Question: Please provide all the information and steps. Calculating Social Security and Medicare Taxes Assume a Social Security tax rate of 6.2% is applied to maximum

Please provide all the information and steps.

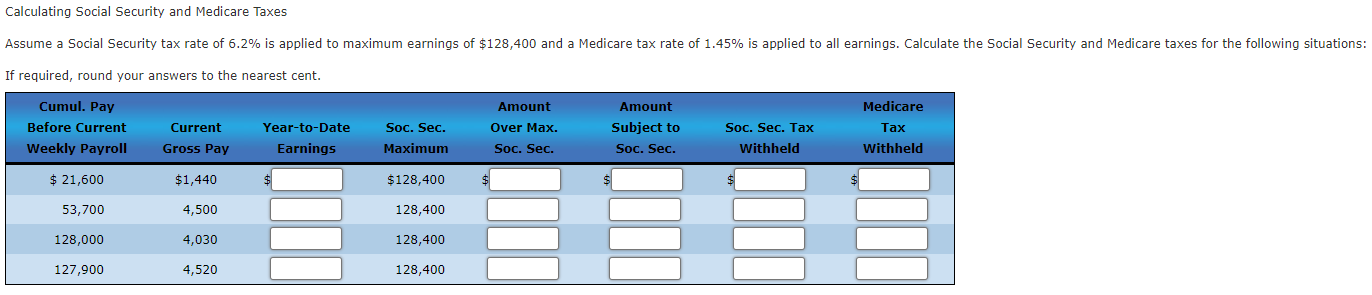

Calculating Social Security and Medicare Taxes Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations: If required, round your answers to the nearest cent. Medicare Cumul. Pay Before Current Weekly Payroll Current Gross Pay Year-to-Date Earnings Tax Amount Over Max. Soc. Sec. Soc. Sec. Maximum Amount Subject to Soc. Sec. Soc. Sec. Tax Withheld Withheld $ 21,600 $1,440 $128,400 53,700 4,500 128,400 128,000 4,030 128,400 127,900 4,520 128,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts