Question: Please provide all the necessary calculations and formulas. Make it as detailed as possible, else will dislike. Numbers 1 and 2 (Partnership Formation) A, B

Please provide all the necessary calculations and formulas. Make it as detailed as possible, else will dislike.

Numbers 1 and 2 (Partnership Formation)

A, B and C decided to form ABC Partnership. It was agreed that A will contribute an equipment with

assessed value of P100,000 with historical cost of P800,000 and accumulated depreciation of P600,000.

A day after the partnership formation, the equipment was sold for P 300,000.

B will contribute a land and building with carrying amount of P1,200,000 and fair value of P1,500,000.

The land and building are subject to a mortgage payable amounting to P300,000 to be assumed by the

partnership. The partners agreed that B will have 60% capital interest in the partnership. The partners

also agreed that C will contribute sufficient cash to the partnership.

1. What is the total agreed capitalization of the ABC Partnership?

2. What is the cash to be contributed by C in the ABC Partnership?

Numbers 5, 6, and 7 (Partnership Operation - Distribution of profit or loss)

On January 1, 2018, A, B and C formed ABC Partnership with original capital contribution of

P300,000, P500,000 and P200,000. A is appointed as managing partner.

During 2018, A, B and C made additional investments of P500,000, P200,000 and P300,000,

respectively. At the end of 2018, A, B and C made drawings of P200,000, P100,000 and P400,000,

respectively. At the end of 2018, the capital balance of C is reported at P320,000. The profit or loss

agreement of the partners is as follows:

? 10% interest on original capital contribution of the partners.

? Quarterly salary of P40,000 and P10,000 for A and B, respectively.

? Bonus to A equivalent to 20% of Net Income after interest and salary to all partners

? Remainder is to be distributed equally among the partners.

5. What is the partnership profit for the year ended December 31, 2018?

6. What is A's share in partnership profit for 2018?

7. What is B's share in partnership profit for 2018?

Number 8 (Admission of partner by purchase)

On December 31, 2018, the Statement of Financial Position of ABC Partnership provided the

following data with profit or loss ratio of 1:6:3:

Current Assets

1,000,000

Total Liabilities

600,000

Noncurrent Assets

2,000,000

A, Capital

900,000

B, Capital

800,000

C, Capital

700,000

On January 1, 2019, D is admitted to the partnership by purchasing 40% of the capital interest of B at a

price of P500,000.

What is the capital balance of B after the admission of D on January 1, 2019?

Number 11 (Partnership Dissolution - Admission of New Partner by Investment)

On December 31, 2018, the Statement of Financial Position of ABC Partnership provided the

following data with profit or loss ratio of 1:6:3:

Current Assets

1,300,000

Total Liabilities

300,000

Noncurrent Assets

2,000,000

A, Capital

1,400,000

B, Capital

700,000

C, Capital

900,000

On January 1, 2019, D is admitted to the partnership by investing P1,000,000 to the partnership for

20% capital interest.

If the all the assets of the existing partnership are properly valued, what is the capital balance of C after

the admission of D?

Numbers 16, 17 and 18 (Partnership Liquidation - Installment Liquidation)

On December 31, 2018, the Statement of Financial Position of ABC Partnership with profit or loss

ratio of 5:3:2 of respective partners A, B and C. showed the following information:

Cash

1,600,000

Total Liabilities

2,000,000

Noncash assets

1,400,000

A, Capital

100,000

B, Capital

500,000

C, Capital

400,000

On January 1, 2019, the partners decided to liquidate the partnership in installment. All partners are

legally declared to be personally insolvent.

As of January 31, 2019, the following transactions occurred:

? Noncash assets with a carrying amount P1,000,000 were sold at a gain of P100,000.

? Liquidation expenses for the month of January amounting to P50,000 were paid.

? It is estimated that liquidation expenses amounting to P150,000 will be incurred for the month

of February, 2019.

? 20% of the liabilities to third persons were settled.

? Available cash was distributed to the partners.

As of February 28, 2019, the following transactions occurred:

? Remaining noncash assets were sold at a loss of P100,000.

? The final liquidation expenses for the month of February amounted to P100,000.

? The remaining liabilities to third persons were settled at a compromise amount of P1,500,000.

? Remaining cash was finally distributed to the partners.

16. What is the amount of cash received by partner C on January 31, 2019?

17. What is the share of B in the maximum possible loss on January 31, 2019?

18. What is the amount of total cash withheld on January 31, 2019?

Numbers 84, 85, 86 and 87

On January 1, 2020, a nonprofit organization received P1,000,000 cash donation from a donor who

stipulated that the amount should be invested indefinitely in revenue producing investment. The deed

of donation also provided that the dividend income shall be used for the acquisition of computers of

the nonprofit organization.

On December 31, 2020, the nonprofit organization received P100,000 cash as dividend income from

the investment of the fund.

On January 1, 2021, the nonprofit organization acquired a computer at a cost of P20,000 with a useful

life of 5 years without residual value.

84. In the statement of activities of the NPO for the year ended December 31, 2020, which of the

following is the proper effect of the transactions?

A. Increase in temporarily restricted net assets by P100,000.

B. Increase in unrestricted net assets by P1,000,000.

C. Increase in unrestricted net assets by P16,000.

D. Decrease in temporarily restricted net assets by P20,000.

85. In the statement of activities of the NPO for the year ended December 31, 2021, which of the

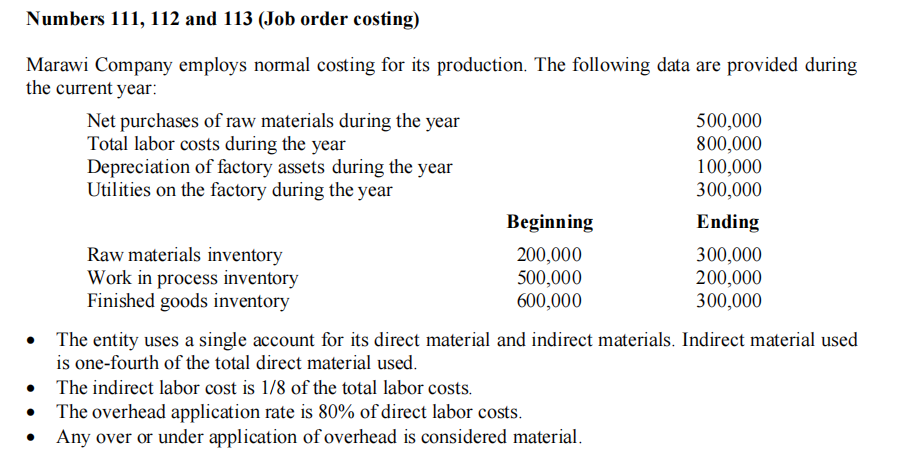

following is the proper effect of the transactions?

A. Increase in temporarily restricted net assets by P100,000.

B. Increase in unrestricted net assets by P1,000,000.

C. Increase in unrestricted net assets by P16,000.

D. Decrease in temporarily restricted net assets by P100,000.

86. How should the cash flows be reported in NPO's Statement of Cash Flows for the year ended

December 31, 2020?

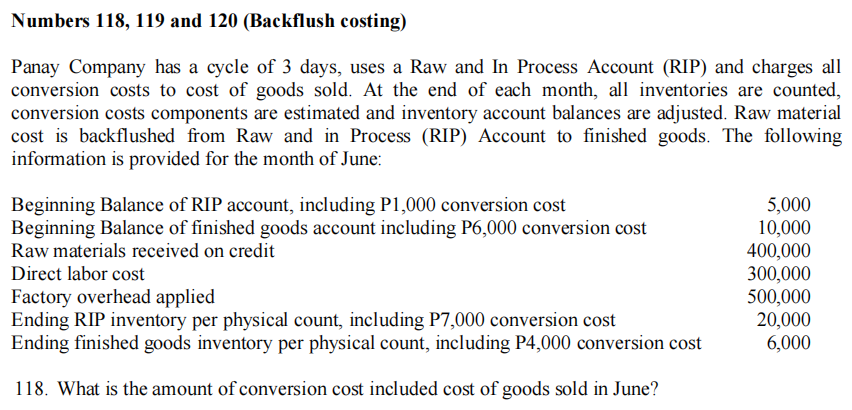

A. Cash receipts from operating activities by P100,000.

B. Cash receipts from financing activities by P1,100,000.

C. Cash disbursements for investing activities by P50,000.

D. Cash disbursements for financing activities by P1,000,000

87. How should the cash flows be reported in NPO's Statement of Cash Flows for the year ended

December 31, 2021?

A. Cash receipts from operating activities by P100,000.

B. Cash receipts from financing activities by P1,100,000.

C. Cash disbursements for investing activities by P20,000.

D. Cash disbursements for investing activities by P100,000.

Number 88

Government Accounting Manual

On December 31, 2018, the Department of Finance billed its lessee on one of its buildings in the

amount of P10,000. On January 31, 2019, the Department of Finance collected all of the accounts

receivable. On February 28, 2019, the Department of Finance remitted the entire collected amount to

the Bureau of Treasury. What is the journal entry to record the remittance by the Department of

Finance to the Bureau of Treasury?

A. Debit - Accounts Receivable P10,000 and Credit - Rent Income P10,000

B. Debit - Accounts Receivable P10,000 and Credit - Retained Earnings P10,000

C. Debit - Cash Collecting Officers P10,000 and Credit - Accounts Receivable P10,000

D. Debit - Cash - Treasury/Agency Deposit, Regular - P10,000 and

Credit Cash - Collecting Officer - P10,000

Numbers 89 and 90

On January 1, 2018, the Department of Public Works and Highways (DPWH) received a P10,000,000

appropriation from the national government for the acquisition of machinery. On February 1, 2018,

DPWH received the allotment from the Department of Budget and Management. On March 1, 2018,

DPWH entered into a contract with CAT Inc. for the acquisition of the machinery with a price of

P8,000,000. On April 1, 2018, DPWH received the Notice of Cash Allocation from Department of

Budget and Management net of 1% withholding tax for income tax of supplier and 5% withholding of

Final Tax on VAT of supplier. On May 1, 2018, CAT Inc. delivered the machinery to DPWH. On June

1, 2018, DPWH paid the obligation to CAT Inc. On July 1, 2018, DPWH remitted the withheld income

tax and final VAT to BIR.

89. What is the journal entry on March 1, 2018?

A. No entry but just posting to appropriate RAPAL

B. No entry but just posting to appropriate RAPAL and to RAOD

C. No entry but just posting of ORS (Obligation Request and Status) to appropriate RAOD

D. Debit Machinery P8,000,000 and credit Accounts Payable P8,000,000

90. What is the journal entry on April 1, 2018?

A. Debit Cash-MDS, Regular P7,520,000 and Credit Subsidy Income from National

Government P7,520,000.

B. Debit Machinery P8,000,000 and Credit Accounts Payable P8,000,000

C. Debit Accounts Payable P8,000,000 and Credit Due to BIR P480,000 and Cash-MDS,

Regular P7,520,000.

D. Debit Due to BIR P480,000 and Credit Subsidy Income from National Government P480,000.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts