Question: please provide answer to this question. this question is based on insurance. please provide answer to this question. INSURANCE EXERCISE HW Student 3 Student 1

please provide answer to this question.

this question is based on insurance. please provide answer to this question.

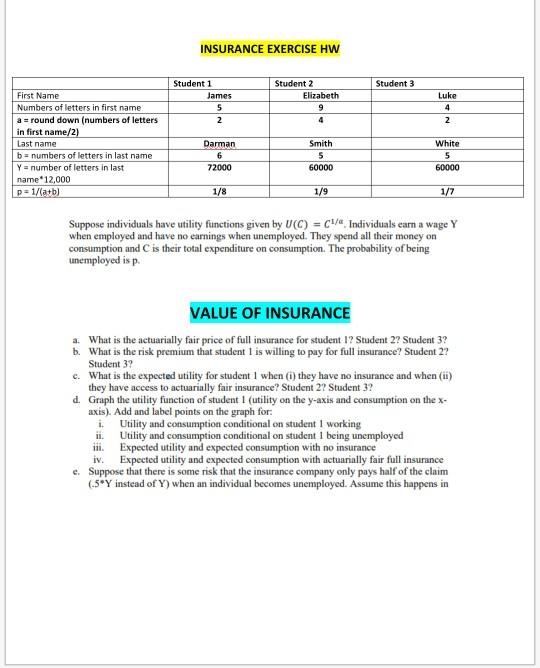

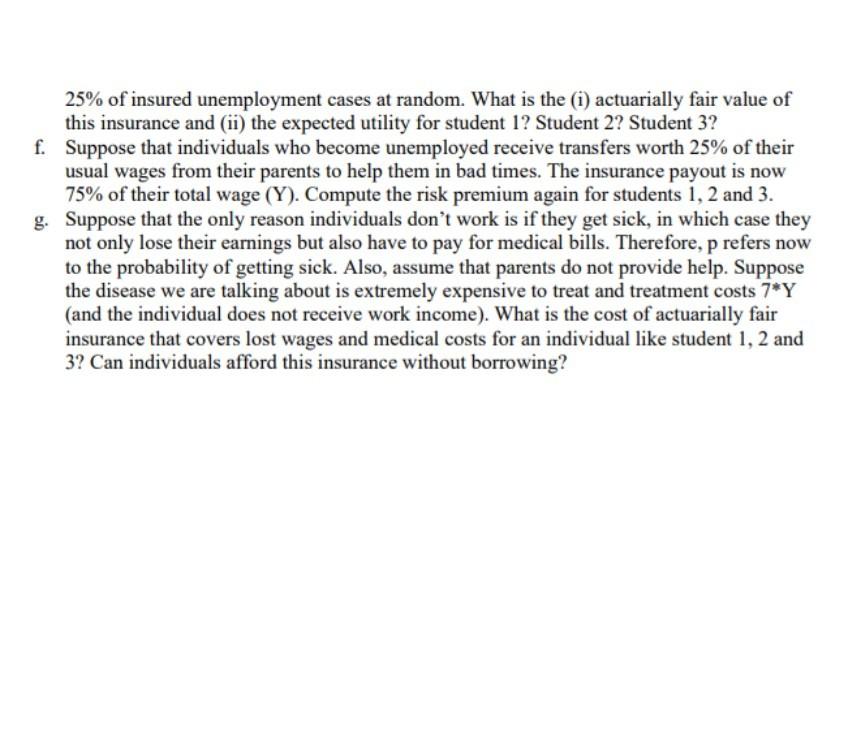

INSURANCE EXERCISE HW Student 3 Student 1 James 5 2 Student 2 Elizabeth 9 Luke EN 4 First Name Numbers of letters in first name a = round down (numbers of letters in first name/2) Last name b = numbers of letters in last name Y = number of letters in last name" 12,000 p=1/(a+b) Darman 6 72000 Smith 5 60000 White 5 60000 1/8 1/9 1/7 Suppose individuals have utility functions given by UC) = C1/4 Individuals earn a wage Y when employed and have no earnings when unemployed. They spend all their money on consumption and C is their total expenditure on consumption. The probability of being unemployed is p. VALUE OF INSURANCE a. What is the actuarially fair price of full insurance for student 1? Student 2? Student 3? b. What is the risk premium that student 1 is willing to pay for full insurance? Student 2? Student 3? c. What is the expected utility for student I when (1) they have no insurance and when (ii) they have access to actuarially fair insurance? Student 2? Student 3? d Graph the utility function of student 1 (utility on the y-axis and consumption on the x- axis). Add and label points on the graph for: i. Utility and consumption conditional on student I working ii. Utility and consumption conditional on student I being unemployed ini. Expected utility and expected consumption with no insurance iv. Expected utility and expected consumption with actuarially fair full insurance e Suppose that there is some risk that the insurance company only pays half of the claim (5*Y instead of Y) when an individual becomes unemployed. Assume this happens in 25% of insured unemployment cases at random. What is the (1) actuarially fair value of this insurance and (ii) the expected utility for student 1? Student 2? Student 3? f. Suppose that individuals who become unemployed receive transfers worth 25% of their usual wages from their parents to help them in bad times. The insurance payout is now 75% of their total wage (Y). Compute the risk premium again for students 1, 2 and 3. g. Suppose that the only reason individuals don't work is if they get sick, in which case they not only lose their earnings but also have to pay for medical bills. Therefore, p refers now to the probability of getting sick. Also, assume that parents do not provide help. Suppose the disease we are talking about is extremely expensive to treat and treatment costs 7*Y (and the individual does not receive work income). What is the cost of actuarially fair insurance that covers lost wages and medical costs for an individual like student 1, 2 and 3? Can individuals afford this insurance without borrowing? INSURANCE EXERCISE HW Student 3 Student 1 James 5 2 Student 2 Elizabeth 9 Luke EN 4 First Name Numbers of letters in first name a = round down (numbers of letters in first name/2) Last name b = numbers of letters in last name Y = number of letters in last name" 12,000 p=1/(a+b) Darman 6 72000 Smith 5 60000 White 5 60000 1/8 1/9 1/7 Suppose individuals have utility functions given by UC) = C1/4 Individuals earn a wage Y when employed and have no earnings when unemployed. They spend all their money on consumption and C is their total expenditure on consumption. The probability of being unemployed is p. VALUE OF INSURANCE a. What is the actuarially fair price of full insurance for student 1? Student 2? Student 3? b. What is the risk premium that student 1 is willing to pay for full insurance? Student 2? Student 3? c. What is the expected utility for student I when (1) they have no insurance and when (ii) they have access to actuarially fair insurance? Student 2? Student 3? d Graph the utility function of student 1 (utility on the y-axis and consumption on the x- axis). Add and label points on the graph for: i. Utility and consumption conditional on student I working ii. Utility and consumption conditional on student I being unemployed ini. Expected utility and expected consumption with no insurance iv. Expected utility and expected consumption with actuarially fair full insurance e Suppose that there is some risk that the insurance company only pays half of the claim (5*Y instead of Y) when an individual becomes unemployed. Assume this happens in 25% of insured unemployment cases at random. What is the (1) actuarially fair value of this insurance and (ii) the expected utility for student 1? Student 2? Student 3? f. Suppose that individuals who become unemployed receive transfers worth 25% of their usual wages from their parents to help them in bad times. The insurance payout is now 75% of their total wage (Y). Compute the risk premium again for students 1, 2 and 3. g. Suppose that the only reason individuals don't work is if they get sick, in which case they not only lose their earnings but also have to pay for medical bills. Therefore, p refers now to the probability of getting sick. Also, assume that parents do not provide help. Suppose the disease we are talking about is extremely expensive to treat and treatment costs 7*Y (and the individual does not receive work income). What is the cost of actuarially fair insurance that covers lost wages and medical costs for an individual like student 1, 2 and 3? Can individuals afford this insurance without borrowing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts