Question: Please provide calculation along with answer. Question 20 6 pts You consider buying a Treasury zero (a special type of zero coupon bond backed by

Please provide calculation along with answer.

Please provide calculation along with answer.

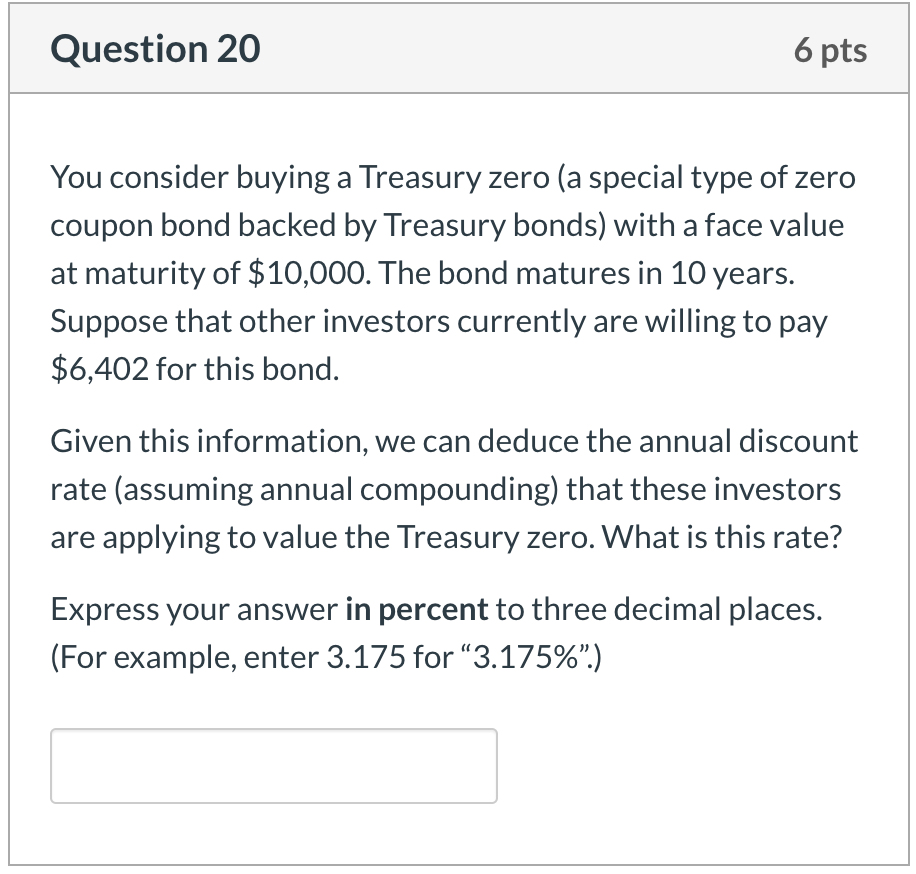

Question 20 6 pts You consider buying a Treasury zero (a special type of zero coupon bond backed by Treasury bonds) with a face value at maturity of $10,000. The bond matures in 10 years. Suppose that other investors currently are willing to pay $6,402 for this bond. Given this information, we can deduce the annual discount rate (assuming annual compounding) that these investors are applying to value the Treasury zero. What is this rate? Express your answer in percent to three decimal places. (For example, enter 3.175 for 3.175%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts