Question: Please provide answer to the problem below. Question 2 (15 points) [15 points] As part of its overall plant modernization and cost reduction program, Western's

Please provide answer to the problem below.

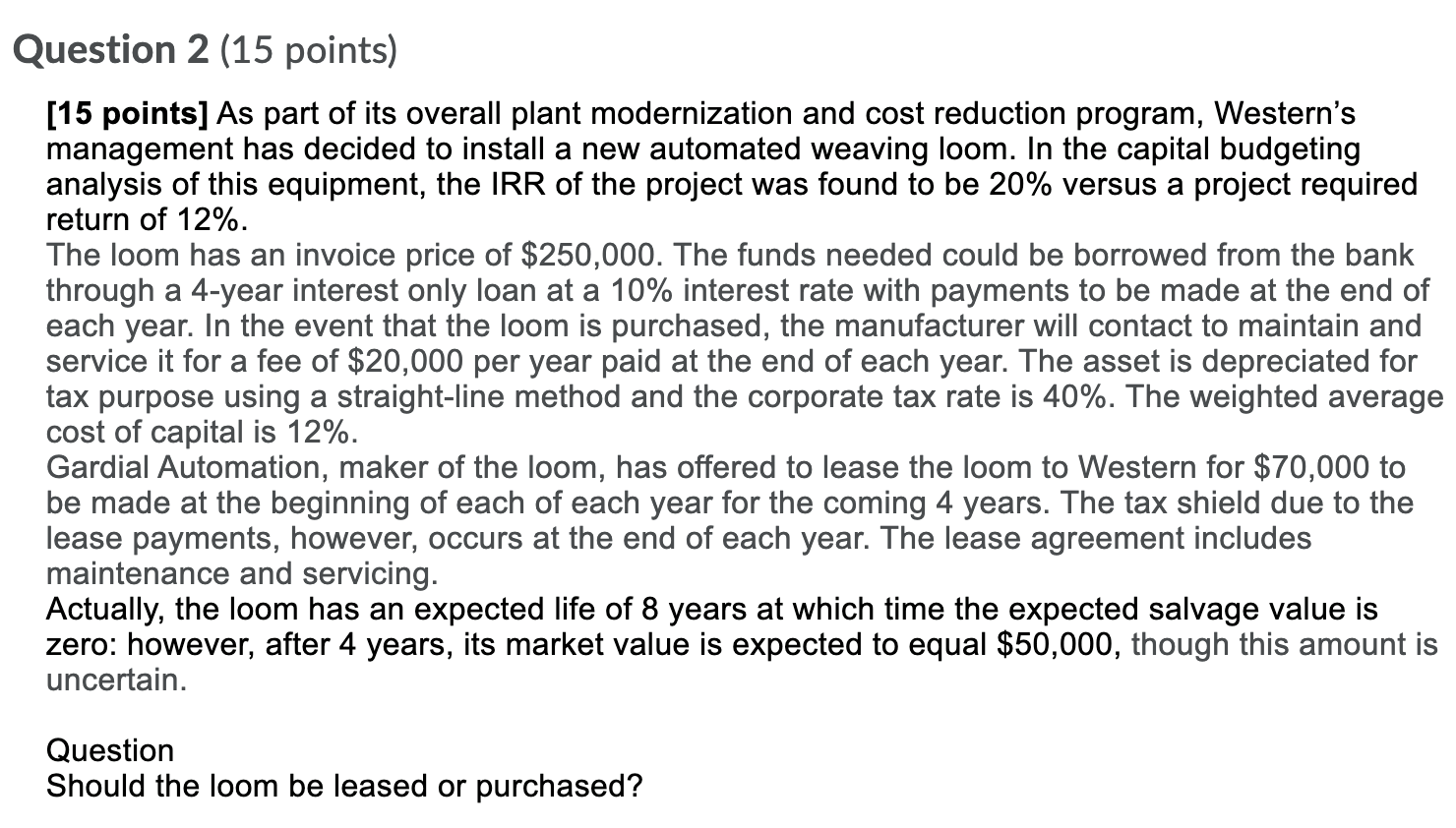

Question 2 (15 points) [15 points] As part of its overall plant modernization and cost reduction program, Western's management has decided to install a new automated weaving loom. In the capital budgeting analysis of this equipment, the IRR of the project was found to be 20% versus a project required return of 12%. The loom has an invoice price of $250,000. The funds needed could be borrowed from the bank through a 4-year interest only loan at a 10% interest rate with payments to be made at the end of each year. In the event that the loom is purchased, the manufacturer will contact to maintain and service it for a fee of $20,000 per year paid at the end of each year. The asset is depreciated for tax purpose using a straight-line method and the corporate tax rate is 40%. The weighted average cost of capital is 12%. Gardial Automation, maker of the loom, has offered to lease the loom to Western for $70,000 to be made at the beginning of each of each year for the coming 4 years. The tax shield due to the lease payments, however, occurs at the end of each year. The lease agreement includes maintenance and servicing. Actually, the loom has an expected life of 8 years at which time the expected salvage value is zero: however, after 4 years, its market value is expected to equal $50,000, though this amount is uncertain. Question Should the loom be leased or purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts