Question: Please provide answer to blank fields Current ratios The condensed statements of Independent Auto Inc. follow Independent Auto Inc Income Statement (S000) For Years Ended

Please provide answer to blank fields

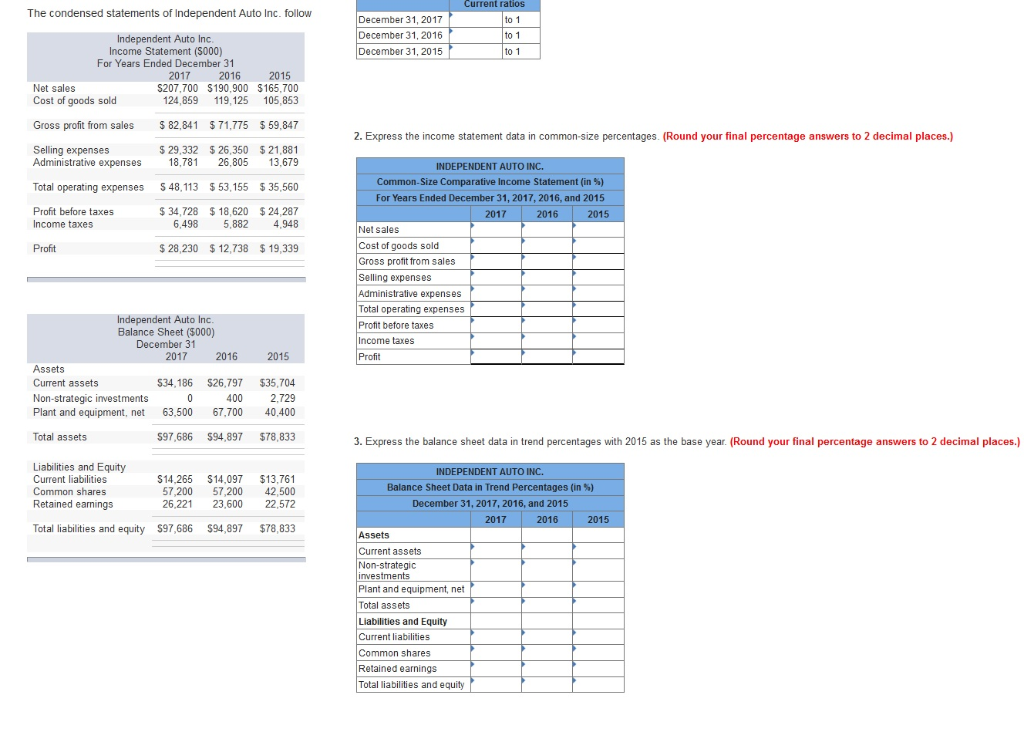

Current ratios The condensed statements of Independent Auto Inc. follow Independent Auto Inc Income Statement (S000) For Years Ended December 31 December 31, 2017 December 31, 2016 December 31, 2015 to 1 to 1 to 1 2017 2016 2015 Net sales Cost of goods sold $207,700 S190,900 $165,700 124,859 119,125 105,853 Gross profit from sales 82,841 $71,775 $59,847 $ 29,332 $26,350 21,881 2. Express the income statement data in common-size percentages. (Round your final percentage answers to 2 decimal places.) Selling expenses Administrative expenses 18,781 26,805 13,679 Total operating expenses $48,113 $53,155 35,560 34,728 $18,620 $24,287 INDEPENDENT AUTO INC common. Size Comparative Income Statement (in %) For Years Ended December 31, 2017, 2016, and 2015 Profit before taxes Income taxes 6,498 5,882 4.948 Net sales Cost of goods sold Gross protit from sales Selling expenses Administrative expenses Total operating expenses Proft before taxes Income taxes Profit Profit $ 28,230 $12,738 $19,339 Independent Auto Inc Balance Sheet (5000) December 31 2016 S34.186 S26,797 $35,704 67,700 S97,686 $94,897 $78,833 2017 2015 Assets Current assets Non-strategic investments Plant and equipment, net Total assets 2,729 40,400 400 63,500 3. Express the balance sheet data in trend percentages with 2015 as the base year. (Round your final percentage answers to 2 decimal places.) Liabilities and Equity Current liabilities Common shares Retained earnings $14,265 $14,097 $13,761 57,200 57,200 42,500 26,221 23,600 22,572 INDEPENDENT AUTO INC. Balance Sheet Data in Trend Percentages (in %) December 31, 2017, 2016, and 2015 2017 2016 2015 Total liabilities and equity $97,686 $94,897 $78,833 Assets Current assets Non-strategic investments Plant and equipment, net Total assets Liabilities and Equity Current liabilities Common shares Retained earnings Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts