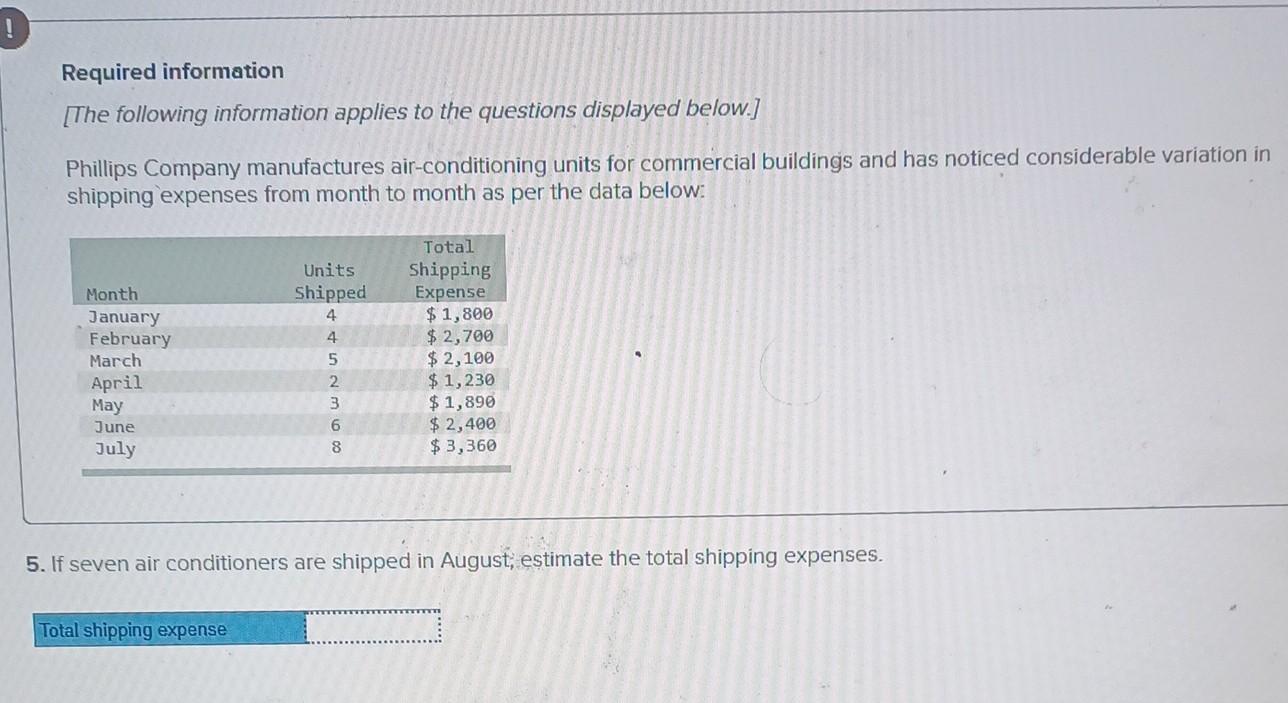

Question: Please provide answer and process. Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and

Please provide answer and process.

![the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dd327046237_39966dd326fd3a22.jpg)

Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below: 5. If seven air conditioners are shipped in August; estimate the total shipping expenses. 6. If nine air conditioners are shipped in September, estimate the fixed shipping expenses. 7. If 10 air conditioners are shipped in October, estimate the variable shipping expense. 8. If the air conditioners have an average sales price of $5,100, variable direct manufacturing costs are $2,550 per unit, variable manufacturing costs (excluding overhead) are $1,020 per unit, and variable selling and administration costs (excluding shipping) are $200 per unit, what is the contribution margin per unit? 9. Given the facts in part 3-8, estimate the total contribution margin for August if seven air conditioners are produced and sold. 10. Given the facts in part 3-8, if total fixed costs (excluding shipping) are $1,250 per month, estimate operating income for August if seven air conditioners are produced and sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts