Question: please provide clean answer A B. K 1 M N O Q R s! T U D E F ALT-MFG-POSTINGS A SUMMARY OF MFG ENTRIES

please provide clean answer

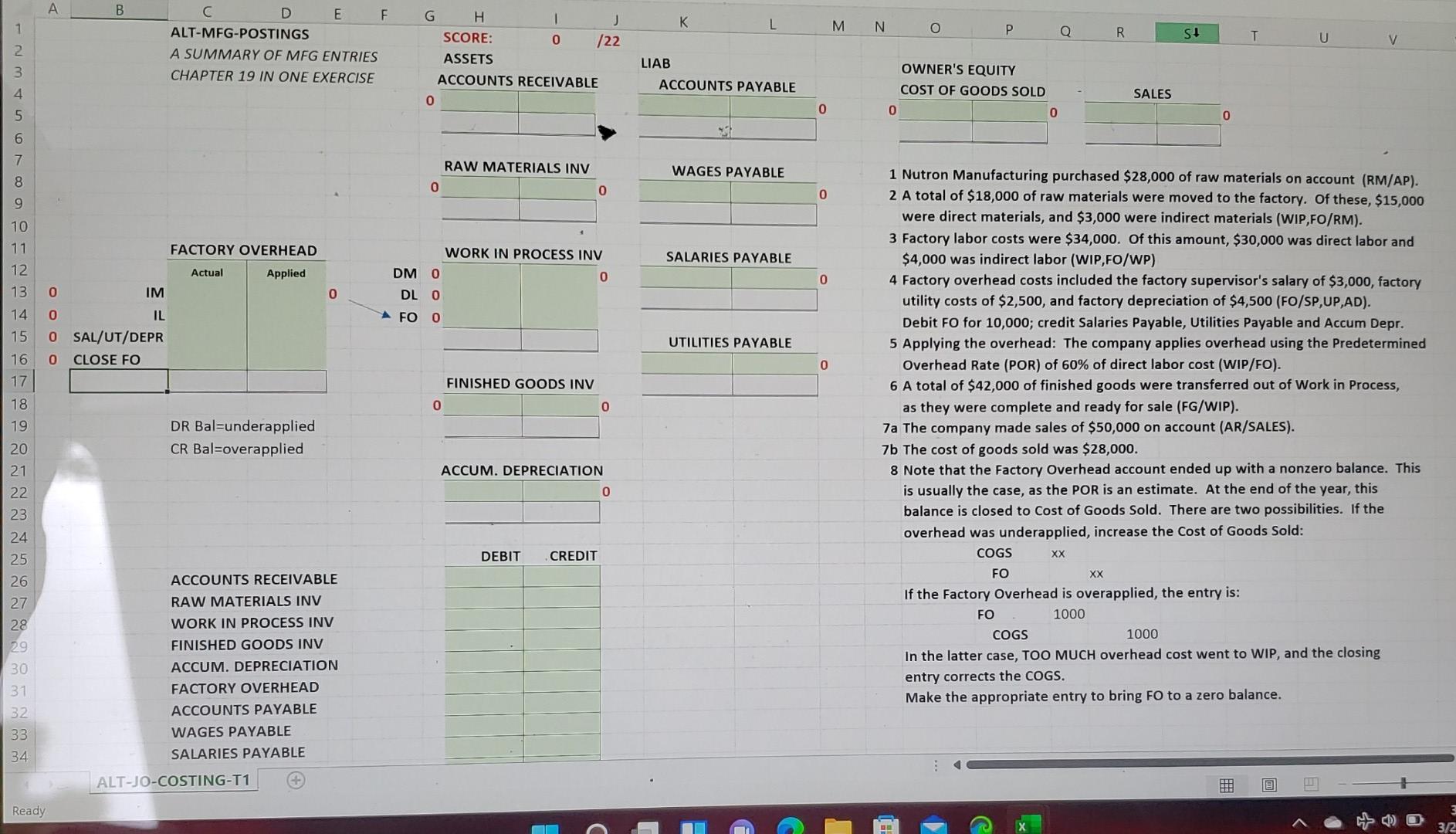

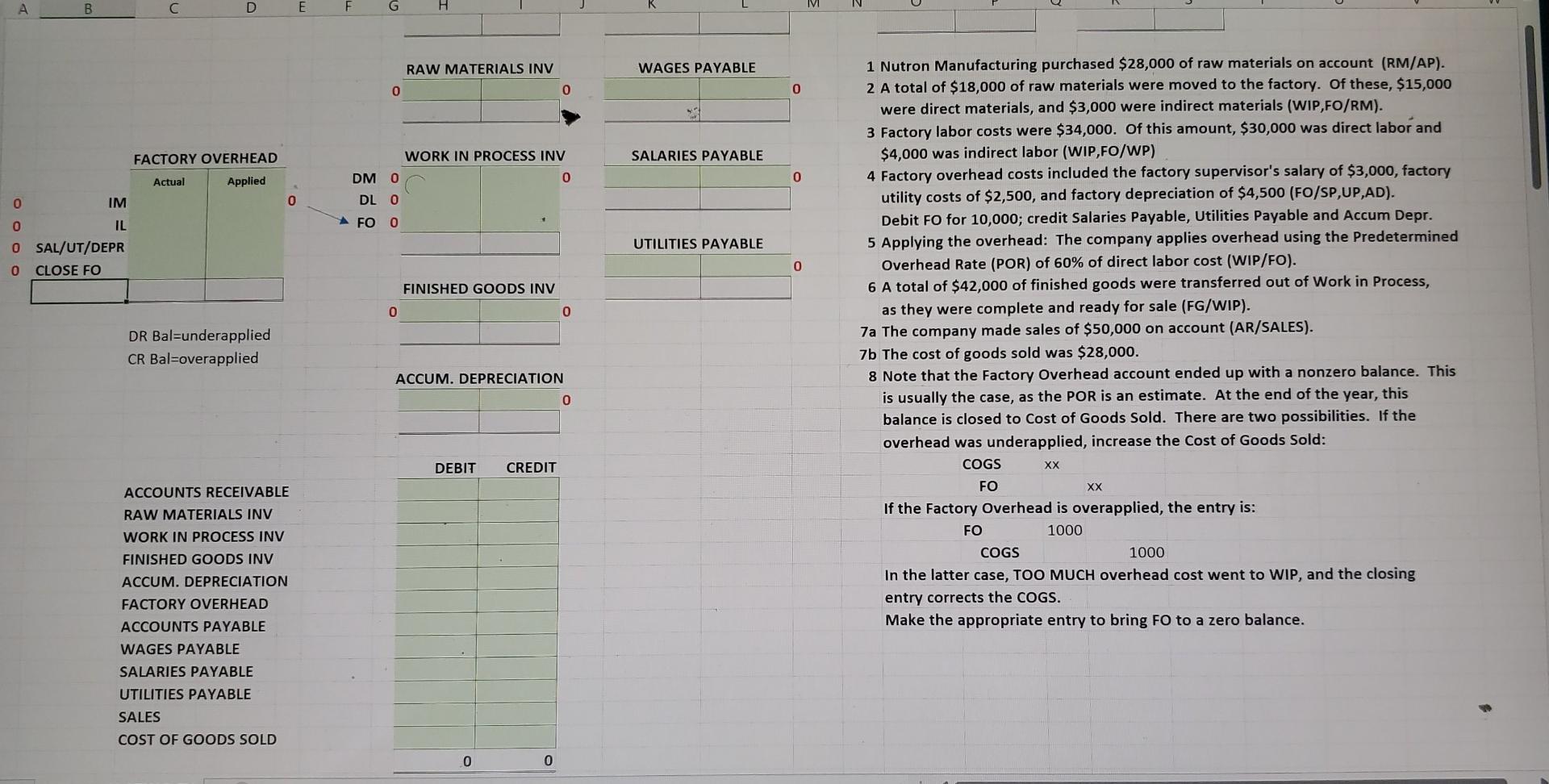

A B. K 1 M N O Q R s! T U D E F ALT-MFG-POSTINGS A SUMMARY OF MFG ENTRIES CHAPTER 19 IN ONE EXERCISE V H 1 J SCORE: 0 /22 ASSETS ACCOUNTS RECEIVABLE 0 3 LIAB ACCOUNTS PAYABLE OWNER'S EQUITY COST OF GOODS SOLD SALES 0 5 0 0 0 6 7 RAW MATERIALS INV WAGES PAYABLE 8 0 0 0 9 10 FACTORY OVERHEAD SALARIES PAYABLE 11 12 13 Actual Applied 0 WORK IN PROCESS INV DM 0 0 DL 0 A FO 0 0 IM 0 0 IL 0 SAL/UT/DEPR 0 CLOSE FO UTILITIES PAYABLE 0 FINISHED GOODS INV 0 0 14 15 16 17 18 19 20 21 22 23 24 DR Bal=underapplied CR Bal=overapplied 1 Nutron Manufacturing purchased $28,000 of raw materials on account (RM/AP). 2 A total of $18,000 of raw materials were moved to the factory. Of these, $15,000 were direct materials, and $3,000 were indirect materials (WIP,FO/RM). 3 Factory labor costs were $34,000. Of this amount, $30,000 was direct labor and $4,000 was indirect labor (WIP,FO/WP) 4 Factory overhead costs included the factory supervisor's salary of $3,000, factory utility costs of $2,500, and factory depreciation of $4,500 (FO/SP,UP,AD). Debit FO for 10,000; credit Salaries Payable, Utilities Payable and Accum Depr. 5 Applying the overhead: The company applies overhead using the Predetermined Overhead Rate (POR) of 60% of direct labor cost (WIP/FO). 6 A total of $42,000 of finished goods were transferred out of Work in Process, as they were complete and ready for sale (FG/WIP). 7a The company made sales of $50,000 on account (AR/SALES). 7b The cost of goods sold was $28,000. 8 Note that the Factory Overhead account ended up with a nonzero balance. This is usually the case, as the POR is an estimate. At the end of the year, this balance is closed to cost of Goods Sold. There are two possibilities. If the overhead was underapplied, increase the cost of Goods Sold: COGS XX FO If the Factory Overhead is overapplied, the entry is: FO 1000 COGS 1000 In the latter case, TOO MUCH overhead cost went to WIP, and the closing entry corrects the COGS. Make the appropriate entry to bring FO to a zero balance. ACCUM. DEPRECIATION 0 DEBIT CREDIT XX 25 26 27 28 29 30 31 32 33 34. ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION FACTORY OVERHEAD ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE ALT-JO-COSTING-T1 Ready 3 3/2 A B C D E G H IVI WAGES PAYABLE RAW MATERIALS INV 0 0 0 FACTORY OVERHEAD SALARIES PAYABLE 0 Actual Applied WORK IN PROCESS INV DM 0 0 DL 0 FO 0 0 IM 0 0 IL 0 SALUT/DEPR 0 CLOSE FO UTILITIES PAYABLE 0 FINISHED GOODS INV 0 0 DR Bal=underapplied CR Bal=overapplied 1 Nutron Manufacturing purchased $28,000 of raw materials on account (RM/AP). 2 A total of $18,000 of raw materials were moved to the factory. Of these, $15,000 were direct materials, and $3,000 were indirect materials (WIP,FO/RM). 3 Factory labor costs were $34,000. Of this amount, $30,000 was direct labor and $4,000 was indirect labor (WIP,FO/WP) 4 Factory overhead costs included the factory supervisor's salary of $3,000, factory utility costs of $2,500, and factory depreciation of $4,500 (FO/SP,UP,AD). Debit FO for 10,000; credit Salaries Payable, Utilities Payable and Accum Depr. 5 Applying the overhead: The company applies overhead using the Predetermined Overhead Rate (POR) of 60% of direct labor cost (WIP/FO). 6 A total of $42,000 of finished goods were transferred out of Work in Process, as they were complete and ready for sale (FG/WIP). 7a The company made sales of $50,000 on account (AR/SALES). 7b The cost of goods sold was $28,000. 8 Note that the Factory Overhead account ended up with a onzero balance. This is usually the case, as the POR is an estimate. At the end of the year, this balance is closed to cost of Goods Sold. There are two possibilities. If the overhead was underapplied, increase the cost of Goods Sold: COGS FO If the Factory Overhead is overapplied, the entry is: FO 1000 COGS In the latter case, TOO MUCH overhead cost went to WIP, and the closing entry corrects the COGS. Make the appropriate entry to bring FO to a zero balance. ACCUM. DEPRECIATION 0 DEBIT CREDIT XX XX 1000 ACCOUNTS RECEIVABLE RAW MATERIALS INV WORK IN PROCESS INV FINISHED GOODS INV ACCUM. DEPRECIATION FACTORY OVERHEAD ACCOUNTS PAYABLE WAGES PAYABLE SALARIES PAYABLE UTILITIES PAYABLE SALES COST OF GOODS SOLD 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts