Question: Please provide answer to the problem below. Question 7 (10 points) [10 points] Motors, Inc. is considering the acquisition of Rubber Tire Co. Rubber Tire

Please provide answer to the problem below.

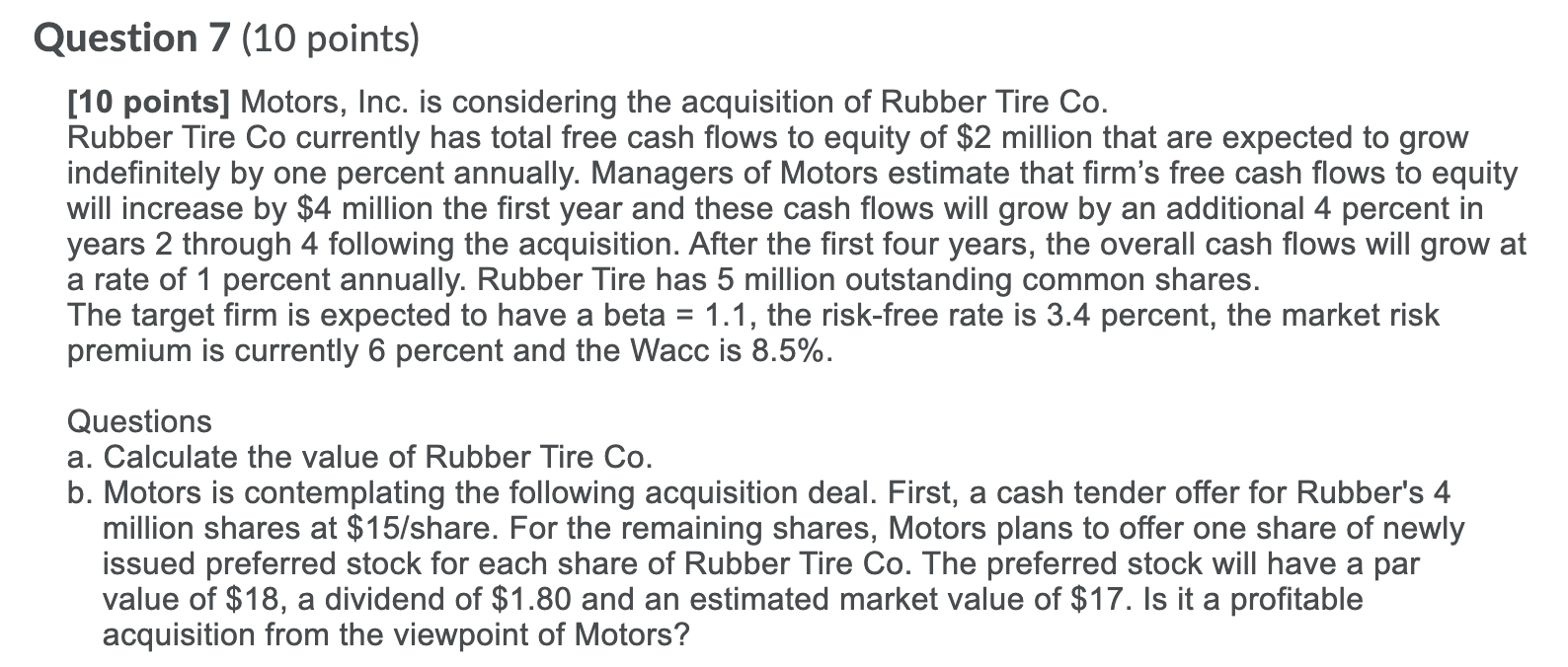

Question 7 (10 points) [10 points] Motors, Inc. is considering the acquisition of Rubber Tire Co. Rubber Tire Co currently has total free cash ows to equity of $2 million that are expected to grow indefinitely by one percent annually. Managers of Motors estimate that firm's free cash flows to equity will increase by $4 million the first year and these cash flows will grow by an additional 4 percent in years 2 through 4 following the acquisition. After the rst four years, the overall cash flows will grow at a rate of 1 percent annually. Rubber Tire has 5 million outstanding common shares. The target firm is expected to have a beta = 1.1, the risk-free rate is 3.4 percent, the market risk premium is currently 6 percent and the Waco is 8.5%. Questions a. Calculate the value of Rubber Tire Co. b. Motors is contemplating the following acquisition deal. First, a cash tender offer for Rubber's 4 million shares at $15/share. For the remaining shares, Motors plans to offer one share of newly issued preferred stock for each share of Rubber Tire Co. The preferred stock will have a par value of $18. a dividend of $1.80 and an estimated market value of $17. Is it a protable acquisition from the viewpoint of Motors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts