Question: Please provide an answer, and explain how you calculated with formulas!! Thanks Stock Z trades at a price of $43 and is expected to pay

Please provide an answer, and explain how you calculated with formulas!! Thanks

Please provide an answer, and explain how you calculated with formulas!! Thanks

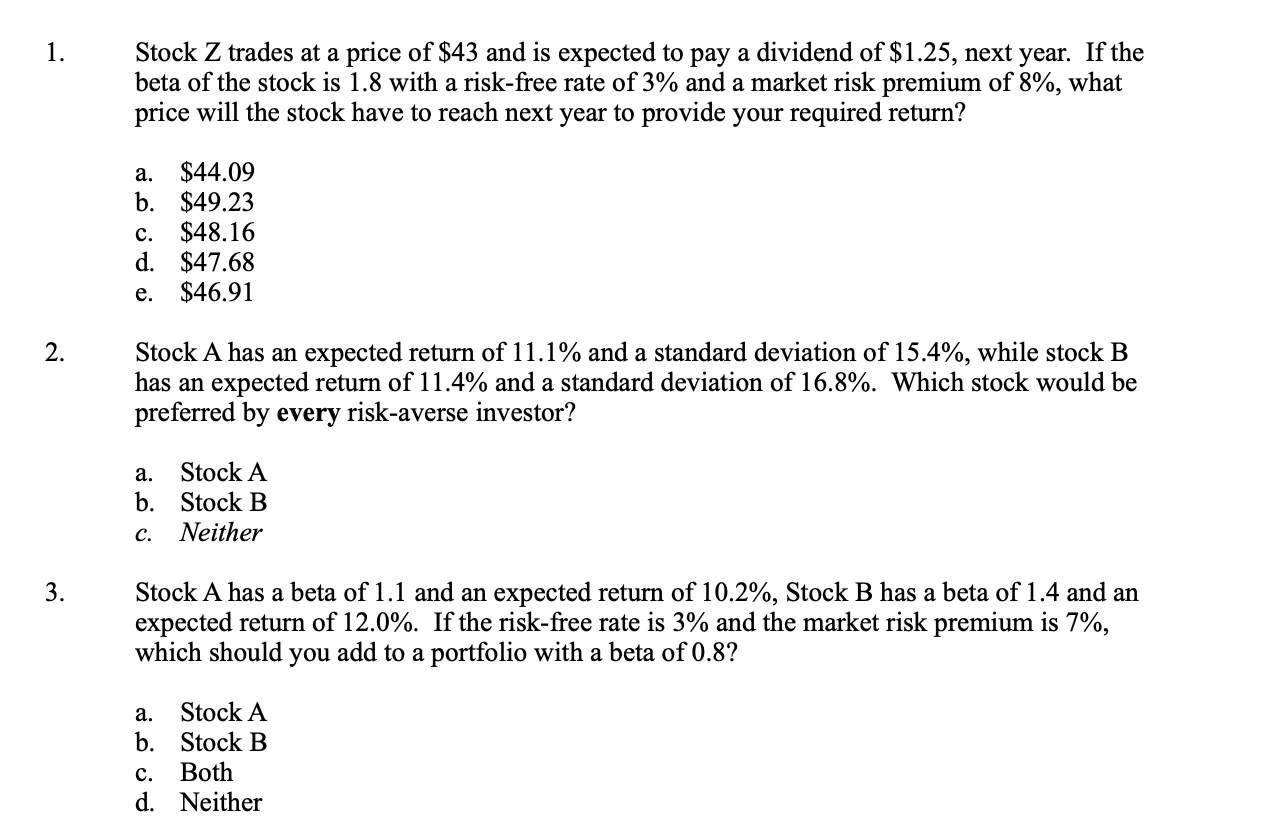

Stock Z trades at a price of $43 and is expected to pay a dividend of $1.25, next year. If the beta of the stock is 1.8 with a risk-free rate of 3% and a market risk premium of 8%, what price will the stock have to reach next year to provide your required return? a. $44.09 $49.23 c. $48.16 d. $47.68 e. $46.91 Stock A has an expected return of 11.1% and a standard deviation of 15.4%, while stock B has an expected return of 11.4% and a standard deviation of 16.8%. Which stock would be preferred by every risk-averse investor? a. Stock A b. Stock B C. Neither - 3. Stock A has a beta of 1.1 and an expected return of 10.2%, Stock B has a beta of 1.4 and an expected return of 12.0%. If the risk-free rate is 3% and the market risk premium is 7%, which should you add to a portfolio with a beta of 0.8? a. Stock A b. Stock B c. Both d. Neither

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts