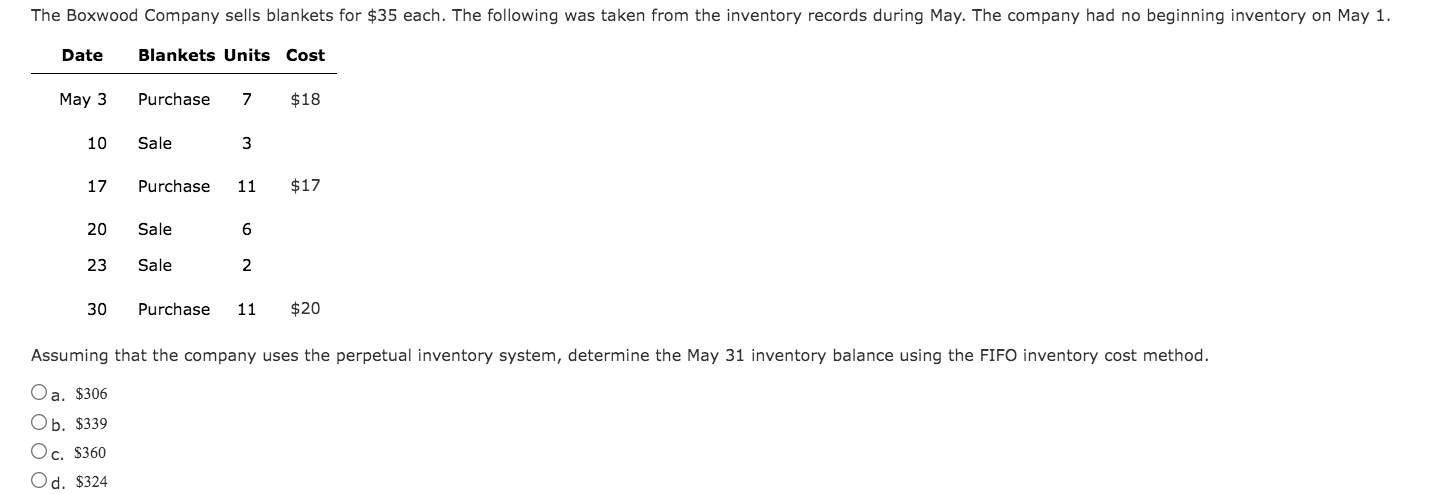

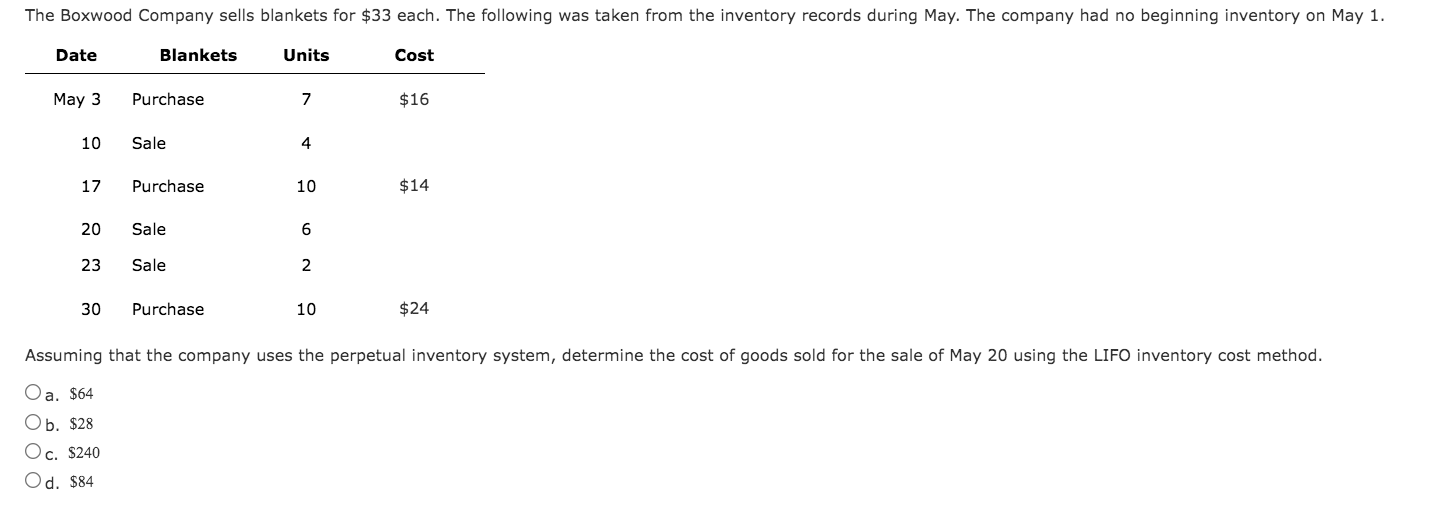

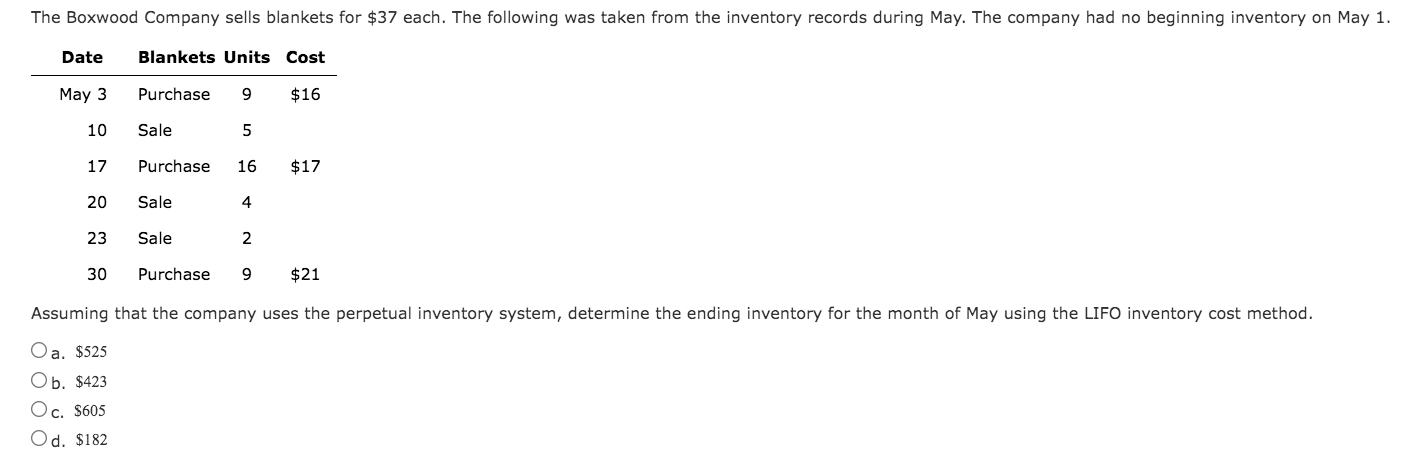

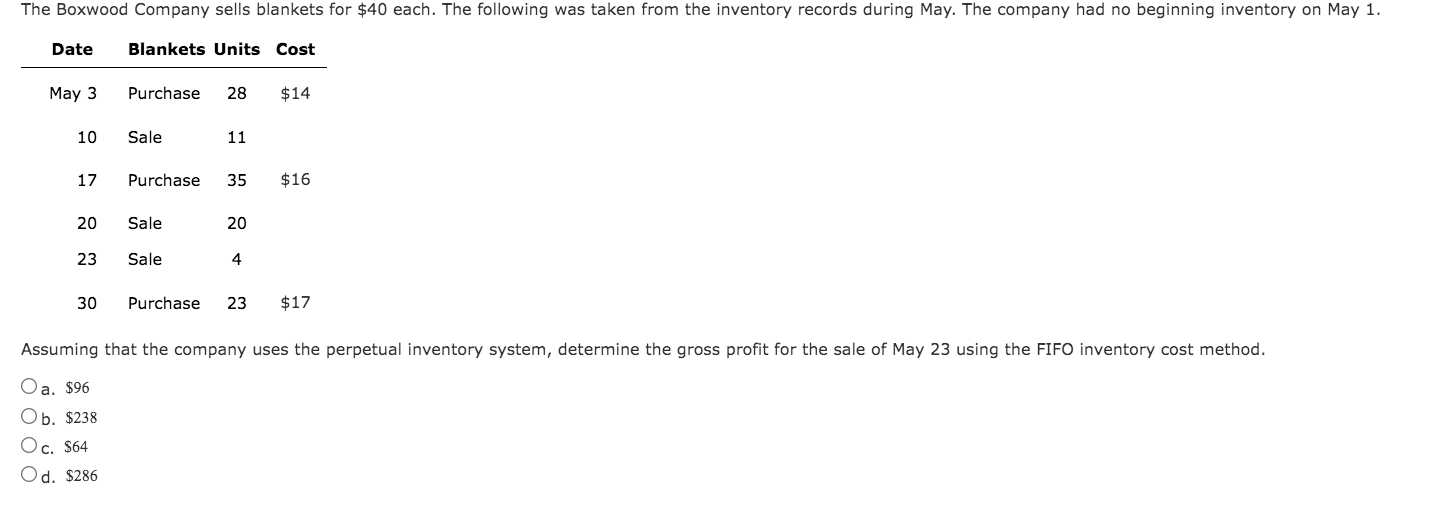

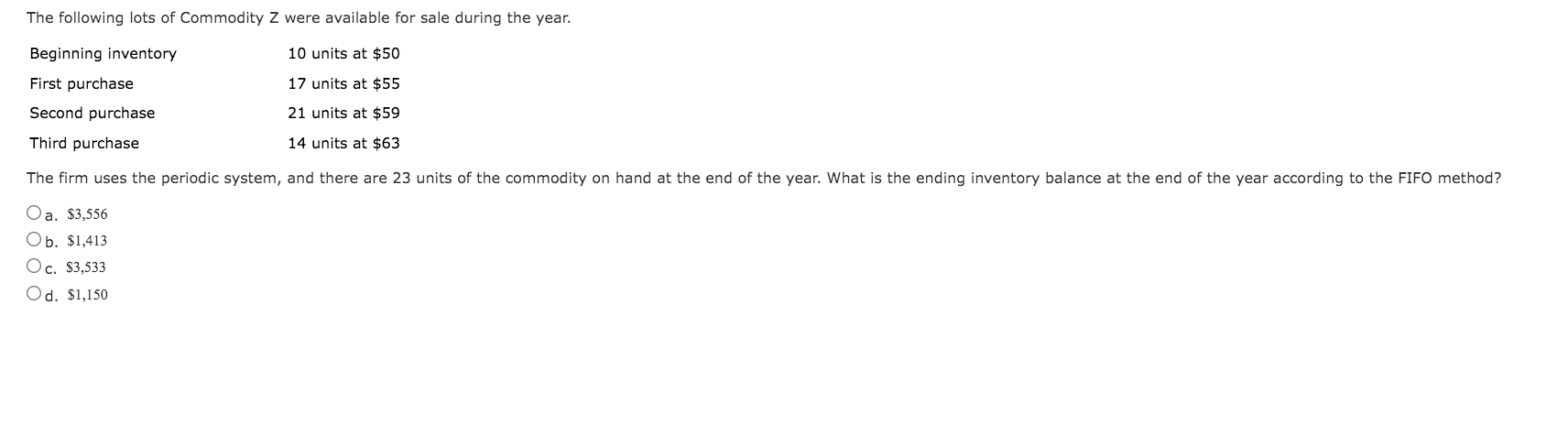

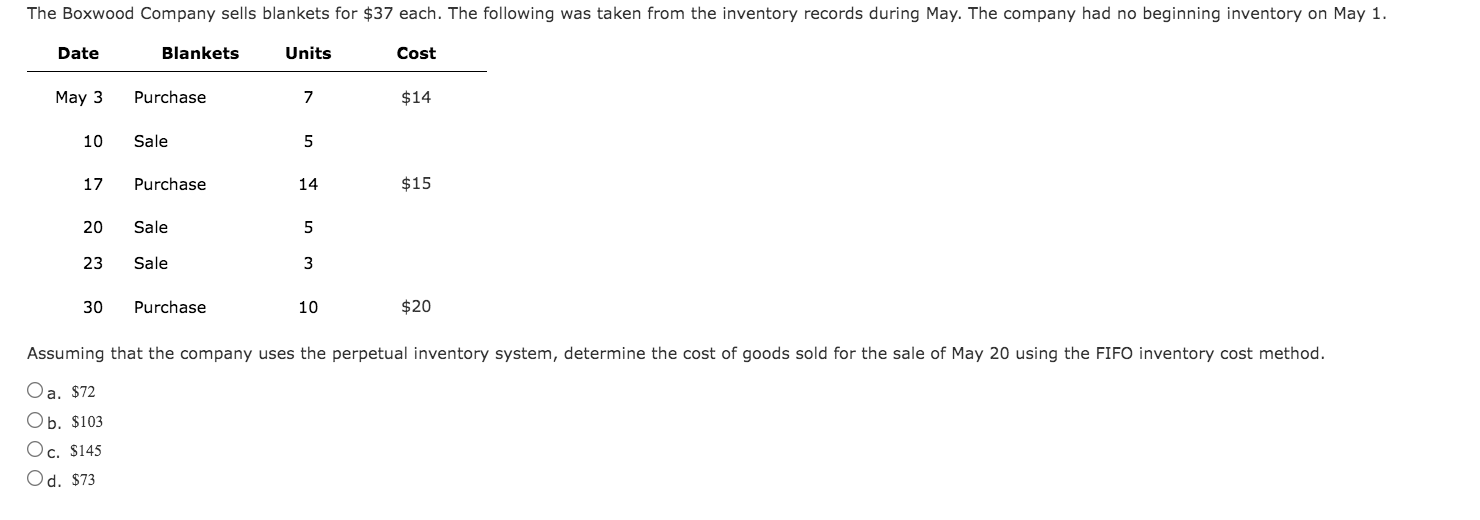

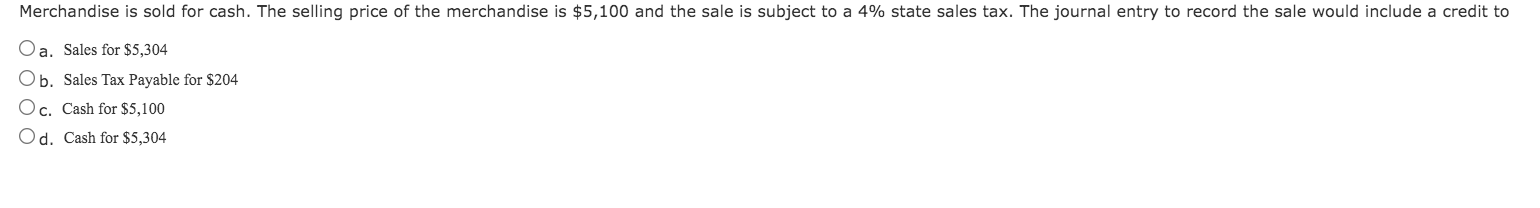

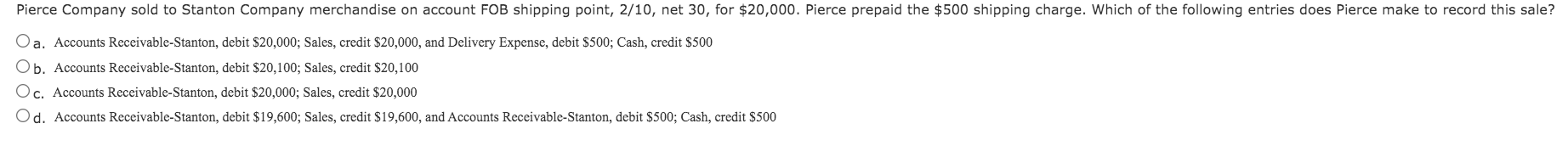

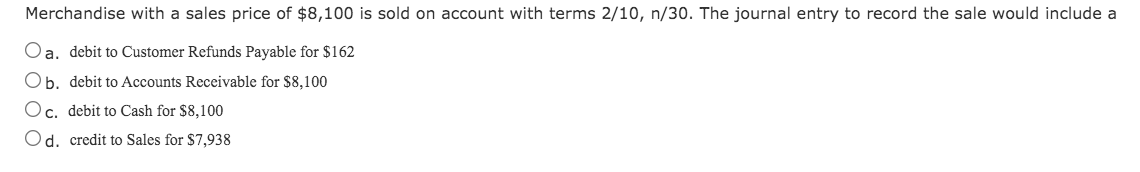

The Boxwood Company sells blankets for $35 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 7 $18 10 Sale 3 17 Purchase 11 $17 20 Sale 6 23 Sale 2 30 Purchase 11 $20 Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the FIFO inventory cost method. Oa. $306 Ob. $339 Oc. $360 Od. $324 The Boxwood Company sells blankets for $33 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 7 $16 10 Sale 4 17 Purchase 10 $14 20 Sale 6 23 Sale 2 30 Purchase 10 $24 Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method. a. $64 Ob. $28 Oc. $240 Od. $84 The Boxwood Company sells blankets for $37 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 9 $16 10 Sale 5 17 Purchase 16 $17 20 Sale 4 23 Sale 2 30 Purchase 9 $21 Assuming that the company uses the perpetual inventory system, determine the ending inventory for the month of May using the LIFO inventory cost method. Oa. $525 Ob. $423 Oc. $605 Od. $182 The Boxwood Company sells blankets for $40 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 28 $14 10 Sale 11 17 Purchase 35 $16 20 Sale 20 23 Sale 4 30 Purchase 23 $17 Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method. Oa. $96 Ob. $238 Oc. $64 Od. $286 The following lots of Commodity Z were available for sale during the year. Beginning inventory 10 units at $50 First purchase 17 units at $55 Second purchase 21 units at $59 Third purchase 14 units at $63 The firm uses the periodic system, and there are 23 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the FIFO method? Oa. $3,556 Ob. $1,413 Oc. $3,533 Od. $1,150 The Boxwood Company sells blankets for $37 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 7 $14 10 Sale 5 17 Purchase 14 $15 20 Sale 5 23 Sale 3 30 Purchase 10 $20 Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method. Oa. $72 Ob. $103 Oc. $145 Od. $73 Merchandise is sold for cash. The selling price of the merchandise is $5,100 and the sale is subject to a 4% state sales tax. The journal entry to record the sale would include a credit to Oa. Sales for $5,304 Ob. Sales Tax Payable for $204 Oc. Cash for $5,100 Od. Cash for $5,304 Pierce Company sold to Stanton Company merchandise on account FOB shipping point, 2/10, net 30, for $20,000. Pierce prepaid the $500 shipping charge. Which of the following entries does Pierce make to record this sale? Oa. Accounts Receivable-Stanton, debit $20,000; Sales, credit $20,000, and Delivery Expense, debit $500; Cash, credit $500 Ob. Accounts Receivable-Stanton, debit $20,100; Sales, credit $20,100 Oc. Accounts Receivable-Stanton, debit $20,000; Sales, credit $20,000 Od. Accounts Receivable-Stanton, debit $19,600; Sales, credit $19,600, and Accounts Receivable-Stanton, debit $500; Cash, credit $500 Merchandise with a sales price of $8,100 is sold on account with terms 2/10, n/30. The journal entry to record the sale would include a O a. debit to Customer Refunds Payable for $162 Ob. debit to Accounts Receivable for $8,100 Oc. debit to Cash for $8,100 Od. credit to Sales for $7,938

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts