Question: Please provide cell reference Aries Electronics Inc. is considering the purchase of a new machine for $300,000. The firm's old machine has a book value

Please provide cell reference

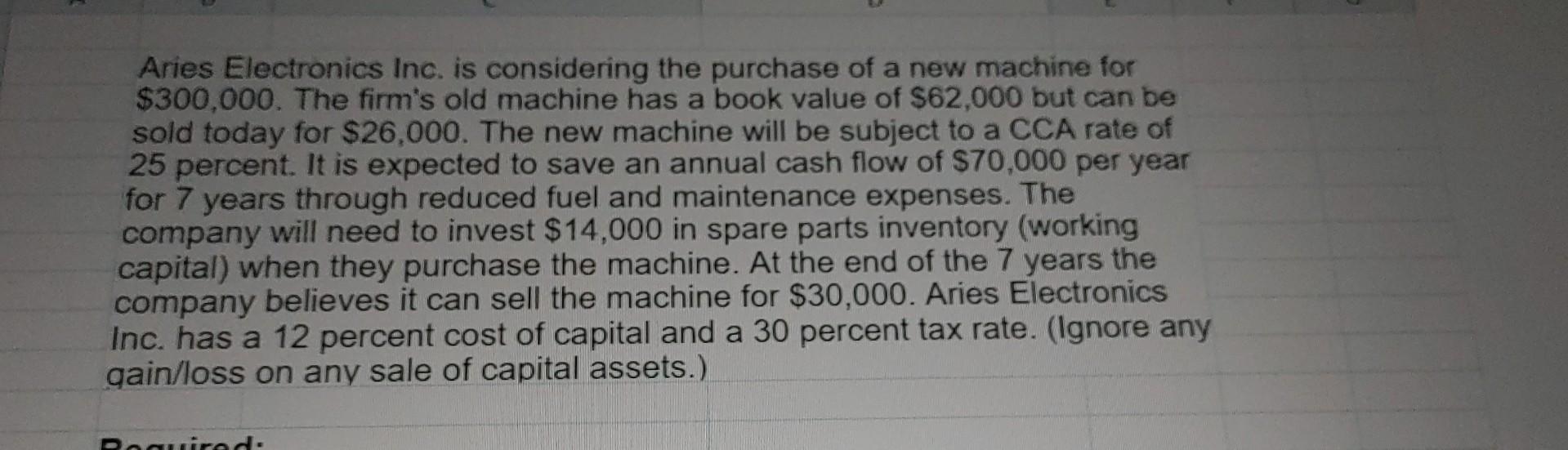

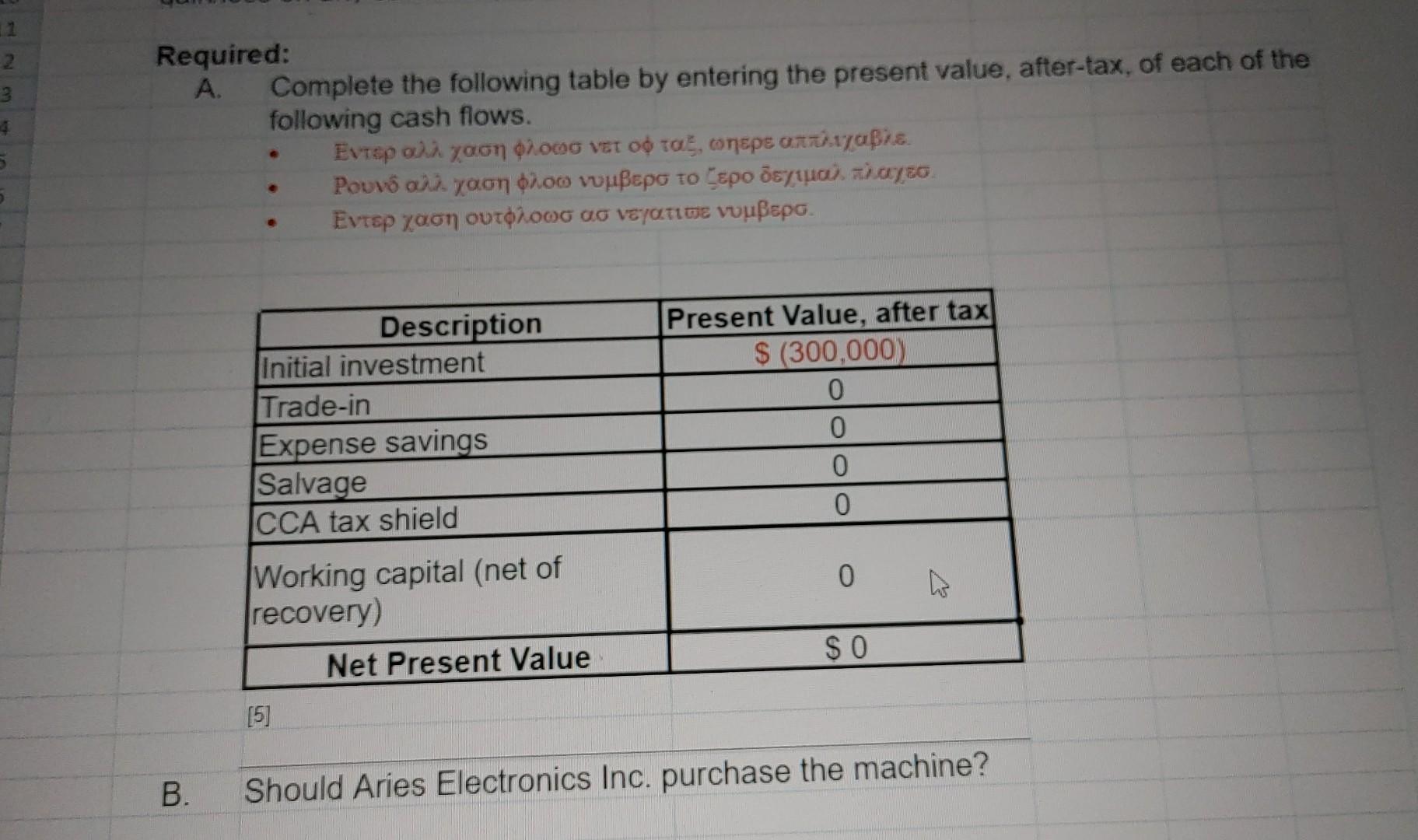

Aries Electronics Inc. is considering the purchase of a new machine for $300,000. The firm's old machine has a book value of $62,000 but can be sold today for $26,000. The new machine will be subject to a CCA rate of 25 percent. It is expected to save an annual cash flow of $70,000 per year for 7 years through reduced fuel and maintenance expenses. The company will need to invest $14,000 in spare parts inventory (working capital) when they purchase the machine. At the end of the 7 years the company believes it can sell the machine for $30,000. Aries Electronics Inc. has a 12 percent cost of capital and a 30 percent tax rate. (Ignore any qain/loss on any sale of capital assets.) Required: A. Complete the following table by entering the present value, after-tax, of each of the following cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts